Expertise comes from understanding and understanding comes from detailing and this is how Mr Basantt Khaitan, MD, Wires & Fabriks (S.A) Ltd., Jaipur has attained his proficiency in the paper industry. His penchant for the industry is well known among his peers and colleagues. To share his understanding and to discuss the present scenario of the industry team Paper Mart get along with Mr. Khaitan for his views on the different subject matter mentioned below.

Paper Mart: First of all provide us the current market update. Is there a gloom or boom and where it is heading?

Basantt Khaitan: Neither gloom nor bloom. Outlook is inspiring long-term but skeptical short-term.

Significant investments for capacity expansions in the past 2 years and the continuing global slowdown seems to have made the market tougher than expected. Mills are under pressure but none seem to have ‘shelved’ their expansion/modernization plans. With China also slowing down, optimistic industry leaders have realized that this may be the best time to scout for good deals for their expansion plans and are very active. Hopefully, we should see a market turn around next year and new expansions to regain momentum, starting mid 2013.

While India represents 15% of the world population, paper consumption stands at just 2% of the world’s paper consumption. China today accounts for 25% of world consumption. From the ’70s till now, China has grown from less than 5 million to 90 million tons per annum of paper & board production. Though not at the same pace, India will surely grow to these levels. Consumerism, cultural shifts and business processes will affect the present ratio of 60% white paper (including newsprint) and 40% brown (including board), to a world average of 60% brown and 40% white.

The average return on capital for leading global paper manufacturers is below 5%, while for most Indian paper companies, it’s quite remarkably still in double digits.

PM: Being a paper machine clothing leader in the Indian paper industry, you understand it very closely. Give your views on the actual scenario of the industry (capacity, production, capabilities etc)?

BK: Paper production is more like a commodity business having low barriers to entry. Many believe paper demand will decrease in an increasingly digital world. Paper prices have performed poorly over the past decade, while prices of component materials have shown double and triple increases. The price of recycled paper has increased manifold while real paper prices have fallen in the last decade. Companies that own their own raw material supplies, referred to as backwardization, have better pricing power. I estimate present installed capacity in India to be over 14 million tons per annum and production to be close to 12 million tons per annum.

Uptill now, paper industry growth has been following India’s average GDP growth trend, therefore even at a pessimistic annual growth of just 6%, the industry would touch 20 million tons by 2020 and 110 Million tons by 2050. If this average growth rate was to be 7% (China’s average growth rate has been 7.5% per annum since 1985, i.e. average for 27 years), India would be producing 80 Million tons by 2040 (27+ years). By this time, many technological gaps would also be minimized because most of the additional capacities would be through large modern machines having world standard operational benchmarks.

PM: In the recent years industry has invested both in capacity expansion and technology up-gradation. Your views on the same and in fact as an important vendor to the industry, how you are gearing up on this front?

BK: If we look back, the Indian paper industry is more than 100 years old. Barring a few exceptions of new modern mills, most of the mills are based on old process technologies. Small scale of operations and use of diverse raw materials pose significant challenges to long term sustainability. Industry needs to consider building strong local supply chains for cost and service efficiencies besides avoiding foreign exchange risks. Having unequivocal faith in the growth and success of the Indian paper industry, Wires and Fabriks have kept themselves at the cutting edge of technology by investing in the latest and best machines for production, partnering with the world’s largest and best producer of forming fabrics – Albany International and aggressively introducing new products for the paper maker’s benefit.

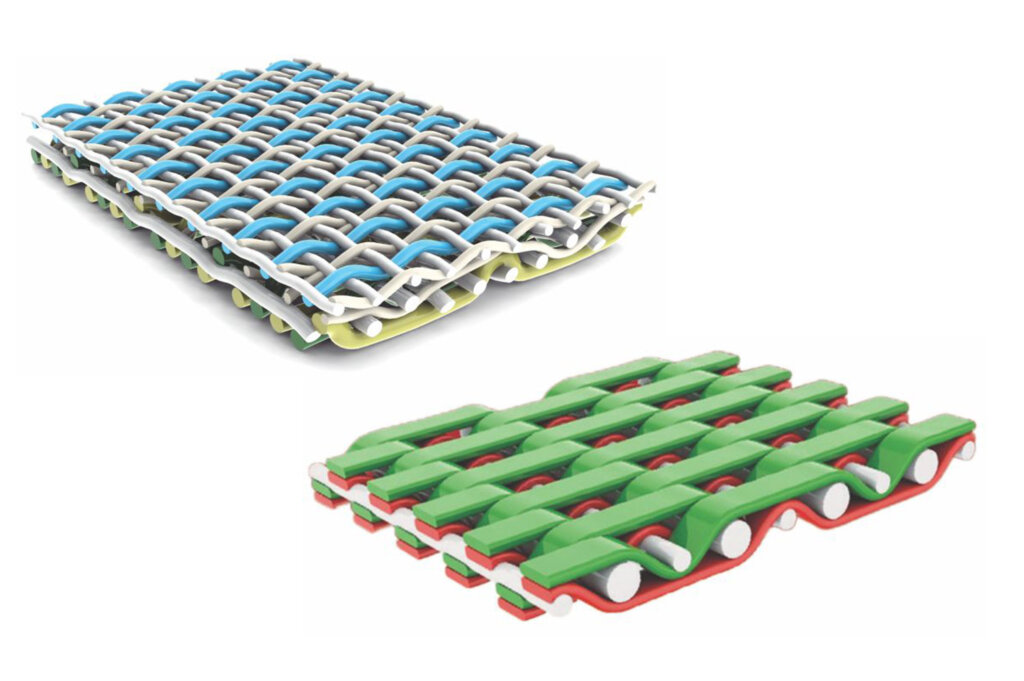

We are equipped to deliver the latest STL (SSB) forming fabrics for forming and unotier screens for dryer section. Pulp fabrics, stainless steel diagonal seam covers with plasma/gold/silver seams and ETP fabrics form part of the basket of products offered by Wires & Fabriks.

