India’s tissue paper industry is experiencing significant growth, with consumption expected to increase from 169,000 tonnes in 2018 to 550,000 tonnes by 2032, at an annual growth rate of 8.8%. While per capita consumption was low in 2023 at about 0.18 kg, significantly less than China’s 8.8 kg and North America’s 27.8 kg, the Indian tissue market is set for a breakthrough as production capacity is expected to reach 417,000 TPA by 2026 with a 19% CAGR from 2024 to early 2026. Paper Mart cuts through the noise to deliver a sharp, data-driven tissue story viewed through the lens of the Indian pulp and paper industry.

An Industry Wrapped in Mystery

The Indian tissue paper industry is an evolving yet opaque sector, where data inconsistencies and unorganized market activities make it difficult to ascertain the true scale of consumption, installed capacity, and actual production. From the standpoint of the Indian pulp and paper industry, the primary manufacturer of tissue paper in the country, the tissue paper segment includes products such as toilet paper, paper towels, facial tissues, napkins, and other hygiene-related paper products (excluding non-tissue hygiene products, such as diapers, sanitary pads, etc.) used in both household (retail) and commercial (AfH) settings.

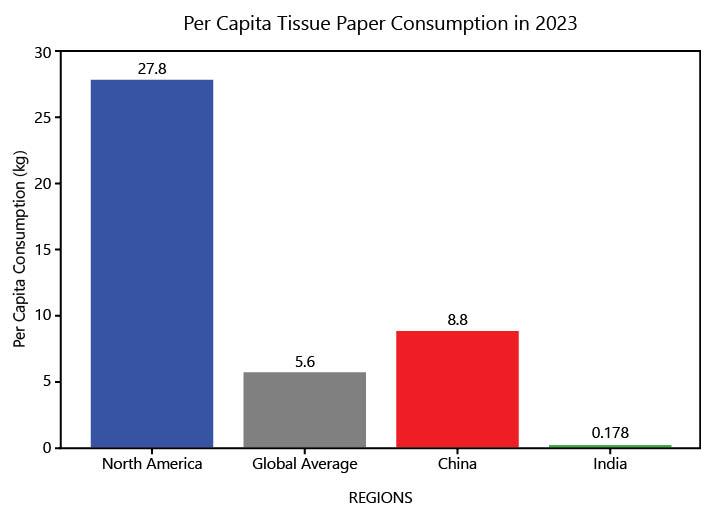

There is no doubt that the industry is witnessing steady growth, driven by increasing hygiene awareness and rising disposable incomes. However, India’s per capita consumption of tissue paper remains significantly lower than the average global consumption at 5.6 kg. In 2023, per capita tissue paper consumption varied significantly across regions, with North America leading at approximately 27.8 kg and China estimated at 8.8 kg, while India remained significantly lower at 0.18 kg.

Paper Mart undertook extensive statistical study to unveil the actual picture of the Indian tissue paper market by analyzing various reports, annual industry surveys, and triangulated projections. Based on the findings from our statistical analysis, we developed our own projections for the Indian tissue industry. Our study focused specifically on (1) tissue-based hygiene paper products (referred to as tissue paper) and (2) the organized-sector Indian pulp and paper industry involved in manufacturing good-quality tissue paper products (including virgin-pulp based premium), ensuring a clear and accurate representation of the tissue market.

6 key premises this article is based on:

- Viewing the Tissue Industry from the Indian Pulp and Paper Industry’s Perspective: The analysis specifically focuses on tissue paper production and consumption as seen through the lens of the Indian pulp and paper industry, rather than including broader market factors like imports and unorganized sector contributions.

- Forking Out a Consumption and Production Estimate Specific to the Indian Pulp and Paper Industry: The study attempts to separate the organized sector’s contribution to tissue paper consumption from the total market, providing a distinct estimate of how much the Indian pulp and paper industry alone produces and supplies.

- Focus on Tissue-Based Hygiene Products: The analysis is limited to tissue-based hygiene products such as toilet paper, facial tissues, paper towels, and napkins, without considering other non-tissue hygiene products (diapers, sanitary pads, etc.).

- Establishing an Independent Growth Projection Model: The article does not rely solely on existing fragmented reports but instead triangulates data from multiple sources and develops its own CAGR-based projections for future consumption and capacity growth.

- Discounting the Unorganized Sector and Imports from Market Projections: The analysis intentionally excludes contributions from the unorganized sector and imported tissue products, arguing that these do not represent the core production and supply trends of the Indian pulp and paper industry.

