The Indian paper industry has steadily evolved in the past two decades. Once dominated by writing and printing paper, it is now the packaging segment that drives expansion, spurred by kraft, duplex, and specialty grades amid fast changing packaging preferences.

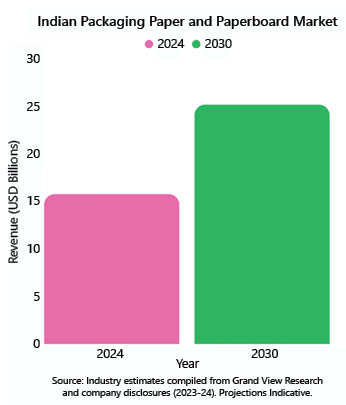

Rising consumption, the growth of e-commerce, and sustainability pressures have made packaging paper one of the fastest-growing categories. Recent estimates place the Indian packaging paper and paperboard market at roughly 15 million tonnes in 2023-24, growing at 8.2% year-on-year, and generating around USD 15.8 billion in 2024, with forecasts pointing toward USD 25.2 billion by 2030. The segment’s robust year-on-year growth is a clear reflection of demand resilience despite global supply chain pressures.

Corrugated boxes, folding boxboards (FBB), coated duplex boards, kraft paper, and liquid packaging boards together make up the bulk of this demand. The market is also supported by increasing penetration of organized retail and government initiatives promoting sustainable packaging. India remains one of the fastest-growing paper markets globally, with per capita paper consumption at 15–16 kg, still far below the world average of 55–60 kg, indicating significant headroom for long-term expansion.

Watch: In Pursuit of Lesser Water Footprint

Sub-Segments of Packaging Paper

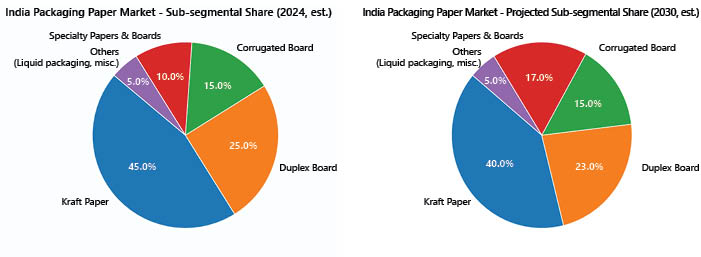

The packaging paper industry in India is broad-based, with several distinct sub-segments catering to different end-use applications, each showing its own growth trajectory.

Kraft paper forms the backbone of the sector, driven largely by the rise of e-commerce and the rapid expansion of supply chains. It is the most widely used material for corrugated boxes, which account for nearly 65–70 per cent of all packaging needs in logistics. India’s kraft paper market has already reached around 11 million tonnes in 2024 and is projected to grow at a CAGR of about 7.2%, likely exceeding 21 million tonnes by 2033.

Producers are actively investing in stronger and lighter kraft grades. As Dinesh Haripara, MD of Apollo Papers explains: “Our core product portfolio includes high BF kraft paper…Manufactured with a strong focus on strength, durability, and printability, our products perform exceptionally well in high-speed corrugation lines…” The company adds that a shift is underway towards higher-BF and low-GSM kraft to optimize box design.

Sripathi Paper and Boards also caters to kraft and linerboard demand alongside its duplex offerings. As Sudarshan Rangaswami, Assistant VP (Finance) notes: “We have a wide variety of products ranging from eco-FBB, white top kraft liner,…developed because of our customer focused approach and a vision to build a value- added packaging board business.” These kraft liners and eco-friendly solutions address the growing preference for recycled, high-performance grades.

Duplex board is another large sub-segment, available in both coated and uncoated varieties, which finds widespread use in FMCG, pharmaceuticals, and personal care packaging. From toothpaste cartons to over-the-counter medicine boxes, duplex board serves as the face of retail packaging. Though coated duplex demand was around 5.2 million tonnes in 2021–22 with projected growth around 7.1%, recent forecasts suggest a more cautious outlook, at approximately 5–6% CAGR through 2034. This moderated outlook is primarily driven by volatility in pulp and chemical prices, which constrains mill margins, and by recurring demand slowdowns linked to surplus domestic capacity.

