India’s paper mills are transforming water from an expendable utility into a recoverable asset, achieving over 90% reuse rates through innovative technologies and closed-loop systems that balance regulatory compliance with operational excellence. Mills are cutting specific water consumption with some mills achieving levels as low as 10.9 m³/tonne, using advanced DAF units, membrane filtration, and AI-powered monitoring systems, while achieving up to 95% freshwater intake reduction through technologies like anaerobic bioreactors and zero liquid discharge systems.

In an industry long associated with heavy water consumption, the pulp and paper sector is undergoing a quiet but crucial revolution where every drop counts, and every loop matters. Water circularity, once a buzzword confined to environmental reports, is now emerging as a core operational imperative for paper mills across India and the world.

The drive for circularity isn’t just about sustainability; it’s about survival, compliance, and competitiveness. As mills grapple with rising water costs, regulatory tightening, and pressure from consumers and investors, many are rethinking their relationship with water. This has led to a gradual shift from water as an expendable utility to water as a recoverable asset embedded in the production ecosystem.

“From a compliance focus in the initial years, the emphasis has now shifted to proactive actions and efficiency drivers, recognizing water not just as an input, but as a valuable resource that must be reused and optimized through every stage of our operations,” as per ITC-PSPD.

“Emami Paper Mills’ approach to water circularity has evolved from basic conservation to a comprehensive recycling and reuse model,” says Ashish Gupta, Director – Operations.

This shift is reflected across the industry, where resource efficiency and ESG compliance are now tightly interwoven. The circularity movement is not merely a defensive strategy against regulatory pressure; it’s being embraced as a proactive avenue for long-term resilience.

A Circular Awakening: Evolving Approaches and Mindsets

Water was once treated as a linear resource: extracted, used, and discarded. Today, leading paper mills are redesigning their relationship with water entirely. The transition from water conservation to active reuse and closed-loop systems is driven by both regulatory mandates and corporate sustainability goals.

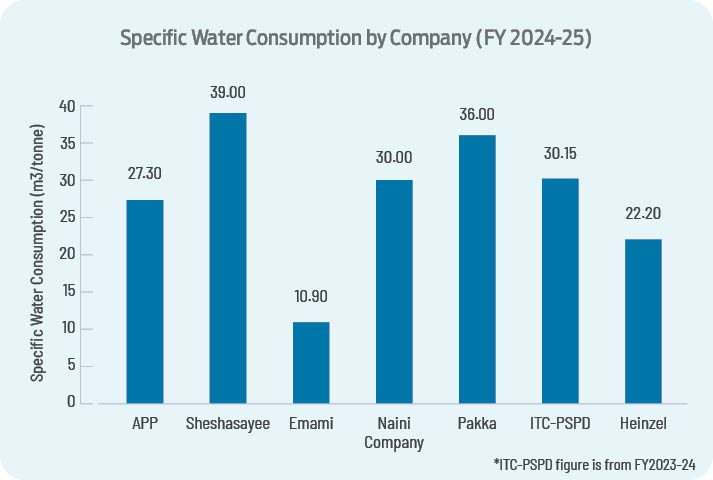

For example, Emami Paper Mills has reduced its specific water consumption from 12.6 m³/tonne to 10.9 m³/tonne over three years by implementing multiple reuse streams and a rainwater recharge system. Similar progress is reported by APP, Naini Papers, and Pakka, each emphasizing strategic reuse, machine redesign, and section-level water audits.

Naini Papers, in particular, has halved its freshwater intake over five years and aims to achieve sub-20 m³/tonne levels by 2026. “With water being the most precious resource, the company focuses on maximum recycling and reuse of water in the process…,” says Pawan Aggarwal, Managing Director.

Indian paper mills report that their journey began with simple reuse initiatives, like cooling water recapture or condensate reuse, and evolved into more complex strategies.

“Our approach has evolved from simply reducing consumption to actively reusing treated effluents… we have integrated systems to recycle backwater…, significantly cutting down freshwater usage,” says Devesh K. Singhal, Director and CEO (Technical), Chandpur Paper.