- Positioning the Industry’s Challenge as Consumption Growth, Not Production Capacity: The article argues that while India has sufficient installed and expanding production capacity, the real issue lies in boosting domestic tissue consumption, which remains far below global averages due to cultural preferences and affordability barriers.

Understanding Consumption Trends

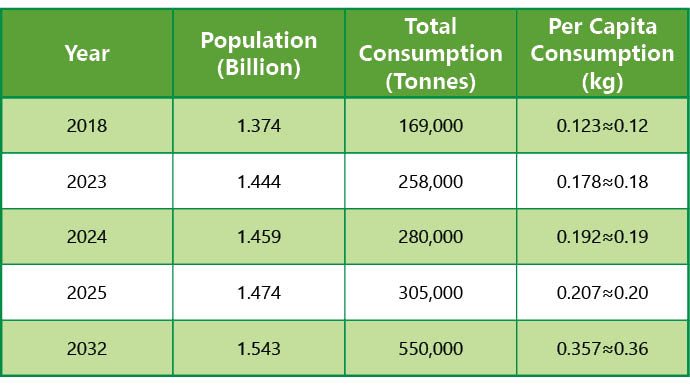

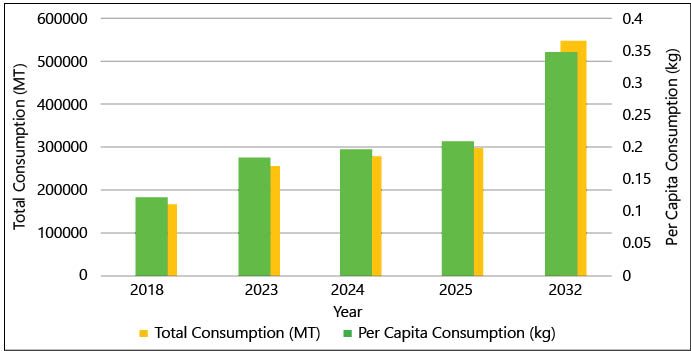

Estimating tissue consumption in India is complex because of the varying methodologies adopted by different research reports. Differing demographics, product baskets, and a lack of official manufacturing and import data further obscure the market size. Through careful analysis, Paper Mart established the estimated per capita consumption of 0.123 kg (≈0.12 g) in 2018, projected to grow at a CAGR of 8.8% from 2018 to 2032. This growth trajectory places India’s total tissue consumption at 550,000 tonnes by 2032, reflecting a significant rise from 169,000 tonnes in 2018.

Installed Capacity and Production Capabilities

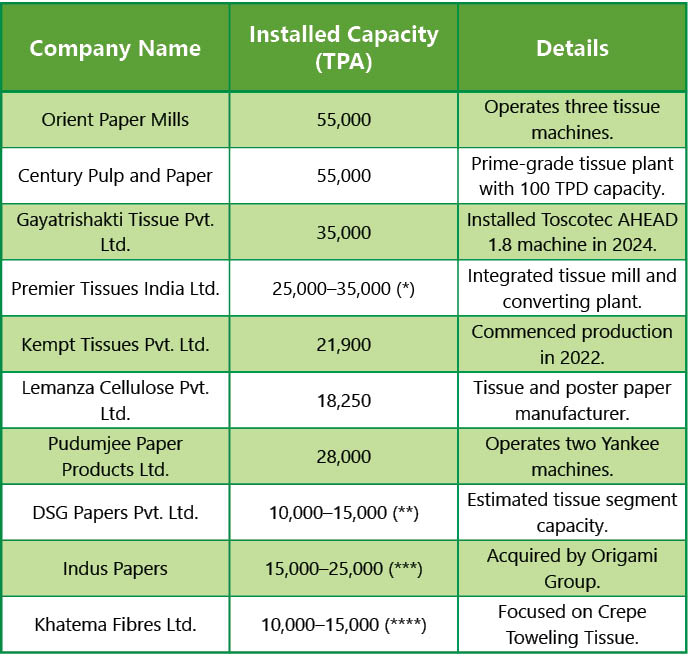

Paper Mart’s 2024 figures for India’s tissue paper production, leaving out tentative capacity figures, indicate a capacity of 238,000–248,000 TPA, concentrated mostly within a small number of established companies. It’s widely understood that installed production capacity is rarely achieved because of operational inefficiencies, downtime, and variable market demand. Therefore, this study estimates India’s current tissue production at 179,000–212,000 TPA, based on industry estimates and historical performance trends, which is around 75-85% of installed capacity. These estimates are true for the current year too as no significant capacities were added since 2024.

