An Overview

Reforms undertaken in the early 1990s made India one of the world’s fastest growing economies. The boom of the IT industry and improved agricultural production created an atmosphere of optimism, which led to the coining of phrases, such as Incredible India, India Shining, and India 2020 around the end of the millennium. The Indian growth story has been one of high gross domestic product (GDP) growth which is primarily driven by the growth in services sector. In the recent years the focus of the government has shifted from promoting Incredible India to building Inclusive India. Inclusive growth needs to be achieved in order to reduce poverty and other social and economic disparities, and also to sustain economic growth. These include enhancing the capacity for growth, generation of employment, development of infrastructure, improved access to quality education, better healthcare, rural transformation, and sustained agricultural growth. Inclusiveness can be realized by high growth rates only when the sources of growth are expanding and thereby including an increasing share of the population in the growth process. With the world’s second largest population and widespread urban and rural poverty, India faces certain challenges and opportunities of bridging the growing gap between haves and the have-nots. It is imperative to focus on inclusive growth factors which are interrelated. India has been responsible for almost 10% of world economic growth in recent years.

Indian Growth Factor

The analysts have projected that the India’s real GDP is expected to register an average growth of around 9.2% during FY11-FY20. This growth will be backed by robust private consumption demand, increase in India’s exports, growth in domestic investments and government’s thrust on infrastructure development. Moreover, rising income levels and increase in the age of middle class working population are expected to result in higher demand from consumer side. Economic growth during the current decade will bring with it challenges in terms of meeting rising needs in ways that are cost-efficient, sustainable and environmentally compatible. Pressures on natural resources will exacerbate during the current decade. Increased demand and environmental concerns will make innovation imperative. The solution will need to lie in technology that meets rising demand that are cost-efficient, sustainable and environmentally compatible and reduces reliance on natural resources.

India will emerge as one of the youngest nations by 2020 and this changing demographic condition could pose some challenges as well, while providing great opportunities. It is passing through a phase of unprecedented demographic changes, where in proportion of working age population (15-59 years) is likely to rise from around 58% in 2001 to over 64% by 2021. The average Indian will be only 29 years old in 2020 as compared to the figures for China and the US that are 37 years, while it is 45 years for West Europe and 48 for Japan. In absolute numbers, there will be around 63.5 million new entrants to the working age group between 2011 and 2016. Further, the bulk of this increase is likely to take place in the relatively younger age group of 20-35 years.

The Paper Connect

The Indian paper industry estimated to be between Rs. 30,000 to Rs. 35,000 crore accounts for over 2.5% of the world’s paper and paperboard production even though the country accounts for nearly 17% of the global population. The industry currently upholds over 700 paper mills wherein less than 50 mills have capacity of 50,000 tons per annum or above and fragmented to a large extent. India is rated as one of the fastest growing paper market on the back of a comparatively healthy GDP growth. As per projections, the paper and paperboards industry is expected to cross 20 million tons by 2020 and 40 million tons by 2030 with an annual growth rate of 7-8 per cent. While few industry insiders feels that the 20 million mark will be touched before 2020. This opens up need for huge capacity build up to meet the emerging demand. The growth of paper industry and its quest to attain global standards in terms of scale, quality and competitiveness has been constrained by shortage of raw material and its prohibitive cost and availability of energy at globally competitive prices. In the last 5 years industry has invested around Rs.10000 – 12000 crore for increasing the productivity through the adoption of more efficient and cleaner technologies and has to continue to do so to attain the objective of being sustainable. The jump from being the 15th largest consumer of paper to 11th shows the industry potential. The government policy towards forests protection has made the paper mills to take responsible actions and industry has done a lot on this track by adopting the social farm forestry and other scientific techniques. But that didn’t proved enough for the security of the raw material for future so some mills have forced to go off shore to secure their requirement for the raw material in future. For instance BILT has acquired Sabah Forest Industries in Malaysia likewise JK Paper has gone to Myanmar. The mid and small size units which contribute the substantial share in paper production will suffer in future from high production costs, uneconomic operation, low quality and challenge in meeting government regulations. In order to survive they have to upgrade their technology and operations or else close down or consolidate.

What’s for the Paper Industry?

The paper industry has an important role to play in the Indian economy. The paper consumption in India currently is 12 kg per capita making it a highly potential market. The potential for per capita consumption increase will stand parallel to the economic growth. In order to serve this upcoming demand Indian paper industry needs to simultaneously upgrade its capacity and technology. At the same time the entry of the foreign player like International Paper acquiring APPM will be a strong reason to upgrade in the every aspect of the paper making till its distribution. The investment has to make its way for mill modernization, productivity improvements and building of new capacities to improve the competitiveness. The appetite of the Indian market is increasing day by day which needs to be addressed and that can only be addressed by continuous investment in production capacities. The paper converting sectors i.e. printing, packaging & publishing too gives positive signs of light at the tunnel’s end.