APP Group has similarly integrated circularity into its operational philosophy, aligning it with international standards and third-party verification processes. “APP’s approach to water circularity has matured from viewing water as a critical operational input to recognizing it as a vital strategic resource that must be managed responsibly,” explains Letchumi Achanah, Head of Stakeholder Engagement & Advocacy at APP Group.

The move toward circularity also reflects broader market and trade dynamics. As global buyers place increasing weight on ESG credentials, Indian paper exporters are under pressure to demonstrate environmental compliance.

European benchmarks, where circular water models are already well-established, are shaping expectations. For example, Heinzel Group, one of the biggest producers of pulp and packaging papers in Central and Eastern Europe, recorded specific freshwater consumption of 22.2 m³/tonne in 2024. Leading mills in India are already demonstrating similar approaches and have reduced their consumption to either match the global benchmark or come closer.

European mills’ focus on circular water management serves as a valuable reference point for Indian industry, especially as global buyers demand sustainable supply chains.

Watch: In Pursuit of Lesser Water Footprint

Practical Moves: Reuse, Recovery, and ZLD in Action

Water circularity in India’s paper industry takes many operational forms: from rainwater harvesting and internal recycling to biosludge repurposing and real-time consumption monitoring.

From the operational side, India’s paper mills are implementing a range of reuse strategies: DAF units, backwater recovery, membrane filtration, and hybrid ZLD systems. “We’re reusing biosludge, a byproduct of effluent treatment, as a renewable energy source,” notes Letchumi Achanah of APP Group.

Many mills are now achieving over 90% water reuse through a combination of on-site innovations and infrastructural adaptations. These include creating internal water loops, optimizing backwater reuse, and building storage capacities to balance seasonal variability.

ITC-PSPD, which reports internal water reuse rates of over 80% at some of its mills, extends the circularity effort beyond the fence, repurposing over 40% of its treated effluent for irrigation in the local catchment. “Our rainwater harvesting potential is nearly four times our factory water consumption,” the company notes.

“Some of the sections are operating with 100% ETP-treated water, and our paper machines are saving more than 90%…,” says Shashi Verma, Environment Head, Pakka Limited.

Emami Paper Mills, another large-scale operator, is leveraging a combination of advanced treatment and monitoring tools. High-efficiency Dissolved Air Flotation (DAF) units, disk filters, scan showers, and membrane filtration systems are central to its water reuse strategy. “Installation of a scan shower in the wire section has helped in substantial reduction of fresh water consumption,” says Ashish Gupta.

Chandpur Paper, a mid-sized operation, has also made significant strides in water management. Its deployment of microscreen filters, upgraded showering systems, and kidney loop solutions has helped improve internal recycling and reduce freshwater intake. “These innovations have optimized water usage across operations, significantly lowering our dependence on freshwater…,” shares Devesh K. Singhal, Director and CEO (Technical).

Demonstrating a strong commitment to environmental stewardship, Naini Papers Limited is actively pursuing optimal water use as a foremost concern. As Pawan Aggarwal, Managing Director of Naini Papers Limited, emphasizes, “Optimal water use will be the foremost concern in the coming years. Achieving full circularity will be our prime goal…”

Meanwhile, with a forward-thinking vision for sustainability, Seshasayee Paper and Boards Limited (SPB) is deeply committed to achieving full water circularity. As Dr. K. Rajkumar, Chief Manager-Environment, explains, “Our approach to water circularity… includes water minimization at source, internal recycling, and reuse of treated wastewater across various process streams.”

Larger integrated mills have also scaled up rainwater harvesting infrastructure, leveraging vast catchment areas to reduce freshwater dependence during monsoon seasons and stabilize year-round supply.

ITC-PSPD spearheads the tech-led water circularity. Its adoption of digital tools supports the idea that digitization is no longer experimental; it’s becoming industry standard. “We have invested in digital systems … on Industry 4.0 tools and data analytics… to support effective water management. Using these platforms, we have built dashboards for paper machine white water towers to monitor and optimize water usage in pulp dilution,” notes the company. It also mirrors similar digital narratives by companies like Pakka.

These efforts, ranging from biosludge reuse and digital monitoring to shared ZLD infrastructure, underscore how mills across sizes and regions are customizing their circularity playbooks while steadily moving toward long-term sustainability.

