With its over 1.5 million tonne capacity, Morbi’s packaging paper industry is not in a mood to stop and is set to add at least 0.5 million tonne in the next 4-5 years, which is a lot. The Indian paper industry will have to sit and notice, if not sooner, then later!

Morbi, about 60 km from Rajkot in on Morbi-Rajkot Highway, welcomes you with thick powdery air saturated with dust, often obscuring your vision. Amid this sooty atmosphere, even if you can’t see much farther in the distance, you won’t by any chance miss the Morbi’s brisk industrial bustle, a thing not as repudiating as dust for a business traveler. Morbi, in Kathiawar, is part of Saurashtra region of Gujarat and is home to over 70 percent of India’s ceramic goods production, a distinction which has become its de facto identity over the world as the ceramic city with its tiles known as ‘Morbi tiles’.

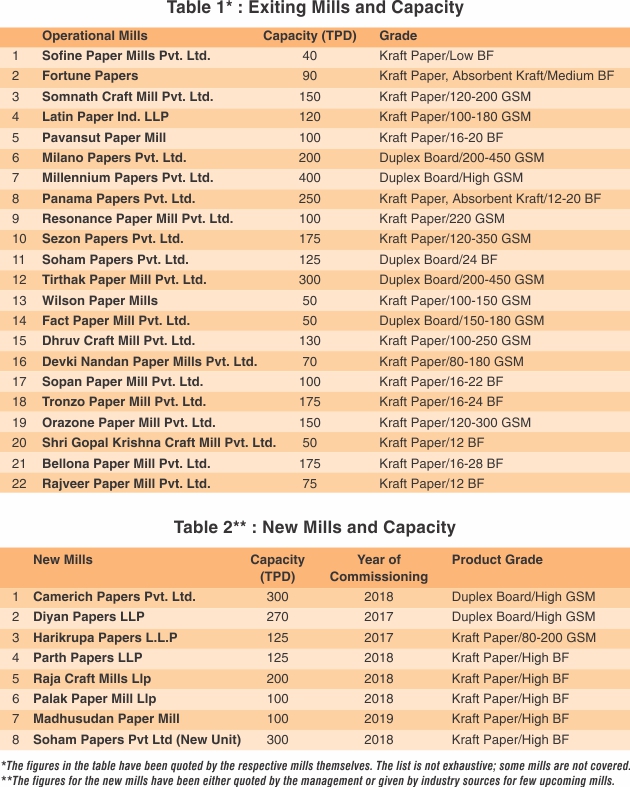

The Paper Mart’s decision to visit Morbi however was not ceramic centric; it was rather coaxed by swiftly emerging new identity in the form of booming paper industry, presently scaling a quantum of over 16,00,000 tonne per annum! A producer of mainly recycle-based kraft paper and duplex board, Morbi’s capacity clock is steadily ticking with addition of appreciable amount every year and if we take into account the present expansions and upcoming new mills, the capacity would be ranging anywhere from 20,00,000 TPA to 21,00,000 TPA by the end of 2019 including kraft and duplex board. This is significant capacity coming out of a single cluster, especially when we think of India’s overall paper production of around 150,00,000 TPA including all segments, W&P, newsprint, packaging, etc.

Continued Capacity Juggernaut

Morbi’s paper production is astounding from the volume’s view-point. The paper industry here remains largely underreported probably because of small sizes of individual mills and their old school production methods. However, put together, Morbi’s total paper volume becomes colossal, close to 1.6 million tonne. There are presently 35 operating mills with capacities ranging from 40-400 TPD, majority producing kraft paper with a few making duplex board. Combined together, these mills churn out around 4500 TPD of kraft paper and duplex board.

And, surprisingly, the capacity juggernaut doesn’t stop here. Morbi’s capacity addition is on a roll with at least 9-10 new mills being commissioned in the time range from 2018 to 2019, some with significant enough capacities in the range of 250-300 TPD. At least 500,000 tonnes would come out from these new mills, making Morbi’s volume touch 2 to 2.1 million tonne mark by the end of 2019. This may sound a little ambitious but is not if we take into account few mill running trials to soon commence the production in 2018, mills like Diyan Papers LLP (275 TPD), Camerich Papers Pvt Ltd (300 TPD), Harikrupa Papers LLP (125 TPD), Parth Papers LLP (125 TPD), and few others. Only these mills if commissioned in 2018 would add at least 300,000 tonnes.

“We were the first to start a paper mill in 1995, and today there are 35 fully-functioning kraft and duplex paper mills here with combined capacity of over 4500 TPD. Initially, these mills were started by tile manufacturers with a purpose of business diversification and to cater local demands. However, as of now, Morbi’s paper industry is a distinct identity with many other drivers to support its growth,” says Mr. Kiritbhai Patel, MD, Tirthak Paper Mill Pvt. Ltd. and ex-President, Morbi Paper Mills Association.

“We were the first to start a paper mill in 1995, and today there are 35 fully-functioning kraft and duplex paper mills here with combined capacity of over 4500 TPD. Initially, these mills were started by tile manufacturers with a purpose of business diversification and to cater local demands. However, as of now, Morbi’s paper industry is a distinct identity with many other drivers to support its growth,” says Mr. Kiritbhai Patel, MD, Tirthak Paper Mill Pvt. Ltd. and ex-President, Morbi Paper Mills Association.

Mr. Kiritbhai Patel seems right in pointing so. The rapid proliferation of paper mills although is hugely supported by immensely bullish tile industry, Morbi’s paper makers have been able to find sufficient market outside too, covering almost entire Gujarat along with significant markets in adjoining Rajasthan, Maharashtra, and Madhya Pradesh. However, it is undeniable that Morbi’s tile industry, now enormous and internationally recognized, is the largest consumer of the kraft paper and duplex produced here.

.

Existing Industries as Growth Drivers

Morbi today is home to around 1200 ceramic mills creating an enormous local demand of both kraft paper and duplex board. Besides, there are traditional watch industry and fast upcoming laminate industry as other potential consumers of paper produced in Morbi. The city is dotted with 350 small to medium size corrugators, mostly supplying to local ceramic and watch manufacturers. Mostly equipped with single facer corrugation machines, these corrugators produce around 35,000-40,000 TPM, which is consumed locally. “There are 35 single facer corrugators with minimum 80 TPM to maximum 200 TPM in Morbi. If we take an average of 100 TPM, there is around 35,000 metric tonne of consumption in Morbi itself,” reports Mr. Pravin Marvaniya, Chairman, Soham Papers Pvt. Ltd. Mr. Marvaniya is also the present president of Morbi Paper Mills Association.

Morbi today is home to around 1200 ceramic mills creating an enormous local demand of both kraft paper and duplex board. Besides, there are traditional watch industry and fast upcoming laminate industry as other potential consumers of paper produced in Morbi. The city is dotted with 350 small to medium size corrugators, mostly supplying to local ceramic and watch manufacturers. Mostly equipped with single facer corrugation machines, these corrugators produce around 35,000-40,000 TPM, which is consumed locally. “There are 35 single facer corrugators with minimum 80 TPM to maximum 200 TPM in Morbi. If we take an average of 100 TPM, there is around 35,000 metric tonne of consumption in Morbi itself,” reports Mr. Pravin Marvaniya, Chairman, Soham Papers Pvt. Ltd. Mr. Marvaniya is also the present president of Morbi Paper Mills Association.

.

.

Morbi also is the largest producer of wall clocks in India and makes a significant proportion of CFL bulbs, all of which require packaging as a must. Home to reputed clock & CFL manufacturers like Ajanta, Orpat, Samay, Sonera, etc, Morbi generates copious demand of packaging material, mostly catered by city’s local paper mills. Besides, the large and still growing ceramic industry base has its own significant packaging requirement. As is evident, most of the paper mills in recent times have been set up by ceramic mill owners realizing their own packaging needs and promising growth of the industry in the region. “As a premier tile maker, we ourselves had a corrugation unit and our monthly consumption used to be in the range of 300-350 tonnes in 2010, when we thought of putting up our first board mill. By 2016, we added capacities to reach to a combined 400 TPD, of which 60 percent is being supplied to local corrugators and the rest to outside markets,” Mr. Vipul Koradiya, Director, Millennium Papers Pvt. Ltd.