Khanna Paper Mills has made deep inroads here with flagship grades such as Diamond Graphic Grey Back (duplex) and Dezire (folding box board). SVR Krishnan, Executive Director (Operations) states, “Our packaging boards are used by the leading national and international brands in consumer goods or FMCG.”

Sripathi Paper and Boards contributes with dust-free duplex grades. “The variety which includes dust-free grey back (nano super), dust-free white back duplex boards (nano gloss), and eco-FBB (nano green) with a wide GSM range from 180 right up to 450 GSM, enables us to offer a one-stop solution to our customers,” explains Sudarshan Rangaswami.

NR Agarwal Industries (NRAIL) is another significant duplex and board producer with a strong domestic footprint. Its portfolio spans FBB, SBS, duplex and triplex boards. “Customer preferences are evolving across industries. To meet this evolving need, we have produced coated duplex boards (WLC) that are eco-friendly, made from recycled fibers…suitable for cereal boxes, dry foods, and FMCG… Folding Box Board (FBB) which is premium-grade… Solid Bleached Sulphate (SBS) boards which are made up of 100% virgin fiber…for embossing and high-end packaging (e.g., perfumes, chocolates, cosmetics),” informs R.N. Agarwal, CMD, NRAIL. The company is scaling up with a new board machine to meet rising demand. “Our roadmap is ambitious and future-ready. To expand our production capacity, a new 1,020 TPD board machine project is underway, enabling us to cater to rising demand.”

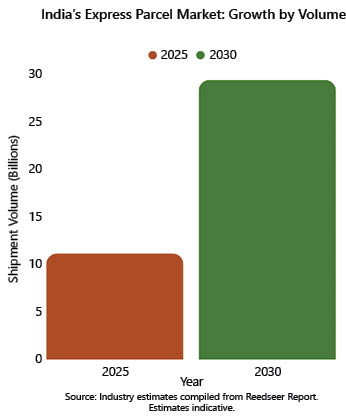

Corrugated boards and sheets, which rely heavily on kraft paper as raw material, have surged with the boom in e-commerce. India’s express parcel market is expected to handle 10–11 billion shipments in FY2025, over half of which come from e-commerce, and is projected to grow nearly 3 times to 24–29 billion parcels by FY2030, driving sustained demand for corrugated packaging. Mills are innovating with strength-to-weight optimization, as Apollo Papers highlights.

Specialty papers and boards represent the most dynamic frontier of the sector. These include barrier-coated papers for food-safe packaging, greaseproof wrappers, liquid packaging boards, and decorative laminates. The segment has gained significant traction after India’s phased ban on single-use plastics, with QSR chains and FMCG majors shifting to sustainable alternatives. The specialty paper market is expected to grow at double-digit rates, with estimates ranging from 10 to 12 per cent CAGR over the next decade.

ITC PSPD has pioneered here with its Filo series: “Our path-breaking Filo series of sustainable paperboards has gained significant traction in the food and beverage industry, both in India and abroad as a substitute to single use plastics, further underlining our commitment to sustainability.”

Tamil Nadu Newsprint and Papers Ltd (TNPL) has invested in premium coated boards. “Our product portfolio includes Folding Box Board (FBB), Solid Bleached Sulphate (SBS) board and cup stock, with a GSM range of 150–400. For cup stock, Aura Flute and Aura Flute Supreme are well suited for paper cups used with hot and cold beverages, with the Supreme range offering premium printability and gloss,” explains Sandeep Saxena, Chairman & MD.

Ruchira Papers is differentiating with agro-residue-based white packaging grades. “We offer high-quality white packaging paper across various GSMs ranging from 60 to 180, suitable for food packaging, pharma, hygiene products, retail packaging, and value-added converting applications,” says Ruchica, Director.

