By Pirita Huotari, Senior Consultant, Business Intelligence, Fisher International, Inc.

Ecological trends and worry over pollution and climate change are putting more and more pressure on the textile market. Rated as one of the most carbon-polluting industries in the world, the textile market creates more CO2 emissions than international flights and maritime transport combined. As new wood-based textile fiber technologies mature, could they offer a viable, ecologically sound option for oil- and cotton-based textile fibers, and an attractive profit opportunity for the pulp and paper industry?

Let’s take a look at the current state of the technologies and their possible competitive position in the textile market.

Background

Creating textiles from wood is not a novel idea. Invented at the end of the 1800s, Viscose, a cellulose-based fiber, was the first man-made textile fiber. Although its original intent was to replace cotton, oil-based fibers, and natural silk, costly production and low wet-strength have historically limited its use. As the demand for textiles has steadily increased and the technology has improved, the consumption of viscose and related fibers (like Lyocell) has gradually increased. Still, the current share of wood-based textiles is only about 6% of the almost 100 million tonnes of textile fiber produced annually.

Oil-based fibers, which currently supply approximately two-thirds of the market, are durable, washable, and easy and inexpensive to produce. The drawbacks are their extensive carbon footprint, low recyclability, and recently proven trait of releasing microplastics into the environment, all of which are driving consumers and brands to look for more environmentally friendly alternatives. As textile demand is growing at the same time as pressure for replacing oil-based fibers is increasing, the market is ready for innovation.

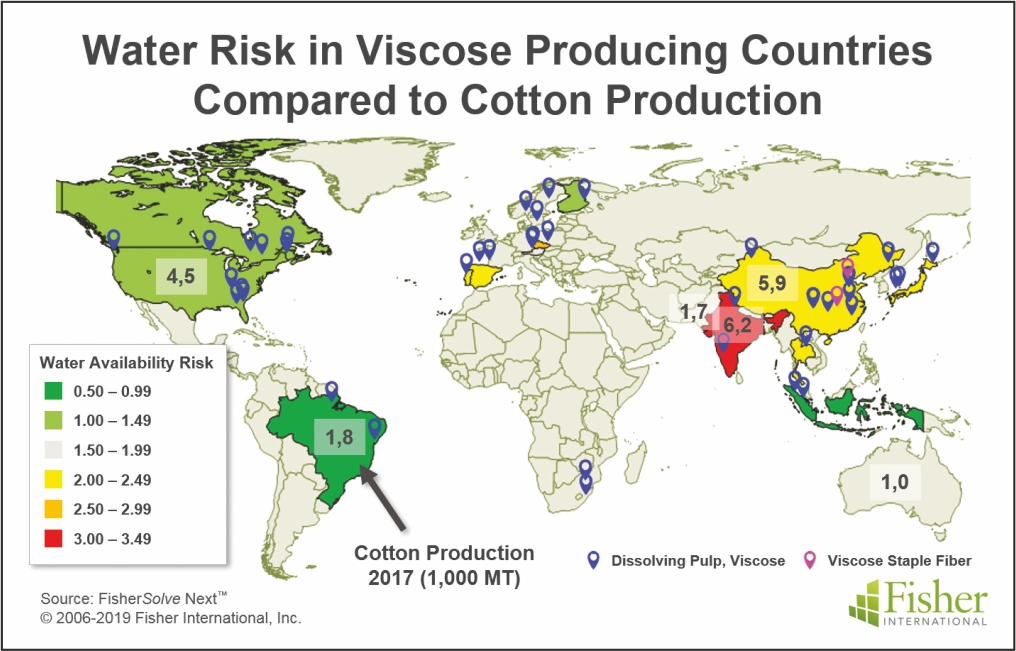

Opportunities for increasing textile production from other natural fibers are limited. The most popular natural fiber, with 27% market share, is cotton. But traditionally, cotton has been classified as “environmentally harmful,” as it is cultivated in the same areas as food crops, and in regions of limited water resources. The water-intensive production process and wide use of pesticides is making cotton’s environmental footprint even worse. Moreover, production has been suffering from crop losses. The next most popular natural fibers are wool and silk, which together only represent a little over 1% of the current textile market, making scaling up their production unlikely.