Morbi also is the largest producer of wall clocks in India and makes a significant proportion of CFL bulbs, all of which require packaging as a must. Home to reputed clock & CFL manufacturers like Ajanta, Orpat, Samay, Sonera, etc, Morbi generates copious demand of packaging material, mostly catered by city’s local paper mills. Besides, the large and still growing ceramic industry base has its own significant packaging requirement. As is evident, most of the paper mills in recent times have been set up by ceramic mill owners realizing their own packaging needs and promising growth of the industry in the region. “As a premier tile maker, we ourselves had a corrugation unit and our monthly consumption used to be in the range of 300-350 tonnes in 2010, when we thought of putting up our first board mill. By 2016, we added capacities to reach to a combined 400 TPD, of which 60 percent is being supplied to local corrugators and the rest to outside markets,” Mr. Vipul Koradiya, Director, Millennium Papers Pvt. Ltd.

.

Grossing a turnover of over INR 4000 Cr, Morbi’s paper industry’s growth is also supported by other favorable factors as nearness to Mundra port and an expansive network of transportation, two big parameters for the successful supply-chain, ensuring fast movement of raw material (waste paper) and finished goods. The paper mills here source the waste paper either locally from adjoining areas or through import, either of which is easy enough for a place like Morbi. The startling growth of Morbi’s paper industry in recent times is also because it did not face any challenge in terms of creating a new network of transportation; it was rather preexisting because of its other industrial bases. “Mundra is the fastest and busiest Indian port, which is sure to facilitate export of paper in coming times as it’s presently facilitating the ceramic export. The way Morbi’s paper industry growing, I’m sure it is going to export a lot of quantity in future as the quality and quantity both would be beyond local consuming capacity,” says Mr. Sunil Patel, Radheshyam Paper Mills Ltd., a producer of quality kraft paper.

Grossing a turnover of over INR 4000 Cr, Morbi’s paper industry’s growth is also supported by other favorable factors as nearness to Mundra port and an expansive network of transportation, two big parameters for the successful supply-chain, ensuring fast movement of raw material (waste paper) and finished goods. The paper mills here source the waste paper either locally from adjoining areas or through import, either of which is easy enough for a place like Morbi. The startling growth of Morbi’s paper industry in recent times is also because it did not face any challenge in terms of creating a new network of transportation; it was rather preexisting because of its other industrial bases. “Mundra is the fastest and busiest Indian port, which is sure to facilitate export of paper in coming times as it’s presently facilitating the ceramic export. The way Morbi’s paper industry growing, I’m sure it is going to export a lot of quantity in future as the quality and quantity both would be beyond local consuming capacity,” says Mr. Sunil Patel, Radheshyam Paper Mills Ltd., a producer of quality kraft paper.

.

Owners’ Personal Involve-ment & Collaborative Business Model

Lasting partnerships and close kinship among owners are also found to be the reasons behind steady growth of paper business in Morbi. A sizeable number of mills have been set up on partnership model, driven largely by common aspiration, experience, and close families or social ties. “You may easily see that majority mills here are being run in partnerships, which is a success mantra for Morbi’s paper industry. Division of work and responsibilities pave the way for dedicated focus in respective areas, ensuring better results. Here, in Morbi, people don’t have the mindset of having the sole control and earn alone,” informs Mr. Bhavik M. Bhatt, Harikrupa Papers LLP.

Lasting partnerships and close kinship among owners are also found to be the reasons behind steady growth of paper business in Morbi. A sizeable number of mills have been set up on partnership model, driven largely by common aspiration, experience, and close families or social ties. “You may easily see that majority mills here are being run in partnerships, which is a success mantra for Morbi’s paper industry. Division of work and responsibilities pave the way for dedicated focus in respective areas, ensuring better results. Here, in Morbi, people don’t have the mindset of having the sole control and earn alone,” informs Mr. Bhavik M. Bhatt, Harikrupa Papers LLP.

.

.

.

.

Others say close family and social kinship is also a facilitator. “Local business communities, like Patel, are bound by traditional honor, goodwill and faith. This makes them help each other and share their know-how, a reason Morbi has seen such fast industrial growth in recent times. Unlike other places, people aren’t so secretive about their work,” says Mr. Bhavesh N. Patel, Director, Panama Papers Pvt. Ltd.

Others say close family and social kinship is also a facilitator. “Local business communities, like Patel, are bound by traditional honor, goodwill and faith. This makes them help each other and share their know-how, a reason Morbi has seen such fast industrial growth in recent times. Unlike other places, people aren’t so secretive about their work,” says Mr. Bhavesh N. Patel, Director, Panama Papers Pvt. Ltd.

However, most entrepreneurs here agree on hard-work, personal supervision, and courage to invest in a new business as the main reason why almost always a new business starts a new trend here in Morbi. Kiritbhai Patel of Tirthak says, “The people of Morbi are brave enough to invest. If an industry is growing, the businessmen here would surely invest. People became attracted towards the type of success paper industry started accruing after its beginning. Now, there are so many people in line ready to start a new paper mill and I am sure they will succeed too.”

.

“The owner of the mill visits the mill regularly and is always on time. Due to this reason, the decisions are made quickly. Even the marketing decisions are taken quickly. You don’t need to go through a proper channel and wait for the decision. The owner is available every time,” argues Mr. Harsh Agola, CMD, Milano Papers Pvt. Ltd., one of the earliest and pioneering producers of duplex board in Morbi.

“The owner of the mill visits the mill regularly and is always on time. Due to this reason, the decisions are made quickly. Even the marketing decisions are taken quickly. You don’t need to go through a proper channel and wait for the decision. The owner is available every time,” argues Mr. Harsh Agola, CMD, Milano Papers Pvt. Ltd., one of the earliest and pioneering producers of duplex board in Morbi.

“Of course, hard work and perseverance of the mill owners in Morbi are examples how a business should be run. Not only us, but all the owners here are punctual at work. They personally look after the purchases, technology, and other things. Decision is made fast and solutions are found faster,” quips Bhavik M. Bhatt of Harikrupa Papers.

“We are not working like mills in other areas. They have a mill at one place and office at the other. They have to manage things sitting from a distance. Besides, they have to hire a good number of people under them. This is opposite to what we do. Our factory and office are in one place, which lets us focus in one direction,” emphasizes Bhavesh N Patel of Panama Papers.

Most of the mills in Morbi self-funded, which keeps owners invested in the business. “In Morbi, we don’t rely on other sources of fund, like banks or other resources of finance. We try to bring the maximum finance on our own and partnering with relatives and close ties. Sourcing funds from other places begets interest burden and legal compliances which are too high and restricts freedom to act on your own pace,” opines Bhavik M Bhatt.

“People in Morbi have a lot of money, earned from various trades. They don’t invest in the industry they don’t know, like entertainment or service industry. People here have roots in the manufacturing industry, which they readily invest in with their own money once they see the prospects or trends of earlier success,” contends Harsh Agola of Panama Papers.

Industrial Consolidation and Product Quality

Morbi’s paper industry may appear unorganized and under-reported today because of their old style production methods but there are strong undercurrent of sentiments towards organizing the industry and improving the quality benchmarks, especially among recent mills and upcoming ones. Many here feel that organization begins with standardization of quality and branding the product, which is fast happening with mills producing high BF, high GSM packaging papers. “A decade or so ago, Morbi’s ceramic industry was also unorganized doing mainly the job works of established companies Kajaria, Somani, etc. But smarting under their quality demands, Morbi of late has been able to establish many brands of its own, brands like Varmora, Simpolo, Oasis, Qutone, Millenium, etc. Now, 5 years from today the same will happen to the paper industry, consolidation and organization on fronts of quality, prices, and common issues,” says Mr. Sunil Patel of Radheshyam Paper Mills.

Most mills may have invested private funds and run their mills in close personal supervision, but this won’t hold good when the capacity reaches a certain point with increased competition and exposure to market beyond. You need to invest in costly technology and processes, which in turn need bigger capital to be sourced from public, another sign for the industry getting organized in terms of public scrutiny. For example, Astron Paper & Board Mill recently released 70-crore IPO to a great success and was subscribed by over 243 times. Astron is to use the net proceeds of the share sale in setting up an additional facility for manufacturing of Kraft Paper among other things. There are many mills whose capacity and quality has reached certain stage and for them, the next leap is going to be bigger in terms of investment, nudging them to go public in times to come.