Innovation Drivers: The Technology Behind the Transition

Technology is at the heart of India’s circularity transition. Real-time water quality monitoring, AI-led flow control, and modular treatment units are now widely discussed.

While mills are pushing boundaries with internal upgrades and process optimization, technology providers are responding with targeted solutions that address the specific operational needs mills have expressed.

Krofta Engineering works closely with paper mills to deploy end-to-end water treatment solutions. “A robust biological treatment followed by technologies like membranes are most commonly used. Their applicability and usage will have the greatest impact in achieving water circularity,” says Raghvendra Khaitan, Managing Director.

Paques India brings advanced anaerobic technologies to the table. “By commissioning multiple BIOPAQ IC and ICX reactors, which are very specific to treating OCC (Old Corrugated Containers) based paper mill effluents, we have helped mills reduce their freshwater intake up to 95%,” says Mani Elanchezhiyan, AVP.

Sidhu Engineering has tackled one of the most stubborn areas of water wastage: high-pressure showering systems. “…mills have some hesitation regarding the implementation of recycled treated water in critical shower zones because of the fear that it might impact the paper quality… Our Robo Cleaner saves 92% of water in the showering process without compromising the paper quality,” says Director Rahul Basra. If true as claimed, this is a significant reduction in shower water use.

To scale circularity, data intelligence is becoming just as important as hardware. “With advanced AI-driven tools like eLIXA®, we provide real-time monitoring and actionable insights, enabling plants to achieve measurable improvements compared to planned targets through audits,” says Ram Santhanam, Director – Engineering, Haber, a company offering analytics tools.

Axchem Solutions India is preparing to introduce advanced chemical treatments to Indian paper mills. “Our flocculation and coagulation agents are highly efficient in removing suspended solids from process water, enabling improved water recycling and reuse,” notes Rajesh Chhabra, Managing Director, Axchem Solutions, reflecting the ongoing evolution of chemical solutions in supporting circular water management.

Digital twins and predictive control systems are also emerging as strategic enablers. “Digital twins of water treatment plants can help simulate and optimize performance before real-world deployment. IoT-enabled monitoring and AI analytics will improve predictive maintenance, energy efficiency, and process control…,” notes Paques’ Elanchezhiyan.

Xylem offers chemical-free, closed-loop solutions using ozone and UV. “Ozone effectively disinfects water and prevents the formation of biofilms… Thanks to the high quality of ozone-treated water, cooling systems can operate at much higher cycles of concentration…, significantly reducing water consumption and environmental impact,” says Alexis Metais. These innovations make ZLD more achievable without excessive chemical dependence.

Collectively, these solutions are not just about individual technologies, but about system-level integration and how effectively multiple components, platforms, and teams work together. Increasingly, mills are adopting mill-wide dashboards, IIoT platforms, and remote-control capabilities to synchronize decision-making across water, energy, and production systems.

The next phase of India’s water circularity journey will likely hinge on this combination: mill-led operational discipline, supported and scaled by the right technological partnerships.

Roadblocks on the Path to Circularity

Despite growing ambition and innovation, the journey toward circular water systems in paper mills faces significant challenges. Many mills, particularly small and mid-sized ones, struggle with operational and financial constraints. High upfront capital costs for advanced technologies like membrane bioreactors, multi-effect evaporators, or real-time digital monitoring platforms remain a major deterrent.

“Mills want to reduce their water consumption, but frankly, they are unable to do so beyond a certain limit,” explains Raghvendra Khaitan, Managing Director of Krofta Engineering Limited, pointing to a widespread preference for short-term ROI, which often stalls systemic changes.

Pawan Aggarwal, Managing Director of Naini Papers Limited, adds: “Achieving full circularity is our prime goal; however, operations demand that the system be purged at certain intervals to maintain product quality.”

Operational reliability is another key hurdle, especially when influent water quality varies widely, such as in mills using old corrugated containers (OCC).

Skilled manpower shortages further complicate this landscape. “Skilled manpower to operate and maintain complex biological and integrated systems is another area of concern for customers,” notes Mani Elanchezhiyan from Paques India.

