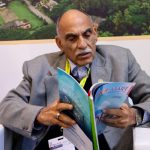

In an exclusive interaction with Paper Mart, Mr. N. Gopalaratnam, Chairman, Seshasayee Paper and Boards Limited, shared that the company is implementing Mill Development Plan IV (MDP-IV) in two phases to expand pulp (wood and bagasse) and paper capacity at its Erode unit by 20%. The company has also acquired Servalakshmi Paper Mill and is reviving it with an estimated capacity of around 75,000 TPA, which will take the total capacity to about 3,30,000 TPA, up from the current 2,55,000 TPA. In addition, Seshasayee Paper and Boards has partnered with a Spanish company to set up and commission nearly 62 MW of hybrid solar and wind power capacity, strengthening its sustainability and renewable energy adoption.

Paper Mart: Please tell us about your participation here at Paperex 2025.

N Gopalaratnam: Paperex is a biennial, internationally renowned exhibition and conference focused on the pulp, paper, packaging, and allied industries. It serves as the world’s largest business platform uniting all segments of the paper value chain, from raw materials and manufacturing technologies to finished products and sustainability innovations.

Paperex 2025, the 17th International Exhibition & Conference on Pulp, Paper, Packaging and Allied Industries was held from 3 to 6 December 2025 at Yashobhoomi, the India International Convention and Expo Centre (IICC) in Dwarka, New Delhi, India. Yashobhoomi is a world-class convention and exhibition venue located in Dwarka, New Delhi, and is one of India’s largest and most modern facilities for large-scale trade shows and international events. Yashobhoomi is probably the most spacious and well appointed space for such large tradeshows and the location received appreciation from all visitors.

Paperex 2025 was a grand event with more than 30,000 footfalls and representation from more than 30 countries, with participation from paper manufacturers, manufacturers of capital equipment, manufacturers of control systems, etc for the pulp and paper industry. Paperex 2025 hosted thousands of industry professionals, exhibitors, and international delegates for discussions on sustainability, innovation, technology, and business opportunities across the global paper and allied sectors.

PM: The company has recently approved INR 405-crore investment at its Erode to enhance pulp and paper capacity by 20 percent. How far have you reached in your goal and how will it accelerate the growth of the company?

NG: The proposed investment- Project Mill Development Plan – IV i.e., MDP-IV, is planned in 2 phases to augment pulp capacity (wood & bagasse) and increase paper capacity by 20% in our Erode Unit. In particular, a 20% expansion of pulp and paper capacity at its Erode plant has been cleared via environmental clearance (EC) from MoEF&CC in August 2025 for Phase-I. The company is awaiting the CTE (Consent to Establish) from TNPCB (Tamil Nadu Pollution Control Board), for commencing the project work. The company expects the project to be completed in the next 18 months.

Watch: Top Paper Companies 2023

PM: The company has installed India’s first wet electrostatic precipitator. Can you tell us about this new technology and how it will help in reducing carbon footprint or emissions? What do you think can be the future of this technology in India?

NG: Seshasayee Paper and Boards (SPB) is the first paper mill in India to install wet electrostatic precipitators (Wet ESP) to reduce particle emissions. Wet ESP is an advanced air-pollution control device used to remove very fine particulate matter (PM), acid mists and sticky condensable pollutants from exhaust gases—especially where conventional ESPs or scrubbers are not effective.

Wet ESP is a high-efficiency electrostatic dust and mist collector that continuously washes away fine, sticky particles from wet flue gas streams, making it ideal for modern paper mills and recovery boilers. This technology has a good future in India considering the tighter environmental regulations being imposed on the industry.

The proposed investment- Project Mill Development Plan – IV i.e., MDP-IV, is planned in 2 phases to augment pulp capacity (wood & bagasse) and increase paper capacity by 20% in our Erode Unit.

PM: What are the other developments happening in your mill?

NG: SPB has acquired the Servalakshmi Paper Mill which is currently non-operational and expects to refurbish or revive at ~75,000 TPA capacity. With this, the aggregate capacity could rise materially to ~330,000 TPA, given the existing ~255,000 TPA base.

SPB has a relatively healthy capital structure and liquidity buffers. Our balance sheet position gives us flexibility to invest and absorb cyclical shocks. Capital-intensive industries like paper need strong balance sheets to invest in upgrades, absorb raw material cost fluctuations, and maintain continuous operations. Our relatively prudent leverage gives it optionality.

PM: SPBL has achieved record operating output of 103% capacity at its Erode mill. What were the challenges involved in achieving this milestone and how do you overcome it?

NG: Our Erode & Tirunelveli Units operated at 103% and 85% of the capacity respectively in FY 2024-25, with total production from both units amounting to 246,431 tonnes (170,426 tonnes in Erode unit; 76,005 tonnes in Tirunelveli unit) in-spite of difficult challenging market conditions. The company could operate its Erode unit at over 100% capacities in-spite of availability issues in wood affecting pulp and paper production and adverse product mix or basis weight mix due to poor market conditions.

The key strength of our Erode unit is the wide range of products that we can manufacture right from colour grades, colour & white copier, white coated and uncoated varieties in creamwove and Maplitho segments, to surface sized papers, MF kraft, food grade papers, board varieties for wedding cards and packaging boards conversion, etc. The Erode unit operates five paper machines, giving us flexibility to manufacture and sell a wide range of products, even in smaller lots. This is the key USP of the Erode unit, enabling the unit to achieve higher capacity utilisations.