Star Paper Mills, with its legacy portfolio, supplies grease-resistant and colored boards. Managing Director Madhukar Mishra informs, “We also offer an array of specialty papers, including MG poster, ARSR poster, stiffer cover, oil- and grease-resistant (OGR) paper, cup stock paper, honeycomb paper, and colored papers & boards for diverse specialized applications.”

Chandpur Paper has positioned itself in MG and chromo papers, also serving specialty end uses. Founder Amit Mittal explains, “Our portfolio includes MG poster paper and chromo (C1S) paper, which are retailed primarily in GSM ranges of 35 to 70. Our paper grades find applications in FMCG packaging, labeling, commercial print, PE lamination, and flexible packaging segments. Keeping an eye on changing market trends and growing environmental pressures, we are also producing value-added and specialty grades.”

Together, these sub-segments highlight the breadth of India’s packaging paper industry, from commodity kraft and duplex to high-value specialty paper and boards. Kraft and duplex papers dominate current market volumes, but specialty paper segments are driving the industry’s expansion. Companies like ITC PSPD with its FiloBev brand, TNPL’s Aura Flute Supreme, Ruchira’s white paper offerings, Sripathi Paper and Boards’ eco-friendly folding box board, and Chandpur Paper’s chromo grades represent the sector’s most dynamic growth opportunities. These specialty paper manufacturers are capturing market share by targeting specific applications that command premium pricing over commodity grades. The shift reflects broader industry consolidation around value-added products as traditional paper demand faces headwinds from digital alternatives.

Inputs and Technology

Packaging paper production in India today runs on a balanced mix of virgin pulp and recycled fiber, but the industry remains exposed to global price swings in both imported pulp and wastepaper. Despite an improving domestic wastepaper ecosystem, the collection and segregation infrastructure is still fragmented, forcing mills to source high-quality recovered fiber from overseas. For integrated players like ITC PSPD and JK Paper, captive pulp capacity helps de-risk supply volatility, while recycled-fiber–based producers such as Khanna Paper Mills, NR Agarwal Industries, and Sripathi Paper and Boards continue to invest in better sorting, pulping, and de-inking technologies to maximize fiber yield.

On the technology front, the industry has seen a steady wave of upgrades aimed at improving strength, reducing grammage, and enhancing resource efficiency. ITC PSPD has strengthened its packaging portfolio through recent technological upgrades, including the commissioning of PM1A and a BCTMP plant at Bhadrachalam for high-quality board furnish, installation of a coater for sustainable barrier boards and a laminating machine at its Bollaram unit, and capacity enhancement of décor paper at Tribeni, alongside being the first in India to commission a High-Pressure Recovery Boiler (HPRB), underscoring its commitment to green technology.

TNPL has adopted two shoe-press machines and invested in coatability and surface sizing systems to produce premium FBB and SBS boards with higher bulk and smoothness at lower basis weights. JK Paper’s 170,000 TPA multi-layer board machine at Fort Songadh is one of the most modern lines in the country, featuring advanced dilution control and quality monitoring systems to produce lightweight boards with consistent performance.

Several mid-sized players have made targeted process upgrades. Khanna Paper Mills has commissioned a Voith Master Jet Tech-3 headbox, allowing better fiber orientation and strength properties. NR Agarwal Industries has focused on lightweighting technology and has recently commissioned a 900 TPD state-of-the-art multiwire board machine, supplied by GSPT Korea and Andritz. Ruchira Papers’ investment in agro-residue pulping lines allows the use of wheat straw, bagasse, and rice husk as raw material, thereby lowering wood dependence and cutting carbon intensity. Besides, the company has invested in automation in sheet formation, process control systems to reduce variability, and enhancements in pulping efficiency to improve yield from agro-residue

In South India, Sripathi Paper and Boards has executed a string of upgrades under its Vision 2028 plan, including a glass-lined calenderer, blade coater on PM4, automatic sheeters with vertical stacking, and a Warehouse Management System (WMS) for seamless dispatch planning. Apollo Papers has implemented real-time monitoring systems that track key quality parameters and improve machine runnability on high-speed corrugation lines.