As such, eyes are turning to so-called bio-based man-made fibers like viscose. Traditional viscose as a material is not much better from a responsible point of view, as it is also graded as environmentally harmful, but for reasons different from those for cotton. The main reasons are the use of uncertified wood and its pollution-causing production process, as chemicals used in production are often disposed of with little or no treatment. Manufacturers have been searching for improvements to the process. As an example, Lyocell fibers are produced in a closed loop process and harmful chemicals are not released into the environment.

However, even with improved production methods, the main disadvantage of viscose and related fibers still remains – price. The end-price of viscose in the market is significantly higher than that of polyester. But, could new technologies address the environmental issues AND the price problem?

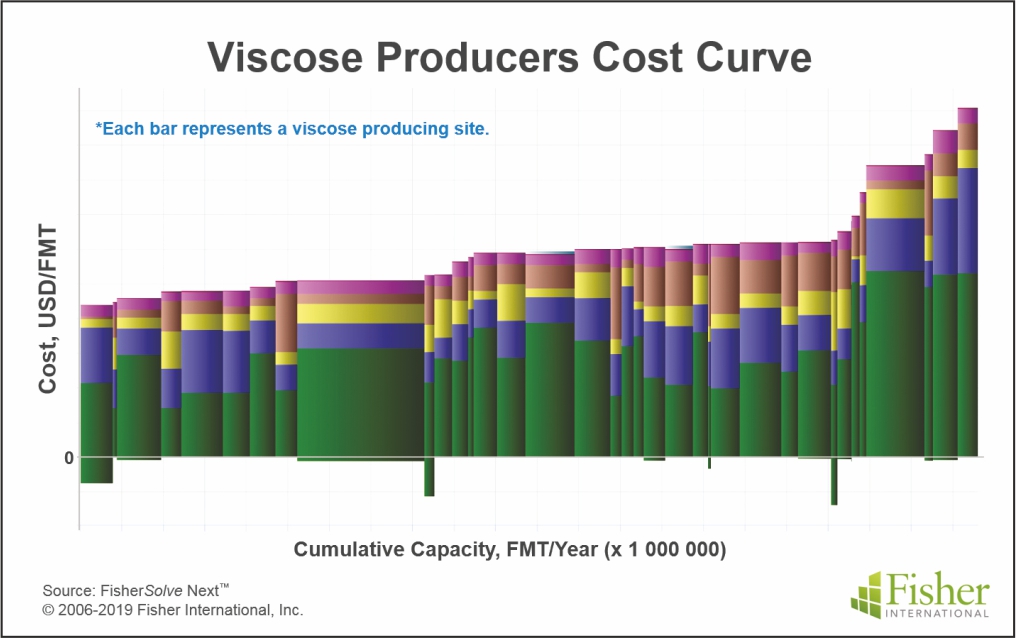

Figure 1 shows that low-cost viscose companies can produce at half that of high-cost manufacturers, leaving room for some to at least compete in broader textile markets. New investment is more likely to enter at the low end of the curve.

New Technologies – What Is Different Now?

A leading company in the competition for new wood-based textile fibers is Finland-based Spinnova, which completed building its new pilot facility in December, 2018. Spinnova’s technology utilizes micro fibrillated cellulose to create textile fiber mechanically without chemicals and zero waste streams.

Metsä Spring (part of Metsä Group) also recently announced building a pilot plant capable of producing textile fiber, using paper-grade captive pulp from the Äänekoski mill in cooperation with the Japanese Itochu Corporation. The capacity of the pilot plant is announced to be 500 tonnes of staple fiber per year.

Examples of other technologies for wood-based textile fibers in development are Cellulose Carbamate (VTT), Ioncell-F (Aalto University) and BioCelSoL (Tampere University of Technology). Many of these technologies can also use other sources of fiber that are not virgin wood, like waste paper and board, old cotton garments or non-wood cellulose.

Competitors to wood-based textile fiber include other bio-based technologies, as well as the recycling of used textiles or other waste streams. There are technologies using bacteria, starch, or waste biomaterials as raw material to produce polymer fibers suitable for replacing oil-based textile fibers. Another consideration is the very low recycling rate of the industry, as new technologies are being developed to reuse old garments for new raw materials.