The fast capacity addition is making some local players uncomfortable, but they also admit that the new players are mainly exploring markets beyond Gujarat and India, in which case they need to correct their basics in terms of quality and other practices.

Mr. Shailesh Patel, Director, Resonance Paper Mill Pvt. Ltd. feels differently on rapid capacity addition. He says, “I do support the capacity expansion, but it has to be pragmatic and should be done after careful survey of the market. On a cautionary note, I would like to say that people who are adding capacity so rapidly shouldn’t do that. They should first study the market scenario, go through it, and then decide for setting up huge capacities.”

Mr. Shailesh Patel, Director, Resonance Paper Mill Pvt. Ltd. feels differently on rapid capacity addition. He says, “I do support the capacity expansion, but it has to be pragmatic and should be done after careful survey of the market. On a cautionary note, I would like to say that people who are adding capacity so rapidly shouldn’t do that. They should first study the market scenario, go through it, and then decide for setting up huge capacities.”

Morbi Paper Mills Association is also fast catching up with the trends outside and trying to unify the mills on common issues. “As an association, we know that time has come for us to unite on common issues like quality, prices, and environment compliances. Mill owners are now at least aware of these concerns,” says Kiritbhai Patel of Tirthak Papers, the ex-president of association.

The present president, Mr. Pravin Marvaniya says, “Now, the paper industry here attained a significant size and has increased exposure to the industry outside. This becomes evident for us to try organizing ourselves on common issues to meet the demands outside. The association is making efforts to make people aware through meetings, seminars, and technical conferences. We have just begun and there are miles to go.”

Supplying beyond local market including export has improved the quality parameters, many feels. “In the new mills, there have been lots of investments in new technology and production cost has increased. These mills can’t produce low-quality products as they are aiming to sell it markets beyond Morbi including export. We ourselves would be exporting 50 percent of material produced from the new duplex board plant,” says Vipul Koradiya of Millennium Papers.

“We export 500-700 TPM. Nobody exports in duplex except us. We export to multiple countries and pay special attention the quality. We are getting repeat orders, which say quality is good. Quality will improve as we get more exposure to outside market; that’s a journey,” says Harsh Agola of Milano.

“For two months, Morbi has also been exporting paper to China. This has raised the bar. If we bring quality then only will we be able to export in the future. Consequently, the new mills have been setting up new technologies for better quality in order to avoid quality issues,” admits Mr. Shailesh B. Patel, Parth Papers LLP.

“For two months, Morbi has also been exporting paper to China. This has raised the bar. If we bring quality then only will we be able to export in the future. Consequently, the new mills have been setting up new technologies for better quality in order to avoid quality issues,” admits Mr. Shailesh B. Patel, Parth Papers LLP.

Diyan Paper which has just run the first trials has impressed everyone with the mill architecture and technology and is going to be the next generation mill for the Morbi’s industry, taking the overall quality benchmarks. “The 50 percent of the production will be supplied to areas of Gujarat and nearby states, i.e. Ahmedabad, Vapi, MP, and Mumbai. The remaining 50 percent to Dubai, Mauritius, and many more places. There are so many queries. People visiting our mill are really impressed with the setup of our mill,” informs Mr. Manish Patel, Diyan Papers LLP.

.

Technology & Environment: Growing Consciousness

Technology is a natural concomitant of quality and is another milepost for getting organized in an indirect sense. Morbi seems to inching towards this objective with greater investment, especially the new mills. As of now, the machines and paper technology is mostly sourced indigenously, but mills are experimenting with few global names in some part of machinery, which is bound to increase with time. Indian players like JMC Paper Tech, DS Engineers, SPM Engineers, etc. are popular players in Morbi region. Most of the bigger capacity mills are seen to be operating paper machines from JMC and DS.

The first generation mills are mostly single-wire, primitive machines with few exception of two-wire machines for producing kraft paper. Newer mills, especially the upcoming ones, are three-wire and four-wire machines for duplex board projects, or high BF paper. These machines are preferred because of easy procurement, cost-effectiveness, and easily-available-post-installation services, which have kept many machines of even first generation running efficiently. In pulp section, beyond JMC and DS, major player like Parason Group has also secured some projects from bigger mills. For individual machine segments, notable names like Thermax and Forbes Marshall can also be seen in new mills, especially upcoming ones like Diyan. As far as single machine components and parts are concerned, there are several suppliers in the region. For example, CTC Impex is the single largest bearing supplier in the Morbi region.

Apart from raw-material security, water also doesn’t seem to be a problem here, water table being sufficiently charged in Morbi. Most mills use ground water and have installed water meters to gauge the amount they are using. As claimed, most mills here practice closed loop water recycling and use most of the recycled water back in the system, resulting in almost ZLD. New mills have set up their own dedicated ETPs, whereas common ETPs are also seen here treating water of more than one mills. Most mills admit they use water within prescribed standards for a recycled-based mill. The waste, mostly plastic, after treating and cleaning the waste paper, is sent to nearby cement factories.

So overall, the nascent paper industry in Morbi doesn’t look totally oblivious to environmental norms and is doing its bit in own way. The journey is still long and more worthwhile actions would happen in future. Most import thing is the growth, which is happening; things like standardization will fall in line for sure!

.

Mills’ Take on Production, Markets & Growth

During individual interviews, almost all mill agreed on Morbi’s local industrial growth as the main driver for its paper industry. They also unanimously said that the paper industry here is inching towards a more organized future because of growing focus on environment, technology, and quality, adding that in future they will be able to compete in even their non-traditional markets.

Tirthak Paper Mill Pvt. Ltd.

First UP and Still Strong With 300 TPD of Duplex Production

“In 1995, we were the first one to set up kraft mill in the Saurashtra region. Tirthak was the sole duplex board producer in the region in 2007. The demand of duplex board was high, which made us enhance our duplex board capacity to 150 TPD within six months, and eventually to 300 TPD within three years,” says Mr. Kiritbhai Patel, MD, Tirthak Paper Mill Pvt. Ltd.

“In 1995, we were the first one to set up kraft mill in the Saurashtra region. Tirthak was the sole duplex board producer in the region in 2007. The demand of duplex board was high, which made us enhance our duplex board capacity to 150 TPD within six months, and eventually to 300 TPD within three years,” says Mr. Kiritbhai Patel, MD, Tirthak Paper Mill Pvt. Ltd.

.

Paper Mart: Please tell us something about Tirthak paper Mill.

Kiritbhai Patel: In 1995, we were the first one to set up kraft mill in the Saurashtra region. Later, in 2006, we set up another unit for duplex board with a capacity of 100 TPD. The product from this unit debuted in the market in early 2007 to huge appreciation by customers. At the time, Tirthak was the sole duplex board producer in the region. The demand of the product was high, which made us enhance our capacity to 150 TPD within six months. The demand was still high and orders ran pending more often and we thought of putting another machine altogether. Consequently, Tirthak’s combined duplex board capacity touched 300 TPD within 3 years of starting the operations.

Not only Tirthak personally grew in that time, but inspired many to take up duplex board production. By the end of 2010, 3-4 more mills started operations taking the total duplex board tally to 800 TPD. In the year 2015, we decided to shut down our kraft operations and devoted solely to duplex board production.

PM: Tell us about the grades and technology at Tirthak Paper Mill.

KP: We are producing LWC, HWC, and white back. The GSM range is 200-450 and we now stick to RCT as a parameter of board strength instead of BF. We were using indigenous paper machines, from JMC and SPM. The technology of paper machines were latest when we installed, but now the technology being fast changing made us undergo many modifications and rebuilds to stay ahead. The upcoming mills are mostly done with MG cylinders and have opted for size-press or other technology available. New machines are also getting bigger and complex in terms of being three-wire or four-wire. We are using now hi-con pulpers in the place of regular pulpers and have gone for massive drive system rebuilds.

PM: What have you done for water conservation? Do you face any regulatory pressure?