Chandpur Paper has recently installed new-technology paper machines and fiber lines to improve both product quality and operational efficiency, complemented by real-time quality monitoring systems that ensure batch-to-batch uniformity and minimize profile deviations. Star Paper Mills has modernized its turbine and energy systems to enhance power efficiency and cut operating costs.

Lightweighting remains a common technological theme across the industry, as converters demand lower GSM paper and boards without compromising strength. “Lightweight packaging is steadily becoming the preference for many due to cost-efficiency and increased awareness on sustainability and we have ensured that we maintain our competitive advantage by meeting this demand without compromising on the performance or the quality of our grades,” informs ITC PSPD.

Several mills are also developing barrier-coated and grease-resistant grades to replace plastic laminates in food service and delivery packaging. Across the board, digitalization, predictive maintenance, and energy-efficiency programs are gaining traction, driven both by cost pressures and the need to meet ESG commitments.

Collectively, these investments show a sector in the midst of technological renewal, building capacity, improving fiber efficiency, lowering energy and water footprints, and laying the groundwork for more specialized, higher-margin packaging products.

Industry Voices and Key Players

The packaging paper sector in India reflects a layered market structure, where large integrated majors set the pace, mid-sized firms scale through innovation, and regional mills sustain niche demand. Together, they create a fabric of resilience and adaptability that has allowed the industry to grow despite challenges of cost pressures and global volatility.

At the top end of the spectrum, ITC PSPD, India’s largest integrated pulp and paper manufacturer with close to one million MT capacity, continues to emphasize sustainability and product diversification. The company affirms, “We are confident this will strengthen the market standing of ITC PSPD and create new opportunities in both the domestic and international markets.”

TNPL, with 600,000 TPA of capacity, has built a strong base in premium boards and is preparing for the next wave of demand. Sandeep Saxena says, “To tap into the growing packaging grade products demand, TNPL is gearing up to produce more Folding Box Board (FBB) grade products which will further enhance customer delight.”

JK Paper has consolidated its leadership in the packaging board segment with both greenfield and acquisition-led expansion. In early 2022, the company commissioned its INR 2,000 crore integrated unit at Fort Songadh, Gujarat, adding 170,000 TPA of multi-layer packaging board and 160,000 TPA of integrated pulp. This pushed its total capacity close to 800,000 TPA, with 15–20 percent of output already routed to export markets.

Complementing this, JK Paper also entered the packaging conversion space through the acquisition of Borkar Packaging, one of India’s leading corrugated and folding-carton producers. As Chairman & Managing Director Harsh Pati Singhania was quoted as saying, “The Packaging Conversion business is amongst the fastest growing segments in the Indian Paper and Packaging industry driven by growth in end use industries. The acquisition of BPPL is in line with the long-term strategic objective of the Company and gives us an opportunity to offer combined solutions to customers with respect to secondary and tertiary packaging.”

Century Pulp & Paper has steadily positioned itself as a leading player in the premium packaging board space, with nearly 182,500 TPA dedicated to multi-layer packaging board production (out of a total 480,000 TPA capacity). Multi-layer packaging board contributes about 40–44% of Century Pulp & Paper’s revenue, underscoring its role as a core product alongside writing & printing paper, tissue, and rayon pulp. Its portfolio includes high-quality grades such as Folding Box Board (FBB) and Solid Bleached Sulphate (SBS), catering to the demanding needs of FMCG, pharmaceutical, and personal care segments. The company emphasizes the use of virgin pulp and eco-friendly coatings, aligning with the growing preference for sustainable and food-safe packaging solutions. Following its recent acquisition by ITC for INR 3,498 crore, CPP’s packaging business is expected to gain further momentum through synergies with ITC’s Paperboards and Specialty Papers Division, expanding capacity utilization and enhancing its presence in domestic and export markets.