Including tentative capacity figures, total installed capacity is projected between 273,000 and 303,000 TPA. Since these companies (whose true capacity figures are not available) are actively manufacturing and supplying tissue paper to market, their tentative capacity should be included in the estimation of total installed capacity. The actual production, therefore, is projected at approximately 205,000–258,000 TPA for the year 2024 (to date). Production in this range aligns with projected consumption of 258,000 TPA in 2023 and 280,000 TPA in 2024.

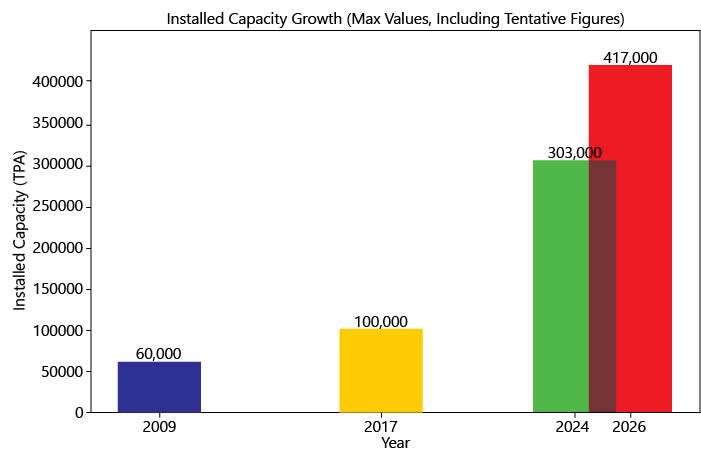

From 60,000 TPA in 2009 to 100,000 TPA in 2017, and now an estimated 273,000–303,000 TPA, India’s tissue paper industry shows impressive growth, boasting a 6.5% CAGR (2009–2017) and a projected 15–17% (2017–2024). The CAGR from 2009–2024 is approximately 10–11%, a positive figure for tissue manufacturing capacity growth. This suggests that India’s installed or operational tissue paper capacity is sufficient and not a cause for concern; rather, the issue lies in the sluggish growth of consumption.

Explanations for Tentative Figures of Installed Capacities:

() Premier Tissues India Ltd.: Premier Tissues has a strong retail presence and operates an integrated tissue mill with an established converting facility. Since exact production figures are not publicly available, an estimated range of 25,000–35,000 TPA is based on its market dominance and conversion operations. () DSG Papers Pvt. Ltd.: DSG Papers is involved in multiple paper segments, including MG poster paper and tissue paper. While the total plant capacity is 55,000 TPA, the tissue segment is estimated to contribute 10,000–15,000 TPA based on industry trends and the company’s focus. () Indus Papers: Indus Papers has been a tissue producer since 1994-95 and was acquired by the Origami Group, a leading converter. Given Origami’s extensive conversion operations and Indus Papers’ tissue-producing role, an estimated capacity of 15,000–25,000 TPA is assumed. () Khatema Fibres Ltd.:

Khatema Fibres specializes in eco-friendly paper products, including Crepe Toweling Tissue, used for kitchen and sanitary applications. The company has a total installed capacity of 50,000 TPA but manufactures multiple grades of paper. Assuming tissue forms a part of its production and based on industry allocations, the tentative estimate for tissue output is 10,000–15,000 TPA.

Future Growth and Expansions

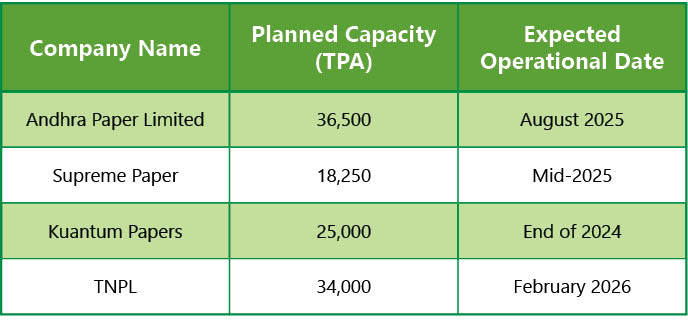

Several companies have announced capacity expansions, collectively adding about 114,000 TPA by early 2026. Considering planned mill capacities, total installed capacity is estimated at 352,000–362,000 TPA (excluding tentative figures) and 387,000–417,000 TPA (including them). From 2024 to early 2026, the CAGR for installed tissue paper capacity is projected to be 21–22% annually; however, incorporating tentative capacities adjusts this to 17–19%.