KP: There is no wastage of water in our mill. We have an ETP system and there is zero liquid discharge. The industry has developed such a technology that the mills are only using the amount of water which is necessary. There is no wastage of water. We are complying with the regulatory norms for recycled-based industry in terms of water consumption, effluents, and emissions.

The requirement of the paper industry is water. And we will always need that. We can’t make paper without water. And, this is a good thing that our industry is growing at such a good speed. The environmentalists should be happy that we are cutting fewer trees. We should be happy that we are a recycled based industry which is utilizing the waste produced in our country. The paper industry especially the packaging board manufacturing industry is scoring on the accounts of making sustainable products instead of plastic and secondly, the import substitution is quite big.

PM: Which factors have led to the growth story of Morbi’s paper industry?

KP: Divyam Paper Mills was the first paper mill in the Morbi region, which was started in 1995. Gradually, the demand for paper started increasing in Morbi and this is what made people come into the paper business. Meanwhile, ceramic industry was also growing and gave further boost to the paper industry. In 2015, there were around 10-15 mills. People, who already invested in ceramic industry, thought of diversifying their business. They thus invested in the paper industry, and within two years, 20-25 more mills of both duplex and kraft were established in Morbi. There are now around 35 paper mills in Morbi with production of about 4500 TPD including both kraft and duplex. The total turnover in this region will be around INR 4,000 Cr. It is a big thing in itself.

Besides, the businessmen in this area, particularly the Patel community, are hardworking and brave enough to invest. If an industry is growing, the businessmen here would surely invest. Besides, people here have an alternate source of income apart from paper. A paper mill owner is not just a paper mill owner; he has other trades to do as well. Also, the ceramic industry in Morbi and the copper industry in Surat are other growth factors. These however are just minor reasons. The biggest one is the courage of the people of Morbi.

Moreover, the story of growth starts with local consumption. Later the industry becomes so big that it becomes difficult to sustain it without exploring newer markets. Even Morbi is going through the same situation right now. To sustain itself, it will have to look for markets outside Morbi. But, I am sure, after five years, the kraft and duplex paper will be exported from India to the entire world, Morbi moving along with it. Only a few companies are exporting as of now, but Smnlowly, the export will become a common phenomenon. Each mill will be seen exporting after 4-5 years.

PM: What is the strategy through which Morbi can look towards more markets?

KP: Today, Morbi has covered the entire Gujarat region. Earlier, we were not supplying to Rajasthan, which we are doing now along with supplying to MP and Mumbai. Slowly, we are spreading across the nation, but the biggest bottleneck for the paper industry is the raw material cost. We need to get waste according to our capacity of making paper, and within our affordability. So, further market expansion has to keep in its view the eventual profitability taking into account the raw material cost and transportations cost.

The good thing about Morbi is that the machines that the people of Morbi are putting up are updated ones. Morbi is ahead of other places that have recently started mills. The organized sector should definitely see Morbi as a challenge. In the ceramic industry, the small players struggled and became the organized ones. Morbi slowly fought against the brands and finally giving better quality with great technology. Same is happening in the paper sector. I am sure with the changing mindset of people towards technology and quality, there will not remain any difference in the quality of ours and other large players.

PM: As the founder-president of Morbi Paper Mills Association, what were your initiatives to help the industry here?

KP: I started the paper mill association and was the first president, working for seven years. I helped people regarding the paper mill production and technology. I made people understand the norms of CBPC and even implemented them.

Every month, we have a meeting of the committee members. We discuss the position of the industry. We also talk about the steps we need to take in terms of prices, quality, technology, etc. We also help in organizing seminars on the topic of energy and water conservation. This is a routine work now and has helped the members recognize many issues and solutions thereof.

.

Soham Papers Pvt. Ltd.

A New 300 TPD Kraft Paper Unit to Start in 2018

“We are putting up a new kraft paper unit with a capacity of 300 TPD and 24 BF of quality. The mill will start production in the next 6 months,” says Mr. Pravin Marvaniya, Chairman, Soham Papers Pvt. Ltd.

“We are putting up a new kraft paper unit with a capacity of 300 TPD and 24 BF of quality. The mill will start production in the next 6 months,” says Mr. Pravin Marvaniya, Chairman, Soham Papers Pvt. Ltd.

PM: Please tell us something about Soham Papers. Do you have any capacity addition plan in near term?

Pravin Marvaniya: When we started, we were at 3000 TPM of duplex board and now it is above 4000 TPM. It has been six years now for Soham. We have a second unit in the name of Dhruv Kraft Mill, which was started later and is producing 3000 TPM quality kraft paper.

As you asked about the capacity expansion, we would like to inform you that we are putting up a new kraft paper unit with a capacity of 300 TPD and 24 BF of quality. We will start the mill in the next 6 months.

PM: Tell us about the technology you are using at Soham.

PM: We are having the pulp section from Parason Group. Besides, we are using the paper machine and related technologies from SPM Engineering Pvt Ltd for the duplex board. We are thinking of buying a new machine from China for the upcoming project and have already seen few of the samples. As I said, we already have two units and this is the third one which is coming up, so we have now sufficient experience of how a particular machine works.

In the duplex category, Soham offers the best quality, agreed upon by both our competitors and customers. This has been possible only because of selecting the right technology partner in various segments of the mill.

PM: Do you face any raw material challenge? What markets does Soham covers through its product?

PM: We don’t have any raw material issue. We are importing our raw material from Europe, UK, US, and many other countries. The varieties of raw materials we are importing are mix waste, super mix quality and so on.

Apart from supplying locally in Morbi, Soham caters to markets of Gujarat, Maharastra, and Rajasthan. Currently, we are not exporting. But, once we set this new unit, we will start exporting too.

PM: How do you see the growth and progress of the Morbi paper industry? And, how Soham Papers will contribute to that growth?

PM: There will be progress for sure. We at Soham Papers will make the highest capacity in Morbi by adding the production of three units. We will contribute to the industry through our giant production and best quality of products. The total capacity will be around 500-600 TPD. In a decade, Morbi’s paper industry has reached at stage where there is no looking back; the industry is set to grow both in terms of quantity and quality.

PM: Being the president of Morbi’s paper mills association, what steps have been taken by you for the paper industry of Morbi?

PM: Apart from quality and price concerns, environment takes the top priority. In our association meetings, we expressly convey that the paper industry here needs to make sure not to pollute the environment. Also, we comply with all the norms of CPCB. In fact, all the paper mills in Morbi see to it. They pay attention to the environment. Everyone has developed closed-loop water recycling system and consumes most of the recycled water in their mills. Besides, they are very keen on the plantation activities. Every company has put the recycled plant and they try to attain zero liquid discharge. We make sure to discuss and implement steps that help the paper mills of Morbi to grow day-by-day. And, we all work together as a community.

The association, in coming days, will be instrumental in consolidation of the Morbi’s paper industry by taking various measures to promote best practices and trends. We are trying to closely follow the nationwide trend in the Indian paper industry in order to move towards an organized future.

PM: What do you think about the packaging industry’s future?

PM: As the Government has started putting a ban on plastic, the growth of the packaging sector is visible. With e-commerce booming in India, packaging has a lot of scope too. I would say it has a bright future.

.

Milano Papers Pvt. Ltd.

Production of 5000 TPM of Export Quality Duplex Board

“We export 500-700 TPM. Nobody exports in duplex except us. I export to multiple countries. We pay special attention to the products for exports. The quality is good and that is why we are getting repeat orders,” says Mr. Harsh Agola, CMD, Milano Papers Pvt. Ltd.

“We export 500-700 TPM. Nobody exports in duplex except us. I export to multiple countries. We pay special attention to the products for exports. The quality is good and that is why we are getting repeat orders,” says Mr. Harsh Agola, CMD, Milano Papers Pvt. Ltd.

.

.

.

Paper Mart: Please tell us about Milano in brief.

Harsh Agola: Our production started in November 2010. We come from a ceramic background and have two units of the same. We wanted to do something new and decided to set up a paper mill. Accordingly, we commissioned the project in November 2010 with a production capacity of 150-200 TPD. It was a simple vision. We are making paper ranging from 200-450 GSM and producing 4500-5000 tonnes monthly.

PM: After operating for about seven years, what are your views on the packaging industry?