Like Century Pulp & Paper, West Coast Paper Mills has reinforced its position in the packaging space, with the bulk of its 320,000 TPA capacity devoted to paperboards and specialty grades such as folding box board, cup stock, and coated duplex board. Packaging products form a significant share of its revenue, reinforcing their role as a strategic growth driver alongside traditional printing and writing papers. Its portfolio serves a diverse range of end-use sectors, including FMCG, pharmaceuticals, foodservice, and e-commerce, where demand for high-strength and food-safe packaging is rising. The company’s “minimum impact–best process” approach underlines its focus on sustainable production, energy efficiency, and eco-friendly packaging solutions. With capacity operating at over 90% utilization and an increasing focus on exports, West Coast Paper Mills is well-positioned to capitalize on the robust growth in consumer packaging demand both in India and key overseas markets.

Mid-sized players are carving out their own space by leveraging recycled fibre, agro-based raw materials, and targeted product differentiation. Khanna Paper Mills, one of the largest recyclers in the country processing nearly 390,000 tonnes annually, is optimistic: “We, at Khanna Paper Mills, are very optimistic about this growth trajectory of good quality paper and packaging boards, due to the major push on literacy level, industrialization, urbanization, e-commerce, Q-commerce and technological advancements.”

Among these, NR Agarwal Industries (NRAIL) is scaling aggressively with a new 1,020 TPD board machine project, describing its roadmap as “ambitious and future-ready.” Ruchira Papers has positioned itself around agro-residue-based packaging grades, with its leadership noting, “Our white packaging paper is made from agri-residue such as wheat straw, sugarcane bagasse, and rice husk – agricultural byproducts that would otherwise go to waste or worse, be burnt.” In South India, Sripathi Paper and Boards, with 800 TPD of capacity at Sivakasi, is pursuing a bold sustainability-driven vision. “Through Vision 2028, we aim to become the first sustainable board enterprise…we will have a unique offering in the export markets,” says Sudarshan Rangaswami.

Regional and specialized producers are also shaping the future of packaging paper. Apollo Papers, based in Gujarat, leverages its proximity to Mundra Port to drive exports and expand its global footprint. Managing Director Dinesh Haripara explains, “With our strategic location near Mundra Port, continuous investment in technology, and customer-centric innovation, we are well-positioned to scale globally and meet the evolving needs of the packaging industry.”

Star Paper Mills, with nearly nine decades of history, underscores its continued relevance. Madhukar Mishra says, “As India’s key packaging paper company, we have been producing packaging grades for nearly 90 years. With the flexibility to manufacture multiple grades, we are well-positioned to cater the rising demands of our customers.” Chandpur Paper, a newer entrant with 120 TPD of capacity, is charting a roadmap based on diversification and exports. Founder Amit Mittal remarks, “Our five-year plan is based on increasing production capacity, consolidating exports, and diversification into food-grade and specialty papers divisions…creating Chandpur Paper as a globally accepted brand.”

Taken together, these voices illustrate the multi-layered nature of India’s packaging paper industry. This diversity of scale and strategy ensures that the sector not only meets growing domestic demand but also strengthens its standing as a globally competitive and sustainable packaging hub.

Segment Challenges and Policy Backing

The packaging paper industry continues to navigate a demanding environment, shaped by raw material volatility, energy costs, logistics bottlenecks, and evolving regulation. Fiber sourcing remains one of the most pressing concerns for producers, especially for those dependent on imported recovered paper. “Disruptions in global supply chains, more specifically shipping, and volatility in raw material, both availability and pricing, and increasing energy costs have been some of the key challenges that have affected the industry at large, and Sripathi Paper and Boards is not an exception to this,” says N. Rama Mohan Murali of Sripathi Paper & Boards.

Energy pricing, in particular, has become a significant variable in cost structures. Chandpur Paper’s Amit Mittal observes, “Raw material and energy price uncertainty continue to be our greatest challenges for our company. In reaction to this, we have diversified our suppliers and are aggressively pursuing backward integration to achieve more cost control and supply guarantees.”