Our company is not limited to commodity grades, we produce printing & writing paper, chromo / coated paper, colored varieties, white & colored MG boards, multilayer packaging, etc. Moreover, our brand presence in key regional markets gives more immediacy and responsiveness versus distant mills. In paper & board, logistics, delivery time, responsiveness, and local service matter a lot. We can leverage lower freight cost and delivery time in our core geography as a competitive advantage versus mills located far away.

PM: Please give us insights on how Indian mills can achieve 100% capacity utilization and resource optimisation ?

NG: Maintaining full capacity in a downturn is challenging but absolutely achievable when demand-side uncertainties are offset by product mix agility, operational excellence, cost leadership, and market diversification.

Product mix optimisation is the most critical factor influencing profitable utilisation. Companies should also parallelly look at strengthening sales and market coverage, cost leadership to stay competitive even in a weak market, inventory management and smart warehousing, building export resilience, improving customer value proposition, strengthening channel confidence during downturn, investing in newer application and value added products, etc.

SPB has a relatively healthy capital structure and liquidity buffers. Our balance sheet position gives us flexibility to invest and absorb cyclical shocks.

PM: Can you tell us about your export footprint?

NG: Approximately 20% of production is exported to around 35 countries, giving exposure to global demand and benchmarks. We hold the status of ‘Golden Export House’ in recognition of its export performance. This breadth lets SPB hedge cyclicality in any one segment (e.g. printing & writing vs packaging) and capture higher-margin opportunities. Our export presence also helps us understand global quality expectations and adopt them in domestic operations.

PM: How do you see the current challenges in the paper industry with regards to paper imports and raw material price surge? How do you plan to overcome it?

NG: Paper industry in India has been battling dual challenges: Firstly, significant drop in sales realisation for domestically manufactured paper due to cheaper duty free imports from China, Indonesia and other SAARC and SE Asian economies.

Secondly, significant increase in the cost of wood which is key raw material for all integrated pulp and paper manufacturers. These two challenges have fundamentally altered the margin perceptions of the Indian paper industry and has made further investments financially not justifiable.

Further the latest GST changes is adversely affecting the domestic paper mills by making tax elements (like IGST) nil for imported paper. This has further aggravated the problems faced by the Indian paper mills. The paper industry is continuously seeking support from the Government to overcome the challenge.

On the mill side, the only ways to overcome this problem is to continuously invest in improving the cost competitiveness and long term sustainability of the paper mills, enhance product offerings, continuously support our channel partners and customers, and ensure export market focus.

PM: How does your mill ensure sustainability or ESG integration into its operations?

NG: SPB continues to emphasize sustainability or ESG integration with ‘high share of renewable energy use’, and ‘wood-positive operations.’ By distributing seedlings, and planting contracts such as ‘agrofarm or contract forestry’, working to augment wood sourcing from nearby states and integration of ESG goals into growth strategy, (i.e. future expansions will need to meet environmental, social, and governance ambitions).

Our company has also recently collaborated with a Spanish company for setting up and commissioning of about 62 MW of hybrid-solar and wind power facilities, for exclusive use by SPB. This facility, to be housed as a separate SPV, will have equity participation from our company under Group Captive Model and this facility will have 9 MW of wind power facilities and 52.8 MW of solar PV facilities.

This strategic tie-up to foster energy from renewable sources, along with the company’s proposed investment in Erode in project MDP-IV and in bio-fuel based boilers in Tirunelveli unit, can ensure that more than 65% of energy needs of all the 3 units of the company be addressed by Green Sources.

PM: How do you foresee the future of the paper industry, and what are your future plans for the next 5-10 years?

NG: Domestic demand is projected to grow steadily, especially in packaging, tissue, and specialty grades: Packaging paper and paperboard demand is expanding rapidly due to e-commerce, FMCG, and ban on single-use plastics, helping these segments grow faster than traditional writing & printing grades. The writing & printing paper segment should also continue to grow moderately, supported by education and office sectors. Tissue and specialty papers are among the fastest-growing product segments driven by rising consumer income and hygiene awareness.

India’s per-capita paper use (~16 kg) is still below the global average (~57 kg) and Asian average (~26 kg), indicating big untapped demand as literacy, urbanization, and organized retail grow. Industry reports estimate the market will expand at a healthy CAGR through the decade, with some forecasts showing significant value growth by 2033.

Our company is betting heavily on scaling up pulp self-sufficiency, augmenting renewable power generation and reactivating idle capacity to boost our scale and reduce dependence on purchased pulp or external costlier power.

These moves aim to consolidate scale, expand capacity, and reduce fixed-cost per unit, improving margin resilience. Scale matters in paper and board for cost absorption, R&D,and capital turnover. Strategic acquisitions that can be integrated for economies of scale, and shared synergies, can accelerate growth while limiting green-field risk.

The hybrid-solar and wind power facilities to be housed as a separate SPV, will have equity participation from our company under Group Captive Model and this facility will have 9 MW of wind power facilities and 52.8 MW of solar PV facilities.