From the technology provider side, customization remains a critical, yet often missing, link. “Many mills seek plug-and-play solutions, but true circularity requires a process-specific, site-optimized design,” Khaitan emphasizes. “This takes time, technical patience, and strong managerial commitment.”

Conservative operational mindsets also pose a challenge. Rahul Basra of Sidhu Engineering observes, “Mills still hesitate to apply advanced cleaning technologies in critical shower zones, fearing an impact on paper quality despite data consistently showing otherwise.”

Addressing these challenges starts with a rigorous water audit. “A well-executed audit improves water conservation and supports operational excellence and regulatory compliance, making it a critical step for the industry,” explains Ram Santhanam, Director – Engineering at Haber.

Customization of solutions goes hand in hand with audits. “We achieve results by conducting detailed plant audits, studying existing systems, and providing tailored suggestions and improvements,” says Khaitan. “This builds confidence with mills as it demonstrates our understanding of their specific needs because it isn’t one-size-fits-all.”

Together, these insights underline that overcoming roadblocks on the path to water circularity requires a blend of technology, expertise, and a flexible, patient approach, one that balances innovation with operational realities.

Compliance or Commitment? The Regulatory Push

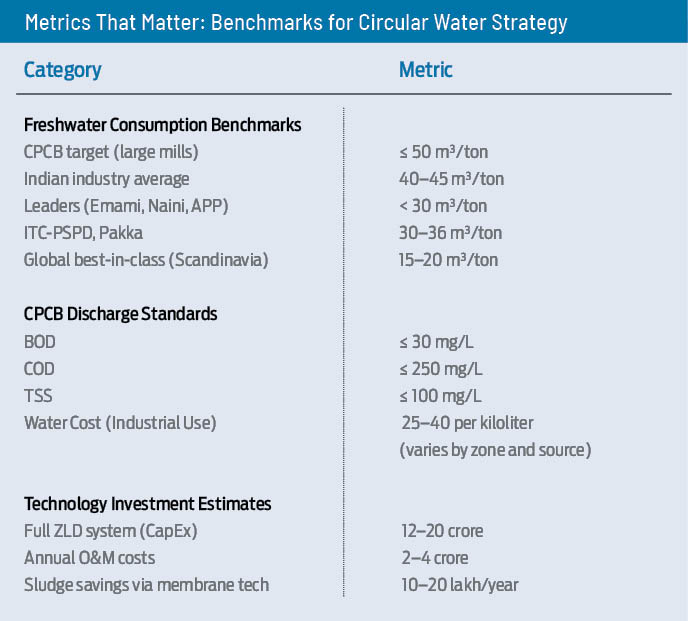

The role of regulation in pushing water circularity cannot be overstated. India’s Central Pollution Control Board (CPCB), along with several state pollution control boards, has established stringent guidelines on freshwater intake and wastewater discharge, especially in industrially sensitive zones.

For many mills, these mandates have triggered ZLD adoption or extensive process retrofitting. Naini Papers reports that state withdrawal limits and pollution control directives were critical catalysts in driving them toward membrane-based ZLD. “Stringent discharge norms drive the industry to invest in advanced treatment technologies and set goals for reducing pollutants,” notes Pawan Aggarwal.

Some mills have not only adhered to CPCB norms but also created rainwater recharge wells and implemented treated water reuse for plantation and irrigation, voluntarily going beyond compliance. “We have constructed 20 recharge wells with gravel filtration systems, for the replenishment of groundwater. These wells have a total recharge capacity of around 26,03,874m³ per year, which is 77% of our total water drawn,” reports Ashish Gupta of Emami

Interestingly, some companies suggest that internal commitments are outpacing external pressures. Disclosure frameworks like BRSR and ESG are motivating deeper change than static pollution norms. ITC-PSPD reinforces this outlook: “The prevailing local and national regulations provide a strong basis and baseline for all the water management initiatives.”

“The regulatory requirements and ESG commitments have accelerated our efforts. Compliance with CPCB/SPCB norms and increased customer requirement of sustainability reporting have further given us a push,” says Gupta.