How Big Could the Potential Market Be?

If new wood-based textile technologies prove to be ecologically feasible, how much wood would the textile market end up using, and would it be profitable?

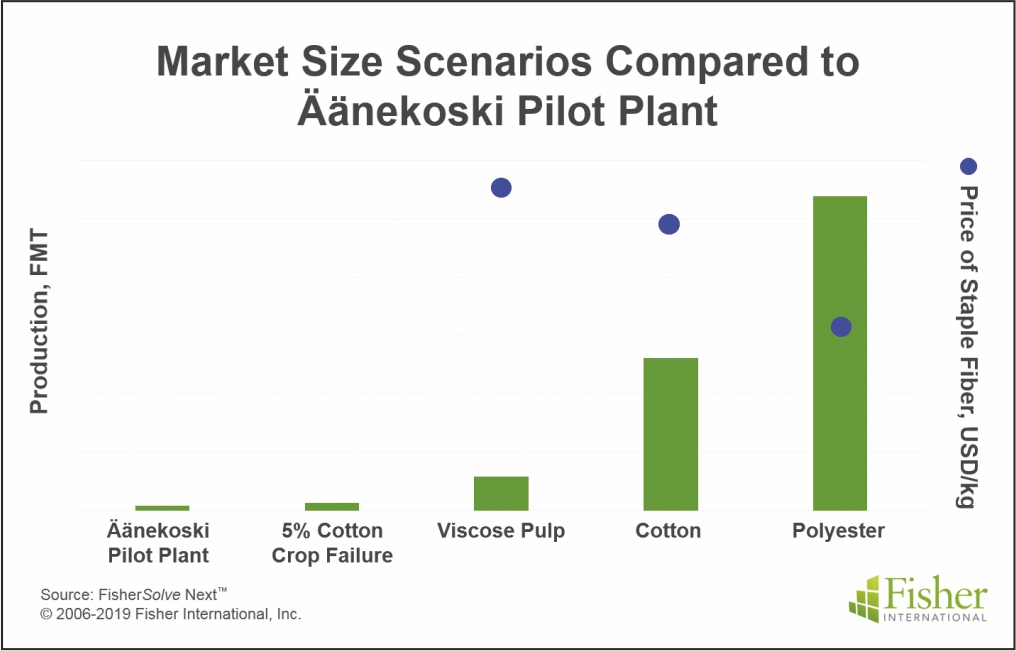

One way of looking at the end-market size is to look at the current production of viscose pulp. Global capacity is about 5.5 million tonnes, depending on how much swing capacity is used for viscose at any given time. If the new processes are capable of producing viscose-quality fiber at lower costs, it could be expected that they would pose a threat to current viscose production. On the other hand, since current producers may have established market positions and delivery networks in place, they may be the logical adopters of these new technologies.

As new technologies develop even further, the next target could be the second biggest textile raw material – cotton. Cotton production for 2018-19 is projected to be about 120 million bales (USA), corresponding to approximately 26 million tonnes of cotton. Imagine if crop failures became more common, let’s say, by losing 5% of the annual crop. There would then be a need for 1.3 million tonnes of fiber from other sources (for simplicity’s sake, we used a 1:1 ratio of cotton weight to other fibers required to substitute, including dissolving pulp). If viscose dissolving pulp provided all of the shortfall, the pulp industry would need to add almost 25% of annual viscose dissolving pulp capacity to meet it.

Market growth is also a huge factor, as the projected need for textiles in 2025 is 140 million tonnes per year. Even if only a third of this growth is fulfilled by cellulose based textiles, this translate to eleven modern pulp lines supplying solely to the textile industry.

So, any way one looks at the market, the opportunities could be significant. But how about profitability?

In comparison to the current viscose pulp production method, the potential savings in raw material of the new technologies are noteworthy. The difference in production costs on a global basis between dissolving pulp used as raw material for viscose, and kraft market pulp is already over USD $135 per tonne on average. Even with Spinnova’s process using micro fibrillated cellulose (which requires more refining), it is expected that the simple textile fiber production evens out the difference to other technologies.