HA: Paper industry is basically a regional game. Honestly, it does not matter much which technology you are using or how much you are investing; what matters is the availability of water and the region you are setting up the paper unit in. If you are setting up a paper mill in such a place where the availability of raw material and the possibility of transporting finished goods cannot be matched, then no matter how advanced technology you install, you will not get a good margin.

The ceramic industry here has laid the foundation for the paper mills in Morbi. Today, there are around 1200 ceramic mills in Morbi with huge consumption of packaging material. Moreover, there was a momentary slowdown in the ceramic industry and people thought of entering into the paper business. Paper is a different product unlike tiles and difficult to manage, machinery being big and complex. For example, in ceramic, we know if we are putting the good quality of raw material, the output will also be of good quality. Whereas, in papermaking, even if you have put the good quality raw material, it doesn’t ensure you will get good quality paper, meaning papermaking is a complex art. You need different teams in the entire procedure of papermaking, skilled in various operations, starting from the pulp section to the finished paper. We should use proper raw material and good coating recipe. Papermaking is a very difficult process irrespective of the advanced technologies which are coming in to make paper making process easier. If you have a good team, then only you can produce good quality paper.

PM: What factors are driving the growth of the Morbi’s paper industry?

HA: People in Morbi follow a more or less a similar pattern. If someone has put up a ceramic mill, another person will go with the same idea. Besides, people in Morbi have money to invest and they invest it manufacturing industry only, not in the entertainment or such other industry. If someone started a business and it worked, others will start following too. Reliable transportation and nearness to port are another factor. The production in Morbi has gone much beyond the local consumption, which is making paper mills, especially new and upcoming, search newer markets in India and beyond. The duplex consumption in Morbi is around 10,000 tonnes with 30,000-40,000 tonnes of kraft consumption.

Just as the ceramic industry, Morbi is becoming a hub of paper industry. The inception of the paper industry in Morbi was different story and now the growth story has become different in terms of sustainability of this production base. The owner of the mill visits the mill regularly and is always on time. Due to this reason, the decisions are made quickly. Even the marketing decisions are taken quickly. You don’t need to go through a proper channel and wait for the decision. The owner is available every time. Transportation and logistics are positive points in Morbi area. The Mundra port is near so it helps in easy transportation.

PM: What are the challenges you are facing in terms raw material and market fronts?

HA: It is the biggest challenge so far. Waste for duplex and waste for kraft are different. In terms of local waste, we earlier used to get the local waste easily. But now, as the number of mills has increased, the waste quantity has been divided. We therefore go towards metro hubs such as Mumbai for waste, which is a bit costly as compared to waste from Vapi or Surat. Secondly, when there will be excess production, you need to explore new markets to sell. If you are making quality products, you don’t have a market in Morbi. For that, you have to go to Mumbai. The paper industries in Surat, Ahmedabad, and Vapi have freight benefits. While on the other hand, we have to give high freight charges because of the distance. We are facing difficulty in this.

There are over 30 mills of kraft in Morbi. In imports, we have a grade called mix waste from USA, the Middle East, and Europe. Mills use a huge amount of this grade. Now even kraft manufacturers are using this grade, dividing the quantity. Apart from this, our main competitor is China. Although we are getting import material, the quality is not as good as we used to get earlier. Even the quantity has come down.

PM: Indian packaging industry as a whole is booming, so where do you see the packaging industry in the next five years? And, do you think Morbi will also lead in the same direction?

HA: In comparison to the European countries, we are using very less amount of paper because of lack of education. With the education and life style changes, the paper consumption will surely go up, including packaging paper. Besides, growing e-commerce and better packaging practices will also generate a lot of packaging paper demand.

As far as Morbi is concerned, the people of Morbi are enterprising and they are always looking for new business avenues. Mills in Morbi are searching pan-Indian market and opening up for exports with many putting automatic plants. I don’t know about entire India, but Morbi will surely lead in the Western region. If packaging will go on booming, Morbi will lead both in quality and quantity with more paper mills being set up in times to come.

PM: Do you export? If yes, tell us about your export market.

HA: We export 500-700 TPM. Nobody exports in duplex except us. I export to multiple countries. We pay special attention to the products for exports. The quality is good that is why we are getting orders on repeat.

PM: You keep on doing modifications from time-to-time. What are the recent modifications done by Milano?

HA: We are doing modifications on regular basis. To make a quality product and looking at the market demand, we have to do changes in our machines. We try to reduce the cost not by putting cheap material but lowering administration cost. That is how we will lower our costing. Besides, we will put up more production. We are planning to increase the capacity to 7000-8000 tonnes. We are thinking that within 4-5 months we will change our mould section and put up 4-5 formers, and will surely increase 1500-2000 tonnes of capacity.

PM: What improvements does the corrugation industry need to do?

HA: They should fix a time limit. Also, maintain a blacklist for those who don’t do payments on time. They should reduce the lead time. They should also control prices and maintain a competitive price. Ultimately, the paper industry as a whole will get the benefit. There should be a standard pricing.

.

Diyan Papers LLP

Set to Commence 100,000 TPA of Duplex Board Production in 2018

“We will be producing 1 lakh tonne per annum and are sure to achieve this target in the first year itself. Also, we are confident we will be able to sell 100 percent of our production,” says Mr. Manish Patel, Diyan Papers LLP.

“We will be producing 1 lakh tonne per annum and are sure to achieve this target in the first year itself. Also, we are confident we will be able to sell 100 percent of our production,” says Mr. Manish Patel, Diyan Papers LLP.

.

.

.

.

PM: Kindly update us about progress of work on the mill and the start date of production. Briefly tell us about the major technologies and the grades you are going to make.

Manish Patel: Diyan Papers will have the largest capacity and highest quality, as far as duplex board is concerned, in Morbi area. The production capacity is over 8000 TPM. The mill was incorporated in May 2016 with work starting soon after and was commissioned in November 2017. The trials runs are mostly over and we are hopeful that the commercial production will start from January 2018. We are targeting to produce at least 6000 tonne a month over few initial months.

We are using the four-wire paper machine and our mill is equipped with paper machine from JMC; the pulp section from Parason; boilers from Thermax; vacuum pumps from Kakati; and wires and fabrics from Voith. The steam and condensate system is supplied by Forbes Marshall Pvt. Ltd. Besides, we have three blade cutters two simplex cutters imported from the Philippines, among other things.

As for grades, we are going to make HWC in the beginning, both in grey- and white-back. FBB and cup stock would be our next target.

PM: Do you have any previous experience in the paper industry? What made you to start a paper mill?

MP: Yes, of course, but in an indirect way. We already have five corrugation units for manufacturing boxes and our consumption of kraft paper and duplex stands somewhere around 300 tonnes TPM each.

We have two tiles unit with requirement of 20,000 boxes per day which made us think of setting up our own corrugation units as the consumption was regular. Similarly, when we have seen the corrugation unit and known sufficient about kraft paper, duplex and corrugation, the next logiocal step was to go for a packaging paper mill, which we did. Besides, the overall growth of the packaging industry was another reassuring factor.

PM: Tell me something about your raw material strategy. Would availability of water be sufficient? What about environment and conservation approaches?

MP: We have planned 100 percent import of raw material in future to fulfill our quality commitment. Right now, we are importing 50 percent of the raw material and the remaining 50 percent we are buying from the domestic market.

As for water, we don’t have any problem currently but we are cautious to have not any in future too. We therefore have actually invested INR 2 Cr to set up an efficient ETP and the mill will use 100 percent of the recycled water and will practically try to achieve zero liquid discharge. Not only that, for air pollution control, we have installed ESP system from Thermax and have tried to practice maximum plantation possible in the area. As a beginner, we are doing our bit and you will surely see increased commit-ment from our side in times to come.

PM: Do you have any plans for capacity addition? Tell us about the markets you are targeting for your products.

MP: We can’t say definitely right now. Once the production is started, we will get an idea. However, we do have the capacity to add 60,000 tonnes more. Our eventual target is to produce 3 lakh metric tonne per annum from this plant through modifications, rebuilds, and adding new machines. We will take one step at a time.