In India, regulation is often the catalyst. In Europe, policy clarity encourages long-term planning. Xylem offers a global comparison. “The main challenge lies in regulation. For many companies, regulatory pressure is the key trigger for action. Circularity is often only pursued when it becomes a requirement of environmental permits,” says Alexis Metais, when asked about the challenges faced by his clients in India.

Policy Landscape & Gaps: The Missing Middle

India’s industrial water governance, led by the Central Pollution Control Board (CPCB) and enforced by state boards, has brought visible improvements in water compliance. Stricter limits on effluent discharge and freshwater abstraction, particularly in industrial clusters, have nudged many paper mills toward water reuse. But the system still suffers from a critical design flaw: It is engineered to penalize laggards, not reward leaders.

By contrast, the European Union’s BAT-BREF framework offers a more mature model. It aligns environmental benchmarks with tax incentives, regulatory consistency, and technical pathways for innovation adoption. In Europe, policy clarity encourages long-term planning. Here, unpredictable benchmarks and shifting targets cause many mills to adopt a wait-and-watch approach.

As Alexis Metais of Xylem notes: “It’s often difficult to determine where authorities intend to set the bar, which leads many stakeholders to adopt a wait-and-watch approach.”

If Europe seems too far removed or abstract to take cure from, we can always look towards our domestic parallels, like India’s Perform, Achieve & Trade (PAT) scheme in the power sector, or Renewable Energy Certificates (RECs) in energy efficiency markets. These models also offer reward-based policy architecture India can emulate for water circularity.

India’s approach remains overly reliant on concentration-based norms (mg/L) for pollutants like BOD, COD, and TSS. This penalizes mills that operate with lower water volumes or high reuse percentages, as their treated effluents can have higher concentrations even when absolute loads are low.

At the same time, companies like Emami and Seshasayee Paper report that internal ESG frameworks and investor expectations, rather than regulation, are now driving deeper investments in circularity. Similarly, technology suppliers like Krofta and Paques point to missed opportunities:

“Environmental regulations are surely a part in influencing demand, but at the same time, the quest, for compliance has to come from top level management, without which the implementation of water circularity will not happen,” says Raghvendra Khaitan, Krofta Engineering.

“Statutory norms are made in general for all the mills irrespective of their efforts towards water conservation, investments made to promote a circular system, etc.,” feels Shashi Verma of Pakka.

Mills investing in advanced systems (such as digital twins, AI-led reuse tracking, or energy-generating anaerobic systems) currently receive no fast-track approvals, environmental cess rebates, or ESG scoring advantages. This leaves circularity as a financial burden rather than a competitive edge.

As Pawan Aggarwal of Naini Papers aptly puts it: “The industry is making extra efforts… which should be rewarded for benchmarking the water reusage, rather than decreasing the same at every NOC renewal.”

The solution lies in bridging the policy middle ground, i.e. introducing sector-specific water reuse credits. aligning BRSR/ESG reporting with regulatory recognition, offering financial instruments and audit incentives for verified circular performance, and standardize reuse policies across states to remove inter-regional inequities.Until this shift from punitive to promotive regulation occurs, India’s most progressive water innovators will continue to operate without policy support, undermining the very momentum needed for national-scale water circularity.

Collaboration is Circular: Co-Creating Sustainable Solutions

Water circularity thrives when mills and technology providers co-develop solutions suited to local realities. Gone are the days of vendor-client transactions. Today, partnership models involving shared design, piloting, data-sharing, and ongoing optimization are proving far more effective.

“At one large OCC-based mill, we co-developed a DAF+ICX+aerobic polishing+water reuse system that met both production expansion needs and zero liquid discharge compliance,” recounts Paques India. These solutions balance long-term reuse with operating cost rationalization.

Krofta Engineering stresses deep audits as the starting point. They never go with a catalogue. “Solutions can only be achieved by doing plant audits. We study their existing systems and share some suggestions and improvements at their end, which gives them confidence in our ability to understand their requirements and give a tailor-made solution. It isn’t one-fit-for-all,” explains Raghvendra Khaitan.

Chemical supplier Axchem, too, integrates application engineering with product delivery. Their Visakhapatnam facility is backed by site-specific chemistry and real-time feedback systems. “We follow a comprehensive approach of not only providing the right chemistry, but also lending the professional engineering to apply it, including equipment, technical support and analysis capabilities,” says Rajesh Chhabra.