The price of polyester has historically been about 50-60% that of viscose, and cotton prices some 90% of viscose. Even if we expected the production cost of the new wood-based fibers to be somewhat higher than viscose due to improved water handling and more environmentally friendly chemicals, it still should be possible to achieve a reasonable end-price in the market with the savings from raw materials (Figure 2).

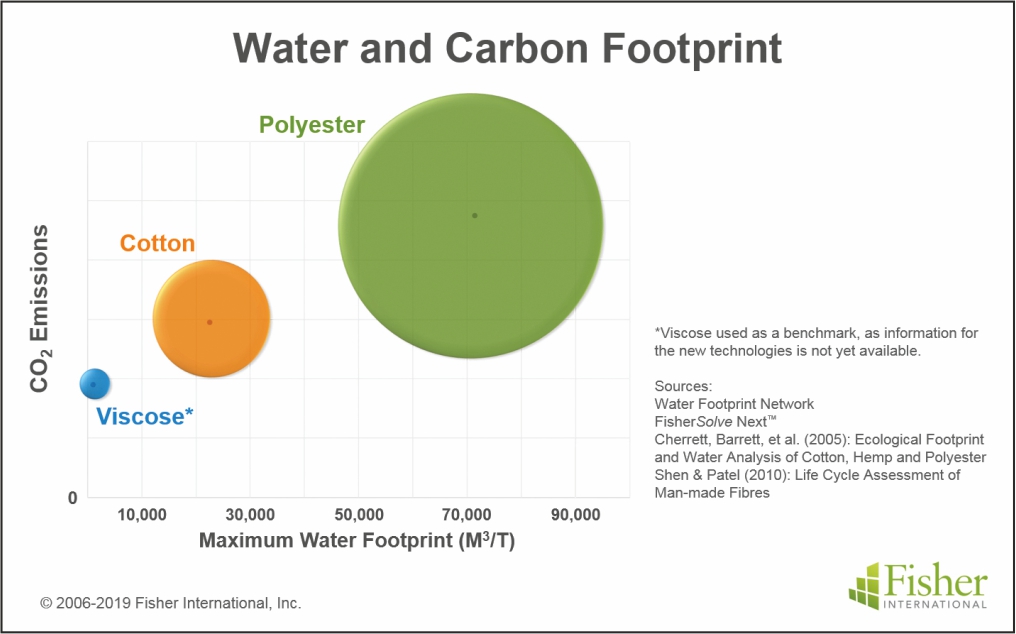

With the price of cotton and viscose pulp fairly comparable, it is reasonable to ask if the new materials could end up competing with cotton, at least initially. As cotton is cultivated in the same area as food crops and wood is not, positioning the alternative fibers as the ‘new cotton’ could end up being a more viable go-to-market strategy than competing with inexpensive polyester. In addition, cotton is mainly produced in areas with water shortages, whereas pulp production is more scattered, and in areas of lower water risk. Even if produced in areas of water scarcity, viscose production only uses about 7% of the water required for cotton production.

Energy Use and Emissions, Water Footprint

It’s no surprise that energy use and carbon emissions from oil-based man-made fibers are bigger than those of wood-based fibers. But the scale of the difference is still shocking. According to a BSR™ report from 2009, energy usage for raw material feedstock and production of polyester fiber is about 90 megajoules per kilogram (MJ/kg) of fiber for polyester. Compare that to the 12 MJ/kg global average of viscose pulp, with one company producing pulp at a low 2.5 MJ/kg.

When taking into consideration that the energy for polyester raw materials is often produced by non-renewable fuels, the difference in CO2 emissions is massive. When wood-based textile fiber is produced at an integrated pulp and paper site with captive pulp, textile fibers can be manufactured with very low or possibly even zero carbon emissions. If viscose production is used again as a benchmark, the lowest emission producer emits under 0.5 MT CO2 eq. per tonne of viscose grade pulp. The water footprint picture is similar. The raw material for viscose and for the new wood-based fibers can be produced with low-water processes, making the water footprint significantly lower than that of cotton or polyester.