The 50 percent of the production will be supplied to different market areas of Gujarat and nearby states, i.e. Ahmedabad, Vapi, few markets in MP, and Mumbai. The remaining 50 percent to Dubai, Mauritius, and many more places. We already have received so many queries. We don’t have any sample, but people who are visiting our mill, are really impressed with the setup of our mill. We will be producing 1 lakh tonne per annum and surely achieve this target in the first year itself. Also, we are confident we will be able to sell 100 percent of our production.

PM: What do you think about the Morbi paper industry and its continuous growth?

MP: The Morbi paper industry is quite hard-working. Around 95 percent of consumption of the total production is in Morbi itself. Morbi will take the growth of the paper industry to a higher level. It will beat Vapi in the coming times.

The best quality producers of kraft paper in Morbi also participate in the discussions with the national associations of paper to learn new trends and how to align our practices to national standard. There are over 33 mills in Morbi with an average production of 100 TPD, giving a figure 1.2 million tonnes, which is conservative estimate. You can see the amount of growth Morbi has captured.

.

Millennium Papers Pvt. Ltd.

Producing 400 TPD of Quality Duplex; Eying 50 Percent Export From the New Plant

“First thought behind owning a paper mill was to fill the gap whenever there is shortage. Besides, future packaging demand outlook looked good and we had to diversify anyway. So, we thought of going for the packaging paper unit. With the first unit, we ensured the first objective; with the second, we served the local market; and with the third, we thought to serve beyond the local market,” says Mr. Vipul Koradiya, Director, Millennium Papers Pvt. Ltd.

“First thought behind owning a paper mill was to fill the gap whenever there is shortage. Besides, future packaging demand outlook looked good and we had to diversify anyway. So, we thought of going for the packaging paper unit. With the first unit, we ensured the first objective; with the second, we served the local market; and with the third, we thought to serve beyond the local market,” says Mr. Vipul Koradiya, Director, Millennium Papers Pvt. Ltd.

PM: Please tell us about Millennium Papers.

Vipul Koradiya: Millennium Papers commenced production from the year 2011. The capacity of our first machine was 150 tonnes and it remained the same for over four years. In 2016, we put our second machine, with a capacity of 250 tonnes. Now, we have a total of 400 tonnes of capacity.

We are producing uncoated, LWC, and HWC grades in our mills. For quality control, we have a proper lab with a QC inspector to supervise. The second machine is a cylinder mould machine with MG section, two calendars, and three coaters, etc. The major technology supplier is SPM Engineers, Ahmedabad; formers and coaters from Jasmira Engineers Pvt. Ltd.; calendar from China; and press roll is gain from SPM.

PM: What do you think about the quality and other factors that need improvement in your mills if you compare your product with that of bigger mills? Which are the major consumption markets for your products?

VK: Apart from supplying to local packaging needs, our products are limited for pharmaceuticals use. In quality, multilayer duplex boards, of course, we can’t compete with players like Emami, Century, ITC, etc. However, if we talk about our mill keeping in view the technology we have, we are producing optimum quality possible and have never faced any issue. We are at our best right now.

In terms of market, Morbi and Ahmadabad are our major markets. Morbi covers 65-70 percent of our production while Ahmadabad 10 percent. Beyond Gujarat, Maharashtra covers the remaining percentage of our production. We also have in-house consumption. We have a corrugation plant where 400 tonnes of duplex board is consumed monthly.

PM: When you started Millennium, you already had tile mills running. What made you to set up a packaging board mill?

VK: As said, we already had our corrugation unit for our own usage. Our own consumption used to be around 300 TPM, within 8000 TPM Morbi’s requirement. Working in tile industry gave us the vision to see its rapid growth, giving higher packaging demand also. First thought behind owning a paper mill was to fill the gap whenever there is shortage. Besides, future packaging demand outlook looked good and we had to diversify anyway. So, we thought of going for the packaging paper unit. With the first unit, we ensured the first objective; with the second, we served the local market; and with the third, we thought to serve beyond the local market.

PM: It has been seven years since you started producing. You even have added capacity. How has been the experience in terms of profit margins, long-term viability of the industry, etc?

VK: Obviously, profit is there because of the mass production. Because of the GST, we are getting late payments and feeling momentary hassles. But, I firmly believe that GST will prove to be a good tax system in the near future for the entrepreneurs. With GST, it has become a sort of unified market system because of which the mills in North, who were earlier getting certain benefits of excise, would no longer avail them. This one-nation-one-tax system has removed the difference in rates of mills. The only difference would be now the transportation cost. Due to this, many new markets have been opened up. For us, it is Rajasthan, which we are looking forward to. Earlier, there was no scope for us because of the competition from North India. We also expect other markets to open up for us.

As far as the viability of this industry is concerned, I can see a lot of growth in the corrugation industry. Even if few new mills are added, the total production would be easily saleable in Gujarat because of the demand in the market. I don’t think new mills would affect the production of the existing mills as the consumption growth is moving simultaneously. Even if the market in Morbi shrinks, there will be an opportunity in other markets. If Morbi is leading in the production with over 1.5 million tonnes, it doesn’t mean that Morbi will be able to sell it entirely locally. We have been supplying to other markets, and the quest of the new markets would continue unabated.

PM: Tell us about your export markets. Besides, tell us about the raw material scenario.

VK: We are getting a good scope for export as well. Millennium would be exporting 50 percent of the material produced from the new duplex board plant. Besides, there have been a lot of investments by the new mills. They can’t produce medium or low quality, which in turn increases the costs. Transportation is easy because of the Mundra port, which is nearby. The cost of transportation in importing and exporting is quite cheap for us. So, of course, the export is one bright avenue for us.

The raw materials that we use are mix waste, BBC, and so on. The maximum material is imported from the US and Europe. Around 60 percent raw material is imported and 40 percent is obtained locally. There are regular price fluctuations in the international waste paper market depending upon the demand of the worldwide. In terms of quality, imported waste paper from Europe or US is virgin and extremely good.

PM: Is there any major investment in technology you have done so far? What about water usage?

VK: The new machine which we have put is fully automatic. We listed out the drawbacks from our existing machine and tried to fix those in the new machine we chose. Besides, on consumption front, we have the lowest water consumption within Morbi. Millennium is running on ZLD for two years. We are using 100 percent of wastewater. Morbi has groundwater so we have not yet felt the shortage of water.

PM: Do you wish to say something more?

VK: Paper consumption is growing day-by-day. Governments all around the world are continuously putting a ban on plastic. This is an opportunity for the paper industry. Paper is a sustainable product. Thus, the growth is continuous. If we talk about changes, there should be more and more automatic corrugation plants in order to increase the production of the corrugators. At the same time, it is not possible that all the corrugators are able to set up an automated plant.

.

Sezon Papers Pvt. Ltd.

175 TPD of RCT-Compliant High GSM Kraft Paper

In our mill, we have especially put triple wire machine and have done crucial modifications in our plant, making it a RCT-based plant to fulfill the compressive strength (CS) demand of the market,” says Mr. Narendra Patel, MD, Sezon Papers Pvt. Ltd.

In our mill, we have especially put triple wire machine and have done crucial modifications in our plant, making it a RCT-based plant to fulfill the compressive strength (CS) demand of the market,” says Mr. Narendra Patel, MD, Sezon Papers Pvt. Ltd.

.

.

.

PM: Tell us something about Sezon Papers.

Narendra Patel: Sezon was started in January 2017. This is relatively a new paper mill. Our capacity is 160-170 metric tonne per day and the machine is designed to exceed 175 metric tonnes. Currently, we are making 16- 28 BF and 120-350 GSM. The capacity of the plant is up to 32 BF. We have almost utilized 70-75 percent of our capacity. By March 2018, we expect to achieve 100 percent of the capacity utilization, which is achievable with certain plant modifications.

In our mill, we have especially put triple wire machine and have done crucial modifications in our plant, making it a RCT-based plant to fulfill the compressive strength (CS) demand of the market. We have done the plant modification in association with Parason Machinery to make it compatible with RCT-based requirements. These modifications have made us produce higher GSM kraft paper, paper tube, and 350 GSM rich ply paper.

PM: How has the market response been for you?