Logistics inefficiencies and regulatory changes compound these pressures. Apollo Papers highlighted the shift in customer preference that requires mills to constantly adjust machine settings and production schedules: “We are witnessing a clear shift in customer preference toward higher-BF as well as low GSM packaging paper and board variants by reducing the number of ply in the box.”

Ruchira Papers points out that managing performance while keeping costs under control remains challenging. Ruchica says, “Balancing performance and cost-efficiency has always been a challenge, especially in times of raw material price volatility and rising energy costs. We tackle this through backward integration, localized sourcing networks, and by continuously benchmarking our processes against best-in-class operations.”

Policy frameworks, including Extended Producer Responsibility (EPR) regulations, have been instrumental in driving demand for recycled fiber-based solutions. “Post-COVID packaging demand has not only grown but also diversified, with a clear tilt towards eco-friendly, recycled, and performance-optimized grades—areas where Sripathi Paper and Boards has a strong, scalable product portfolio,” noted Murali.

This shift aligns with the government’s push for plastic substitution, which continues to encourage innovation in barrier-coated and food-grade papers. ITC PSPD says, “There have been several regulatory changes in the packaging industry – such as the Plastic Waste Management Rules and ban on Single-use plastic items. We have been able to leverage our R&D capabilities to launch several paper-based alternatives to single-use plastics.”

Also Read: ITC PSPD Champions Sustainable Packaging Through Research and Innovation

Future Outlook

Packaging paper demand in India is projected to remain strong through the rest of the decade, though growth estimates vary by source. Some forecasts see the market expanding from about USD 13.7 billion in 2025 to nearly USD 18.9 billion by 2030, implying a CAGR of 6–7 per cent. Other reports are more bullish, projecting an increase from USD 8.4 billion in 2024 to roughly USD 19 billion by 2030, which would reflect double-digit growth of around 14 per cent annually. Regardless of the exact pace, analysts agree that kraft paper and duplex boards will remain the largest contributors to overall demand.

Driven by the push to replace plastics, demand for advanced packaging solutions is on the rise. Barrier-coated boards, mono-material food-safe wraps, and flexible specialty papers are gaining ground, particularly among premium FMCG and food service brands. In fact, the specialty papers market, covering decorative and high-barrier grades, was at about USD 1.92 billion in 2023 and is expected to grow from about USD 2.52 billion in 2024 to USD 5.76 billion by 2035, at a CAGR of approximately 7.8%.

Further, as domestic mills scale up their production and improve quality, India is poised to tap growing demand across Asia and Africa. Compact and cost-sensitive, these markets are increasingly seeking paper-based packaging alternatives, especially for fast-moving consumer goods and food items. With improved economies of scale and competitive pricing, Indian producers are well-positioned to fill this gap, especially in corrugated and folding-carton grades that dominate but also premium liquid cartons, which are seeing growth at around 7.6% CAGR.

Sustainability is now central. Paperboard based on recycled fibers already accounts for over half of sales (53%), while hybrid grades that blend recycled with virgin fibers are gaining, with a projected 7.8% CAGR, according to a report. To secure raw material and reduce ecological impact, investments in wastepaper collection and in-house forestry (bagasse or agro-residues) will become increasingly important. These efforts will not only reduce import dependency but also cater to eco-conscious consumers and regulatory requirements.

The medium-term outlook remains optimistic, supported by e-commerce growth, rising penetration of organized retail, and brand-owner commitments to sustainability. ITC PSPD emphasized its confidence in growth momentum: “…while we keep driving our growth in our existing export markets, we are now venturing into international markets that have remained untapped until now.”

Strategically, mills are aligning investments with future demand centers. Ruchira Papers’ leadership summed up their approach: “We continue to explore new categories and functional improvements that cater to emerging applications and align with sustainability goals.”

All told, the industry’s future looks set for steady expansion, with a mix of measured volume growth and strategic upgrading in product quality. The decade ahead is less about raw scale and more about innovation, sustainability, and global competitiveness.