In Figure 3 we can see that CO2 footprints can vary quite a lot, but the average dissolving pulp producers’ footprints are smaller than those of cotton textiles. (Viscose was used as a benchmark, as information for the new technologies is not yet available.)

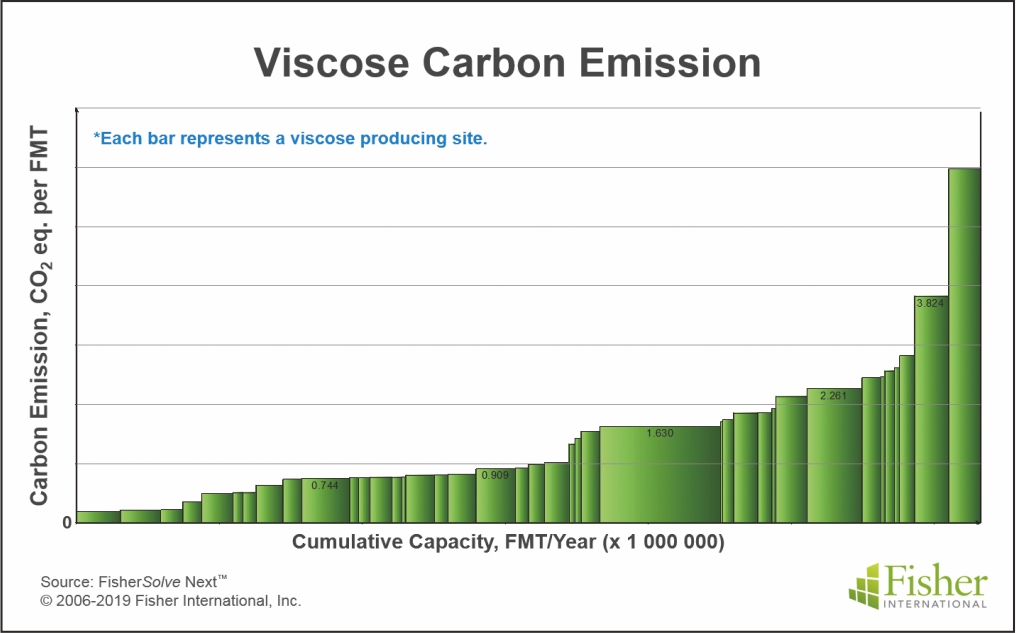

Figure 4 shows the amount of carbon emitted per tonnes of viscose produced by each mill. Carbon footprints vary so widely in viscose production that, as the importance of sustainability increases, some manufacturers may be able to develop large advantages over competitors.

The Big Question – Where Would the Fiber Come from?

The size of the textile market in tonnes is about half of the global pulp and paper market. So, we could be talking about a significant increase in fiber usage should wood-based fiber gain a foothold in the textile market.

Looking at the cost and environmental benefits of wood fiber, again using viscose as a benchmark, about half of the viscose pulp is produced in North America or Europe, whereas the center of cotton production is in India, China and Pakistan (Figure 5). As most of the garments used all over the world are manufactured in Asia Pacific, transport would be an obvious drawback for wood-based fibers regarding both cost as well as the environmental impact.

From a cost benefit perspective, options to tackling the challenge could be to push the production cost so low, that even with a transport component it would still compete with other raw materials, or to develop a scalable and raw-material flexible technology which could be set up closer to the manufacturers, therefore addressing both the cost as well as the environmental issues.

A Great Opportunity for Fast Movers

“The economy of scale is a huge advantage for wood-based textile fibers in comparison to other emerging technologies”, comments Emmi Berlin from Spinnova. The forest industry has an incomparable competitive advantage of being able to produce sustainable, stable quality raw material in bulk quantity year-round. This is something which could eventually pose a threat even to oil-based fibers and open an unprecedent profit opportunity for the industry. The drawback is that technology development is relatively slow. With the first technologies just now in pilot stage, it is likely to take years before consumers will start seeing the new fibers in the shops. As solutions are needed now, the fastest is likely to win the game. Will the forest industry move quickly enough to take advantage of the opportunity?

The original story was published in fisher International Inc. (www.fisheri.com)