With the new developments taking place at JK Paper Ltd. team Paper Mart interacted with Mr. A.S. Mehta, President, JK Paper Ltd. who has joined JK Paper a year back from JK Tyres & Industries Ltd. In the span of one year he has acquired a formidable understanding of the Indian paper industry, its challenges and opportunities, future market etc. below are the details of the interaction.

Paper Mart: Your outlook on the industry and the segments you operate?

A.S. Mehta: Paper industry predominantly is a capital intensive industry due to which its assets turnover ratio stays pretty low. It is a slightly attractive industry globally due to which they are able to get certain valuations. Indian paper industry despite having, a somewhat healthier margin as compared to them is, however, unable to attract investors for getting the real valuation.

Indian paper industry is very cyclic in nature, in terms of raw material availability which forms 50 to 60% of cost in production process depending on the location of the mill. In my analysis of the wood based cost structure of last 20 to 25 years, I found that at every 3 or 4 years the wood cost jumps and in another 1.5 or 2 years it comes down. And, when you co-relate the profitability of the paper industry to this cycle it follows the same structure.

Presently we are going through high input cost phase and it is not a good time to do the correction on the paper prices as there is a slight mismatch between demand and supply. The captive farming cycle has started in Andhra Pradesh, Orissa and other regions, which will supply adequate quantities of wood and bring down the wood prices. Besides there are no big capacities lined up in the next 2 years and only our production will come on stream i.e. in the first quarter of next financial year. So, whatever capacities are there they will fairly match the demand and then we might have some opportunity to correct the paper prices.

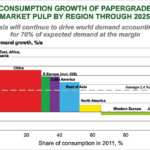

JK Paper is operating into three categories namely Copier paper, High-end Packaging Boards and Coated paper. The paper demand has linkages with economic activities of the country so all the segments will have a very healthy growth. The whole paradigm shift is happening wherein the middle class is aspiring by adopting the new level of lifestyle and the thrust of government on education is on rise. The increased usage in schools and universities and in corporate sector has made copier paper a high growth segment. The Government is talking about 30% increase in the education spending, which acts as another push on. Nowadays many homes have a printing device, which was not there earlier, for which they need copier paper.

In the last 5 years this segment grew at a CAGR of 14%, and with even conservative thoughts it should grow at the rate of 10 to 12% annually. The second business segment is Coated paper, which is used for printing, advertising and high end marketing activities etc. It has grown at a rate of 15% in the last 5 years and anticipated to grow at the 12% to 13% annually. Likewise the High-end Packaging Board has grown at a rate of over 19% in the last 5 years and is likely to grow at 17% annually in future.

PM: JK Paper is doing massive expansion of over Rs. 1650 crores. Kindly elaborate on your strategy?

ASM: JK Paper has been among the top copier brands in the India in terms of quality and price. We had a market share of 35%, five years back. Though the market was increasing continuously we weren’t able to meet the market requirements. The machines were exploited to an extent of 110%, in spite of that we were not able to meet the market demand.

We could have done a simple expansion by adding a machine of 50,000 to 60,000 tons of copier paper. But our idea behind this expansion was to build the most modern facility incorporating the state of art technology and viable capacity with one single machine. This machine will be unique in India and has a capacity to churn out 165,000 tons of paper. Second we are putting a brand new pulp mill with a unique embedded technology. The combination of these two machines is not only better in terms of quality per se rather cost wise they are the best. We will be saving the money by producing the paper on these machines.

The overall perspective was to take a long term vision of next 20-30 years for these machines to stay. In today’s scenario scale and the economic viability plays a very important role. The present vintage machines in India that produce 20,000 or 30,000 or 50,000 tons of paper have no economic viability in future. The renaissance will be for machines, which can churn out 100, 000; 200,000 and 300,000 tons of paper embedded with most advanced technological interface. To support the above endeavor we are also investing around Rs. 25 crore to build the most modern warehousing process, which is fully automatic.

PM: Your thoughts on the consolidation or restructuring happening or can happen in India. According to you how market will shape up in future?

ASM: Indian paper industry comprises of large, medium and small category players wherein small category players will remain in market as they are much localized and they have some advantages with them possibly in process of handling the business. Unorganized business sometime becomes more profitable than the organized business. But, there is a market for everyone.

When you talk about, only the large enterprises then the cost differential, price differential and brand perception plays a very important role. Everyone has a market to sell his products and JK have chosen its consumer segment which offers premium for better quality. Coming on to the consolidation it will take place in the near future.

I don’t think that any company coming from outside will find India as an easy market. It takes a long time to create the brand loyalty and customers connect. To my mind the Indian consumer is very brand loyal and the switch over from X brand to Y brand is not that easy unless he is not completely dissatisfied.

PM: You entered Myanmar for your pulp requirement; so what is the plan ahead?

ASM: The reason we went out to Myanmar was that this is the nearby place, which is opening up for business and has large forest cover with high-grade trees suitable for manufacturing paper. Myanmar Paper Company has an annual pulp production capacity of 70,000 tons and paper capacity of 15,000-17,000 tons. Our plan is to use 10,000-15,000 tons of pulp in Myanmar and ship the rest to India. This pulp will be used for our plant at Songadh, Gujarat. As of yet we are using imported pulp and it’s just that we are replacing the imported pulp with our own source. Moreover, to feed the newly installed pulp mill in Orissa the wood requirement will be met by our captive plantations and sourcing wood from Andhra Pradesh and nearby area.

PM: What are the key challenges and opportunities for Indian paper industry?

ASM: The biggest challenge to my mind is the availability of the wood for the industry and this challenge is to be addressed by the industry in its own way. India has approximately 30 million hectare of waste and degraded land. It can’t be put to use so we have suggested to the forestry department that either you do plantation or allow us to do plantation so it’s a win-win situation for the country. In Brazil every paper mill has captive plantation because the government has given them land on lease; the wood price in Brazil is $30 per ton whereas in India it is at least $100, which kills our viability. Let’s keep aside the paper industry interest but at least we are creating a green belt for the country which is depleting day by day.

Being a high energy consuming industry the availability of power is a great concern. To run our power plants the supply of coal is not sufficient. For Government the State power plants are the priority sectors and… we are left behind. Again to tackle the issue of availability of adequate water we undertake the water recycling regime. With the advanced technology our new machine will use half of the water what we are using today per unit of output. Another challenge is the availability of the manpower, as the paper mills are located in the remote area so it’s tough for us to retain them for long.

Despite all the above challenges, the opportunity for the Indian paper industry is there. It will grow phenomenally in the coming years. To reap the benefit of the growth we have to focus on other areas also like marketing, branding, customer-oriented approach vis-à-vis improving on the distribution channel.