NP: We are focusing on the market. We don’t want to go to the market, instead want the customer to come to us. We are accordingly setting our quality parameters. Besides, I have two corrugation units working in Morbi with combined capacity of 250 TPM, both running for over 10 years. The experience of being a corrugator has really been helpful. I think every paper mill owner should have the knowledge of corrugation. It is necessary to know how to make a box and what are the challenges that come while manufacturing a box. I was involved in the production of boxes and therefore I am aware of the challenges. That experience is helping me here in manufacturing kraft paper. I am having zero complaints now from my customers.

The corrugation industry has two main demands from paper manufacturers, viz. acceptable moisture range and stable GSM, which we are maintaining quite efficnetly.

PM: To enhance the demand in future, what steps should be taken by the Morbi mills?

NP: First of all, we can work on the on-time delivery or service for the customers. For that, we need to better our transportation. Besides, Morbi should work more on the quality front. Now, because of the FMCG market growing, the manufacturers should think of providing food grade paper. If these all are done, the market for Morbi’s packaging paper can grow manifold.

PM: Morbi is leading the packaging paper industry volume-wise. What are the main drivers of the paper industry here?

NP: After the ‘Make in India’ vision, everyone is thinking of doing something or the other. Every individual is going ahead keeping this vision in mind. The tile makers used to have small units where they were making 5000 boxes per day. They have now gone to 8000-10000 boxes per day. Followed by their requirement of boxes, chemicals, packaging materials, and the other related industries started growing too. The other industries started to expand vertically. Regionally, it has become a craze for people to do something new. Not only the paper industry, but the other industries too are growing in Morbi. So, Morbi’s intrinsic growth aspirations are one of the main drivers. Besides, transportation facility and nearness to import are other drivers.

PM: It is difficult to sustain an industry growing like this if efforts are not undertaken to explore othe markets soon. What do you think?

NP: I guess Morbi is ready to face the competition as the local consumption is already less than the total production of the mills in Morbi. The capacity has been expanded to a considerable 4000-4500 metric tonne per day, including kraft and duplex. But, the local demand is far less than this. People are going to nearer states like Rajasthan, MP, and Maharashtra in search of market. The market will of course expand in times to come as we are finding many takers for our product outside Gujarat. The recent demand from China has also risen, and some of the mills were already exporting duplex boards to various countries. This indicates the future expansion of the market for Morbi.

PM: Tell us if Sezon exports too.

NP: We have started exporting a few months back. Our order is pending and we have kept aside 1000 metric tonne for exports. We make single quality. Rest depends on the requirement of the customer.

PM: What is the raw material scenario at Sezon Papers? How are you helping the environment conservation?

NP: We are importing from America, the Middle-East, and Gulf countries. We also source a little bit of the raw material locally in order to add short fiber. The ratio between imported and domestic raw material is 70:30. We have to remain dependent on the imports as we don’t have adequate and quality pulp. If we need long fiber then we have to remain dependent on the imports. We can’t get the virgin pulp from the Indian market.

On the water front, we are going to ZLD. Also, we are focusing fully on saving the energy. Our motors take the amount of pressure it needs. Not more than that. Our motto is to save energy and save trees.

PM: Tell us more about the Morbi’s growth.

NP: High production, low cost, and maximum market penetration; through this, Morbi can definitely contribute to the overall growth of the Indian paper industry.

The first paper mill in Morbi was Divyang Paper Mills started in the year 1995. It was a small mill with 50-60 tonnes of capacity. They started the paper mill to meet the regional demand. Later, with industries expanding in Morbi, especially ceramic industry, in the last five years Morbi has seen vertical growth. The success of the ceramic industry has somehow had an impact on the growth of Morbi’s paper industry due to the demand of the corrugated boxes. In Morbi, there are around 350 corrugators. There may be minimum 80 tonnes to 200 tonnes of single facer corrugators. If you calculate keeping 350 corrugators in mind and take an average of 100 metric tonnes per month, there is around 35,000 metric tonne of consumption in Morbi itself. There is around 30-35 percent of the duplex and remaining 60-65 percent of kraft consumption. There is an average of 100 metric tonne demand in a month per corrugators. In the last two years, around 20-22 new mills have been built in Morbi. And almost all of them have a capacity of more than 150 TPD. This demand is due to the regional as well as outer demands. The transportation availability is quite good in Morbi. People have this mindset that planning a paper mill in Morbi is suitable.

.

Harikrupa Papers LLP

125 TPD High GSM Kraft Paper Plant Started in December 2017

“I personally believe the share of Morbi will be very significant in future for the packaging industry, many mills still coming up. As far as the future of the packaging industry is concerned, due to the environmental awareness and the dangers of the usage of plastic, the use of packaging kraft paper will be tremendous,” Mr. Bhavik M. Bhatt, Designated Partner, Harikrupa Papers LLP

“I personally believe the share of Morbi will be very significant in future for the packaging industry, many mills still coming up. As far as the future of the packaging industry is concerned, due to the environmental awareness and the dangers of the usage of plastic, the use of packaging kraft paper will be tremendous,” Mr. Bhavik M. Bhatt, Designated Partner, Harikrupa Papers LLP

.

PM: What inspired you to set up a paper mill? Tell us about the capacity and probable startup date of your mill. How much are you expecting to produce in the first few months?

Bhavik M. Bhatt: Being a sustainable product, both in terms of business and environment, we thought of entering into the paper industry. The demand for paper is growing every day, the paper packaging being the most eco-friendly.

The commissioning of the mill has already started in November 2016. The total installed capacity is 125 TPD. By mid of December 2017, we will start the commercial production. There are some snags related to power. The sub-station nearby was not having sufficient power support. We have got our machines designed in such a manner that we can further expand to 150 tonnes in a couple of months.

Initially, we will be producing 2500-3000 tonnes per month. We are going to produce the kraft paper ranging from 80-200 GSM with BF quality from 12-28 BF.

PM: How are you going to source the raw material? Where do you intend to market your product?

BMB: Currently, we are importing our raw material from US, Europe, and the Middle-East. Our suppliers are the giants from the US, which are quite particular about the quality of the waste material they are supplying. They have modern methods of sorting their wastes. Also, we are over cautious while ordering and buying the material in order to make the quality paper.

With regards to market for our products, I don’t feel there is much scope of consumption locally. There are many paper mills in Morbi. Definitely, I have to look out for markets outside Morbi or I should say outside Gujarat. We see a good potential in Gujarat, north and central India. In coming times, Morbi would be able to compete with other players both quality- and quantity-wise and thus market expansion will naturally happen on that account.

PM: Tell us something about some of the technologies that you have put in your mill. Anything specific to save water and energy?

BMB: We have installed the paper machine with MG cylinder instead of going for a size-press section. In Morbi, most of the new mills are coming with size press. MG uses the strength of the fiber whereas the size-press uses the strength of chemicals. We believe we need to give our customers the best quality paper with purest possible fiber. The kind of technology we have chosen will bring out the maximum benefit from the fiber rather than depending on the chemicals.

On the water front, we have installed a modern ETP and our plant will be based on ZLD. Secondly, we have installed 360 bag filters to curb the pollution from our boiler. Thirdly, we have installed a blow-through system to reuse our waste steam which is supposed to get evaporated. As far as paper making is concerned, in India, especially in Gujarat, mostly all the paper mills run on the Fourdrinier concept. There are minor changes in regards to the pulp section.

On power front, there are no special technologies, but we have selected our motors as per its power consumption capacity. We need to save the electricity and start looking ways to optimize the usage.

PM: What factors are driving the growth of the Morbi’s paper industry?

BMB: The main reason is the hard work and perseverance of the mill owners in Morbi. Not only us, but all the owners are punctual at work. They personally look after the purchases, technology, and other things. Another factor is the partners. You will find many partners in all the factories of Morbi. They will divide their work and responsibilities. There are many sustainable and long-lasting partnerships in Morbi, which is not possible in other parts of the country.

Secondly, in Morbi, we mostly don’t rely on other sources of fund. We try to bring the maximum finance on our own. We take from our relatives and partners. If you are sourcing funds from other places, you will face interest burden and legal compliances which are too high. At the same time, when your money is at stake, you need to invest the best you have. A 100 TPD paper mill usually takes 10 months to start in Morbi.

PM: What are your views on sustainability of the Indian paper industry in the long-term? What would be Morbi’s stake in the future of the paper industry?