Haber’s engagement model revolves around digitization. “With advanced Al-driven tools like eLIXA®, we provide real-time monitoring and actionable insights, enabling plants to achieve measurable improvements in implementation vis-à-vis planned through audits,» notes Ram Santhanam.

Circularity 2.0 and the Next Wave

What does the next phase of water circularity look like? Experts agree that a combination of decentralization, digitalization, and smart chemistry will define the future. The goal is no longer just compliance or even full ZLD, but intelligent ZLD, where reuse and recovery respond to live demand and quality metrics.

“The next decade is going to be a historic transformation in automation and decision-making. We at Pakka are open and curious to rewrite the next generation of automation in an industrial setup,” says Shashi Verma of Pakka.

Raghvendra Khaitan of Krofta predicts decentralized water treatment becoming the norm. Each section of a plant will have its own loop. No one-size-fits-all anymore. AI will manage flows better than any manual SOP. Looking ahead, he predicts that “AI/IoT will surely play a major role in the coming years. This will help mills and even suppliers to get better offerings.”

Paques points to compact systems and energy-positive reuse. “Advanced anaerobic technologies like low-footprint ICX/IC reactors and biogas upgrading systems will further enhance energy recovery and water reuse,” says Mani Elanchezhiyan.

Xylem sees ozone-based platforms gaining traction as biological resistance rises. “…there is growing demand for ozone and UV technologies in process and cooling water applications,” says Alexis Metais.

Water circularity in the pulp and paper industry is no longer a fringe experiment; it’s a central pillar of sustainable manufacturing. The transition is uneven, and the path remains challenging. But the momentum is unmistakable.

Circular Water Economics: Making the Case for ROI

Beyond sustainability and compliance, circular water systems are beginning to make strong financial sense for paper mills. The investment in reuse and recovery technologies, once viewed purely as environmental or regulatory obligations, is now revealing tangible returns across operational, energy, and resource dimensions.

One of the most compelling examples comes from Paques India’s client, Sainsons Paper, where purified biogas recovered from anaerobic reactors is sold to a nearby HPCL station. This has not only eliminated fossil fuel reliance in the boilers but also created a new revenue stream for Sainsons.

At full scale, such systems can generate upwards of ₹20–25 lakh annually in savings and earnings. “Reduced sludge generation in anaerobic systems has also helped lower disposal costs,” explains Mani Elanchezhiyan.

Water treatment systems, especially those integrating anaerobic and aerobic modules, help reduce energy consumption and chemical usage. In anaerobic digestion, for instance, biogas generation substitutes for coal or diesel used in steam generation—driving down both carbon footprint and operational cost.

Then there’s sludge. With innovations like Krofta’s dewatering and alternate-use systems, mills now spend significantly less on sludge disposal, an often-overlooked operational expense. “Their (clients’) sludge disposal cost has also reduced after installing our dewatering systems, especially after implementing alternate use of sludge,” says Raghvendra Khaitan.

On the resource side, the economics of freshwater replacement are increasingly compelling. In regions where industrial water tariffs range from ₹25 to over ₹40 per kiloliter, the cost of sourcing and treating water can significantly burden operational budgets. Mills that successfully reuse even 30–40% of their process water report noticeable cost reductions, particularly in areas with limited freshwater availability or higher tariffs.

While specific savings vary by location and process, sustainability leaders like Shashi Verma of Pakka note that backwater recovery and ETP-treated reuse collectively result in “substantial annual savings in both water procurement and treatment costs,” a figure that can run into tens of lakhs for medium-to-large mills.

These numbers grow significantly when aggregated over 5–10 years. As capital costs for membrane, automation, and digital systems decline, the payback period for large-scale circular infrastructure is compressing from 5–7 years to as little as 2–3 years for integrated solutions. When circularity is tied to operational stability, energy reduction, and brand ESG scoring, its ROI becomes multifaceted.

This shift from cost-center to value-creation is perhaps the most important signal that water circularity in the Indian pulp and paper industry has arrived as a business imperative—not just an ecological ideal.