Paper Mart forecasts the industry’s total installed capacity to peak at 417,000 TPA by 2026, with a 19% CAGR from 2024 to early 2026. This estimate shows sound investment and growth in the sector. The rise in capacity neatly corresponds to projected consumption: 280,000 TPA (2024), 305,000 TPA (2025), and 357,000 TPA (2026), indicating a balanced supply-demand in the quality tissue sector featured in this article. Should consumption grow as projected, 2026 capacity will surpass demand, generating a surplus to replace imports and informal sector goods.

Discounting the Unorganized Sector & Imports

The estimates for both consumption and operational capacities are exclusively based on the organized pulp and paper sector, reflecting how much of their production is absorbed by the market. Accounting for the unorganized sector, which also caters to tissue consumption needs, is a complex task and has not been included in these estimates. The frequently mentioned estimate of about 0.5 kg of per capita consumption in India, while imprecise, probably accounts for imports and the informal sector; however, it doesn’t reflect the supply situation (who is supplying how much).

A 0.5 kg estimate suggests India’s 2024 tissue consumption would be around 730,000 tonnes—a substantial difference from our projected 280,000 tonnes. With a projected consumption of 280,000 tonnes in 2024, the estimated actual production (205,000–258,000 TPA) seems consistent with India’s pulp and paper industry capacity. This confirms that our consumption estimate accurately represents the production capabilities and grade specifications of the Indian pulp and paper industry. Furthermore, this emphasizes the consistent expansion of tissue manufacturing capacity to satisfy market needs.

Until there is a clear and comprehensive account of imports and the unorganized sector’s contribution to India’s tissue paper market, the consumption and production figures in this article should be considered the only workable approximations from the Indian pulp and paper industry’s perspective, as they represent the visible consumption the industry can directly serve or approach. Furthermore, the unorganized sector caters mainly to budget-conscious consumers, prioritizing inexpensive tissue production over higher-quality, virgin pulp tissue. In short, while above-estimate consumption exists, especially in the informal sector, it’s not practical for India’s pulp and paper industry due to product and quality variations. Therefore, eye what you can supply!

Watch: In Pursuit of Lesser Water Footprint

Challenges and Market Limitations

Despite growth, India’s tissue paper industry faces several hurdles. Capacity-wise, the Indian pulp and paper industry is well-positioned, with production closely aligned to meet estimated consumption figures. However, the real challenge lies in driving consumption growth, which requires consumer education, improved affordability, and a broader shift in hygiene perceptions to unlock the industry’s full potential. At just about 0.18 kg per capita consumption in 2023, India lags significantly behind the global average and countries like North America and China. This stark gap highlights the slow adoption of tissue-based hygiene products, influenced by cultural preferences for traditional alternatives like cloth and water, low awareness, and limited accessibility.

More importantly, India’s tissue paper industry struggles with data inconsistencies, making market assessment and strategic planning a challenge. The problem lies in the non-disclosure of official capacity, production, and sales figures by the majority of manufacturers in India, severely limiting data analysis and the ability to present accurate estimates or viable figures. The lack of viable estimates on consumption and actual production critically harms the industry, preventing informed decision-making for strategic growth and future expansion.

Unlike structured global markets, fragmented reporting clouds visibility on production, consumption, and imports. Heavy reliance on imported premium-grade tissue persists due to limited access to high-quality raw materials, driving up costs and exposing the sector to global price swings. At the same time, pulp shortages, outdated machinery, and supply chain inefficiencies prevent domestic production from reaching its full potential. The industry’s fragmented landscape, dominated by small-scale manufacturers producing low-cost, non-standardized tissue, further slows growth.

Also Read: TNPL’s INR 600+ Crore Capex Plan: Driving Sustainable Growth and Innovation

The Road Ahead

The Indian tissue paper industry is on a clear growth path, with rising awareness and infrastructure developments fueling demand. Moreover, the consumer-centric measures outlined in the Union Budget 2025-26 are expected to enhance disposable incomes and stimulate consumer spending. This, in turn, is likely to lead to increased demand for tissue products, benefiting the tissue paper industry in India. With new capacities on the horizon, the Indian pulp and paper industry is well-positioned to meet the rising tissue paper demand, particularly in the grades it supplies. However, addressing data transparency, enhancing domestic production quality, and integrating the unorganized sector will be crucial for sustainable growth. With robust investment in capacity expansion and increasing consumer adoption, India’s tissue market is poised for a transformative future.

The figures and numbers in this article are just estimates and not exhaustive. They are indicative at best and serve as an approximation of market trends.