BMB: The paper industry will definitely survive. The main reason for this is our industry leaders. The industry’s giants like JK, ITC, Century, Khanna are very well connected with the Govt. We are reaping benefits of their long-time work indirectly. They have prepared a ground for us to think of paper as a viable business. Their best practices, opinions, and aspirations matter a lot to us.

Besides, we don’t have any representation with the Govt. right now. The organized paper industry however has strong representation with the Govt. The IGST has been reduced from 12 to 5 percent on imported waste paper only because of their efforts.

PM: The packaging industry is booming and this will continue in future as well. What are your views on that and amid that growth, where do you see the Morbi’s paper industry?

BMB: I personally believe the share of Morbi will be very significant in future for the packaging industry, many mills still coming up. As far as the future of the packaging industry is concerned, due to the environmental awareness and the dangers of the usage of plastic, the use of packag-ing kraft paper will be tremendous.

.

Panama Papers Pvt. Ltd.

The Producer of the Best Absorbent Karft in Morbi

“Panama is also making absorbent kraft for the use in laminate industry. We are the top company in absorbent kraft here. The kraft paper which we produce is in the range from 250 TPD. So, we have total capacity of 200 TPD with actual production 180 TPD,” says Mr. Bhavesh N. Patel, Director, Panama Papers Pvt. Ltd.

“Panama is also making absorbent kraft for the use in laminate industry. We are the top company in absorbent kraft here. The kraft paper which we produce is in the range from 250 TPD. So, we have total capacity of 200 TPD with actual production 180 TPD,” says Mr. Bhavesh N. Patel, Director, Panama Papers Pvt. Ltd.

.

.

PM: Tell us something about Panama Papers.

Bhavesh N. Patel: We started in 2005. Our capacity was 80 tonnes TPD of kraft paper and we were making somewhere between 70-80 tonnes. In 2015, we added a new machine of 120 tonnes of capacity. We are now running both machines now. Panama is also making absorbent kraft for the use in laminate industry. We are the top company in absorbent kraft here. The kraft paper which we produce is in the range from 12-20 BF. So, we have total capacity of 250 TPD with actual production 180 TPD.

PM: Tell us about your variety and grades. Was entering into the paper industry a diversification motive?

BNP: We just make two varieties. One is the paper used in corrugated box. It ranges from 12 BF to 20 BF. The second product, our main product, is the absorbent kraft paper and it takes almost 80 percent of our total production.

I used to have a ceramic business. I thought of bringing a new product in the market. At that time, there were a good number of ceramic units and a handful of paper mills. We, therefore, thought of putting up a paper mill.

PM: Tell us about the technology you use at Panama Papers. What about water usage at your mill?

BNP: The first machine was a line-shaft paper machine. But, the new machine is the silent drive. Apart from this, we have increased the deckle size of the machine. It is producing 120 tonnes now. Technology changes very fast. You need to update yourself in terms of technology in order to grow your company.

Our water consumption is within the standard limit. We have ZLD and use all of the waste water back into the system.

PM: Tell us about the major markets you are covering right now.

BNP: Only two-three mills used to make the paper I am making. Now, almost 30 paper mills are making absorbent kraft for the laminate industry. The markets we cover are Morbi, Ahmedabad, and Rajkot. Because of the transportation cost, we are not able to supply to farther places. But, the local consumption and demand is good; so our production is consumed easily.

PM: Which factors did encourage the people of Morbi to go for packaging paper production?

BNP: The people of Morbi are brave and hard working. The owners themselves keenly participate in the work. That’s why the industries in Morbi are gaining success. As compared to the traditional ceramic industry, the paper industry here is relatively new. However, it has gain a foothold strong enough to compete with older industries. This is, of course, because of our spirit to take new challenges and convert them into success by hard work.

Also, we are not working like mills in other areas. They have a mill at one place and office at the other. They have to manage things sitting from a distance. Besides, they have to hire a good number of people under them. This is opposite to what we do. Our work is in one place. That’s why we are able to focus in one direction. We can even beat bigger companies I am sure.

Moreover, the Patel community in Morbi is quite industrious and they like to share and grow by mutually helping each other. In other places, people are so secretive about their work. I guess these are the reasons that helped Morbi to grow its paper industry.

PM: Tell us about the raw material scenario.

BNP: As we make kraft paper, the waste paper is the main raw material which we source from Gujarat, MP, and Rajasthan. Apart from this, we import. But, as we make B-grade paper, we majorly use the local raw material. The gold paper which I make, that is made from 100 percent imported raw material. The cost difference is around Rs. 4-5 per tonne in the local and imported raw material.

If we start making our paper from imported waste paper instead of local one, we will see an increase in the cost. There will be an increase in power consumption too and the production will become less. Besides, the rate of imported waste is not fixed. It depends on the local demand.

PM: What are the future plans of Panama Papers?

BNP: We are planning to go into tissue production after 4-5 months. Right now, I am surveying the market for the product. I think there is a rising demand for tissues alongside packaging. I recently went to China for the same. Morbi doesn’t have a tissue plant as yet. The production of tissue in India is less but the growth rate is large, around 15-20 percent. We will start with a small mill and will see the demand. If it works, we will think to expand.

.

Fortune Papers

100 Percent Capacity Utilization With Consistent Quality

“The local consumption in Morbi will also grow manifold because of the ceramic and other traditional industries in the region. With the national growth of packaging industry, I do see Morbi’s packaging industry growing as well. It has already grown to an amazing level in terms of volume, but now it is time for it to grow in terms of quality and variety,” speaks Mr. Kuldeep Ubhadia, Managing Partner, Fortune Papers.

PM: Please tell us something about Fortune Paper Mills.

Kuldeep Ubhadia: We started in the year 2012. This is our sixth year. Opening this mill was a diversification from tiles. Previously, we had two tile units. For packaging, we have not increased the capacity. We have the same capacity with which we started. But, I can say we have achieved the consistency in production in terms of quantity and quality. We have optimized the machine’s capacity and are have utilizing the 100 percent with a production of 70-90 TPD.

Basically, we are making absorbent and tube grades. Our absorbent kraft is being consumed by the laminate industry based in Morbi, Rajkot, and places near Ahmedabad. The raw material sourcing scenario is getting difficult day-by-day up to a certain level. But if you are consistently importing from the Gulf markets, it won’t be much difficult. The local sources are from MP, Maharashtra, Rajasthan, and Gujarat.

Quality and cost wise if we compare the local sourcing and the imports, import is better. However, this is not always true and your profit margins largely depend on the type of product you make, where sometimes local waste may also prove sufficient.

PM: Are you going to add some capacity in future?

KU: Yes, we are thinking to add capacity in the next one or two years though we haven’t decided the capacity yet. However, we have to look out for the scope of improvement in the existing unit. Capacity expansion is a secondary thing for us; we first need to maintain our quality continuously.

PM: As you know, the packaging itself is a growing sector and there is a huge potential for future growth. So, what do you see as the future of Morbi, apart from the local consumption?

KU: Apart from the local consumption, we see Saurashtra region as a big market. If you go in the coastal belt, there is a huge market for fisheries. The fishing industry uses packaging as well and we see a potential market in that trade. Ahmedabad is another market for us. The market is not an issue anymore.

PM: What are the growth drivers for the Indian packaging industry in general and Morbi’s paper industry in particular?

KU: Packaging has overall become an important commercial activity in almost all trades and industries. Besides, e-Commerce and organized retail have given packaging a new boost. The suppliers are packing and sending the goods to the customers, both for safety and good looks, increasing the product USP. This is ultimately benefiting the packaging industry by generating enormous demand.

The local consumption in Morbi will also grow manifold because of the ceramic and other traditional industries in the region. With the national growth of packaging industry, I do see Morbi’s packaging industry growing as well. It has already grown to an amazing level in terms of volume, but now it is time for it to grow in terms of quality and variety. Up till some time back, the ceramic industry was just serving the domestic market, but it has now reached the global market in a big way with its unique product offering. On the same line, we will soon see the Morbi’s packaging industry competing with the best in India and beyond. Once the quantity is achieved, the quality will follow in time.

PM: Do you think Morbi’s growth is on right track? What about investing in better technologies?