STL forming fabric was introduced in 2006 and has provided formidable competition to international brands. It’s design has been engineered and specifically designed to meet Indian paper making conditions where a large variety of paper needs to be made on the same machine with a varied mix of fiber. It provides higher life, lower energy & chemical demands, improved retention & formation and a cleaner run.

Unotier Dryer screens offer considerable advantages for high speed machines and Unirun positions – with higher surface contact area to increase the heat transfer with better sheet support, higher life and lower energy consumption.

Today’s customer is looking for ‘solutions’ and not just products. Our team attempts to understand sometimes unspoken desires of the customer through dialogues, studies, tests and referrals to our collaborators for their experience with similar situations. Saving energy, increasing operational reliability/repeatability and efficiencies while improving paper quality and fabric life time are always in our mind during such studies.

PM: According to you what capabilities, best practices and assets will the Indian paper industry need to leverage in order to sustain its competitive essence?

BK: Scaling up is, to my view, the most important capability the industry needs. It’s perhaps the only way to mitigate costs – which one can no longer ‘pass-on’. Like quality, being environment friendly is an asset, not a cost. Industry must believe and practice this not only to be competitive but also to attract the best talent.

Because of the infrastructure, raw material and market structure, world scale mills are yet to be established here. Sooner than later, economic pressures will make this happen. This start will bring a wave of gigantic changes in the whole industry the way business is operated, the kind of people who run it and the supply chain structure. Here again, China is a great example for the industry to follow by closing small mills mainly for environmental reasons and encouraging establishment of economically and environmentally viable world scale plants. Promotion of social forestry will create a huge job potential for the lower and middle class work force while automation and excellence in engineering will attract the best talents in manufacturing.

Faster machines, increased operational reliability through automation, increased productivity, reduced consumption of water, energy & fiber and improved product quality all at lower costs this is the challenge every industry faces! Human ingenuity and the power of software will dramatically change the way industry is run.

In spite of having modern technology, the West is saddled with old machines because they have no room for new mills/expansions. China today has the fastest machines, the most efficient and lowest cost operations, the least environmentally impacting mills in the world today all because they have installed the latest machines with updated technology.

This is the greatest opportunity Indian paper mills will have, to install the most modern machines having the least environmental impact and operating at the lowest consumption levels of key resources like energy/water and fiber. The challenge of raw material security is being squarely and successfully faced by the leading industry players through social forestry. By 2020, this could enable a dramatic change in the raw material sphere from when the large mills will be able to scale up to global levels in terms of capacity and efficiencies.

PM: India’s current consumption of paper is about 10 kg per capita against the world’s average consumption of 57 kg? What according to you would be the challenges and opportunities for the Indian paper industry in filling the above gap?

BK: I don’t wish to sound as if I know all the problems of the industry and therefore have easy solutions too. Industry stalwarts have more than a fair idea of the issues at hand. I believe the industry wants to do it’s social bit by building sustainable practices. However, supportive gestures are necessary for any endeavor to be successful. Government policies need to become ‘enabling’ in order that industry can grow – not only survive.

The industry is unanimous in citing availability of raw material as its single biggest challenge. China faces similar issues. China lacks the natural resources for paper and has no labor cost advantage. China’s forest base is among the smallest in the world per capita. Consequently, China is the largest importer in the world of pulp and recycled paper. What is different however are the huge subsidies that the government doles out to support the growth. The imposed anti-dumping and anti-subsidy duties on Chinese fine paper exports into Europe and US may have indirectly provided an opportunity to the Indian paper industry.

Gaps in nearly every sphere – energy/water/chemical/fiber consumption, are so high – that opportunities exist everywhere. If the government plays more a role of ‘enabler’ rather than ‘controller’ things would change automatically for the better.

PM: “It’s the people who run the show behind the screen”. What possible actions industry should take to attract the people/young brigade to minimize its dearth?

BK: Scaling up the paper technology training institutes already existing could be the first step in terms of size and quality. Size should not mean just number of students but more so number of streams of training. Not just technology training but also management training for paper mills. Not just training engineers but blue collar workers training as well.

It is believed that 30 million tons per annum is the critical mass for the paper industry to usher in a total change in levels and quality of operations. For India, this could start happening around 2020. China reached 30 million tons in 2000 and since then it has tripled its output to nearly 90 million tons per annum today (in just 12 years).

Developing products for the customer is a business prerequisite because of competition so is developing people for the company because of survival or for the need for growth. With 5 institutions, India has a fairly strong base for education in paper technology they only need to be spruced up to world standards by creating a ‘pull’ demand so that students choose to study paper making. This will happen once it scales up and earns a name of a professionally run clean and environmental friendly industry.