Printing & Publishing Sector

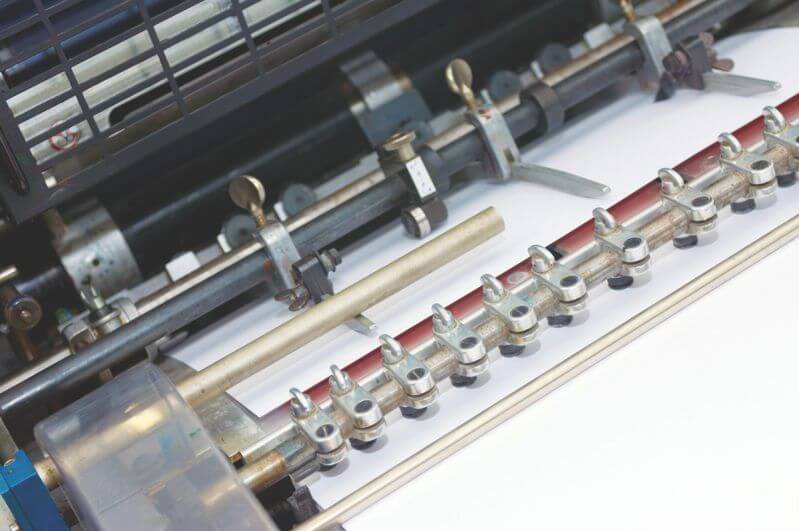

Over the years, the printing industry has grown in all parts of the globe making giant strides in recent times in improving its machinery in terms of the scope, technology and speed. The industry is growing systematically and regularly, scattered to all over the country majority of which are very small in operations. Today Indian publishing is one of the greatest in the world and the country is counted among the top seven publishing nations. Increasing number of printers are now adopting newer and modern technologies adapting to the changing trend of new style of working. It ensures that consumer get the optimum quality products at bare minimum price. Going forward the booming Indian economy will be backed by literate population on the rise, increasing consumerism, entry of global brands in the country and opening of the sector to foreign investors would drive the growth in print requirement.

Some of the statistics that emerged were that the size of the Indian publishing and printing industry is estimated to be of USD 1.9 billion (about Rs. 9,500 crore) and USD 25 billion (about Rs. 1,25,000 crore),respectively. According to a recent survey by US-based consultancy firm Pira International, the size of Indian book printing is about Rs. 7,000 crore. This is predicted to reach Rs. 10,000 crore by 2016. Furthermore, India is also fast becoming a hub for the outsourcing of publishing and printing services. Currently, India has a share of 60 per cent of global publishing outsourcing. This robust growth in printing and publishing sector leaves a great opportunity for the Indian paper industry to grow at a pace which should be more than the GDP. Besides this the paper industry has also to match the needs of printing industry especially in terms of world class quality at competitive price and availability.

Packaging Sector

The Indian packaging industry is estimated to be worth Rs. 63,000 crore growing at 11% annually and is expected to cross a turnover of Rs. 95,000 crore by the year 2015. Demand for packaging is driven by high growth in volume sales of the majority of consumer goods categories. Growth in organized and modern retailing channels such as supermarkets and hypermarkets is the main driver of this shift towards packaged goods. As these modern retail outlets are better equipped to showcase packaged products compared to India’s traditional retail outlets, the role of packaging in influencing purchasing decisions in-store is greatly increasing and this has made packaging an even more important marketing tool than ever before. The usage of packaged goods products are trickling down from India’s large cities to rural masses. The rise in competition among consumer goods manufacturers and the increasing focus on providing end consumers with the most convenient closures were among the key drivers for this growth. The recent development of gutkha packaging has created the outburst for the paper manufacture to develop the value added products for various special applications. People are becoming more health conscious; there is a growing trend towards well-packed, branded products, rather than the loose and unpackaged formats. Today, even a common man is conscious about the food he consumes in day-to-day life. This is the reason why FMCG companies put a lot of emphasis on the packaging – not just to ensure longer shelf life for their products but also as a marketing strategy. India’s retail market is expected to grow at 7% over the next 10 years, reaching a size of USD 850 billion by 2020. Traditional retail is expected to grow at 5 per cent and reach a size of USD 650 billion, while organized retail is expected to grow at 25 per cent and reach a size of USD 200 billion by 2020.

Newspaper Sector

In 2011, India led the world in terms of newspaper circulation with nearly 330 million newspapers circulated daily says Wikipedia. Both number and circulation of registered newspapers have gone up. The 55th annual report of Registrar of Newspapers for India (RNI) for 2010-11 titled “Press in India” says the percentage of growth of registered publications increased by 6.25% over the previous year (2009-2010). In the year 2010-2011, a total of 4853 new newspapers registered. The annual report has highlighted key trends for the Indian press for the year 2010- 11. The analysis provides a broad overview about the general trend of the Indian press based on the number and claimed circulation of newspapers.

• The total number of registered newspapers stood at 82,237.

• 4853 New newspapers were registered during 2010- 11.

• The percentage of growth for registered publications over the previous year was 6.25%.

• RNI approved 13,229 titles for the year 2010 ending March 31st 2011.

• The largest number of newspapers and periodicals registered in any Indian language was in Hindi with a figure of 32,793. English had the second largest number of newspapers and periodicals which was 11,478.

• The total circulation of newspapers stood at 32,92,04,841 as against 30,88,16,563 copies in 2009-10.