Paper Mart presents a feature article on the packaging sector by initiating a dialogue with the key paper mills, the corrugators, and the brand owners/institutional buyers of packaging in India. This feature presents a rundown and some key insights on the packaging sector- views with regard to the future of the packaging sector and how big a role will be played by the innovations in the sustainable material solutions, the demand drivers of the market, and the efforts made by the companies in view of the development of innovative packaging solutions.

Paper Mart presents a feature article on the packaging sector by initiating a dialogue with the key paper mills, the corrugators, and the brand owners/institutional buyers of packaging in India. This feature presents a rundown and some key insights on the packaging sector- views with regard to the future of the packaging sector and how big a role will be played by the innovations in the sustainable material solutions, the demand drivers of the market, and the efforts made by the companies in view of the development of innovative packaging solutions.

The market is moving more and more toward sustainable solutions and the overall demand for paper-based packaging is projected to increase in the coming years. Since the incorporation of sustainability opens up doors for different packaging possibilities, there have been many breakthroughs in paper-based packaging solutions in recent times. Moreover, the massive surge in e-commerce in recent times has laid the groundwork for further growth in the packaging sector.

According to a report by IBEF, the packaging sector is categorized into two major segments -rigid and flexible packaging, with rigid packaging accounting for 64% market share. Also, in terms of packaging materials, 55% of the sector is dominated by plastics, followed by paper & cardboard (20%) and glass (10%).

Rise of e-commerce

With technology becoming a ubiquitous part of our cultural fabric, the power of the internet has paved a way for the evolution and growth of e-commerce. Rising internet proliferation and further access to technology coupled with increasing smartphones use have laid the groundwork for consumers to shift to online shopping methods such as mobile commerce and social commerce on social media platforms such as WhatsApp, Instagram, and Facebook. Thus, the advent of the ever-evolving and dynamic e-commerce sector is creating a surge in demand for innovative packaging solutions that will cater to the evolving customer perceptions.

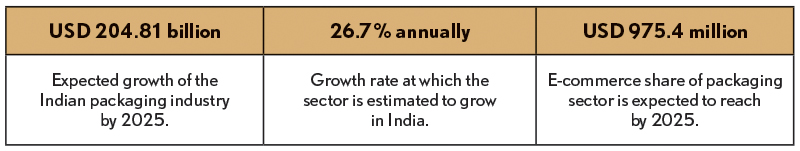

According to a market research report by IBEF, titled ‘Indian Packaging Industry Riding on the E-Commerce Wave’, the Indian packaging industry is expected to reach USD 204.81 billion by 2025 from USD 50.5 billion in 2019 at 26.7% annually. The e-commerce segment of the packaging market was estimated at USD 451.4 million in 2019 and is forecast to reach USD 975.4 million by 2025 at 13.8% annually.

With the rise of e-commerce, it is no longer necessary for consumers to visit brick-and-mortar stores when what they’re looking for can be delivered right to their doors. This market change has been a boon for the packaging sector. Now, the important aspect is – developing right-sized packaging to reduce waste and increase efficiency, having the product’s box to be as primary and assessing whether secondary packaging is still needed as the growth of e-tailers is reshaping the entire e-commerce system.

With the surge in e-commerce, the Indian packaging industry is witnessing sharp growth and is one of the strongest growing segments. According to the Indian Institute of Packaging (IIP), the packaging consumption in India has increased by 200% in the past decade, from 4.3 kgs per person per annum (pppa) to 8.6 kgs pppa.

Sustainability as the key driver for growth

All thanks to a growing demand for more eco-friendly packaging from informed consumers and activists, the manufacturers and retailers are on the verge of a packaging renaissance in which new recyclable and compostable containers will begin to permeate the market. There has been an upsurge in awareness amongst consumers concerning eco-friendliness and sustainability, and without a doubt, they will prefer brands that advocate environmentally-friendly products and sustainability.

To achieve eco-friendly packaging, manufacturers must look beyond recycling, and instead research and implement innovative and creative methods that can make a difference in the long run. This can be accomplished by adopting the practices of a circular economy and integrating processes that address waste prevention. Packaging that is minimal in size, reusable, devoid of plastic and developed with responsibly sourced materials will drastically lower the carbon footprint and prevent spoilage.

Growth in retail brings multitude of opportunities

In the present retail landscape, outlets such as — supermarkets, convenience stores, supercenters, etc. are increasing at a rapid pace, opening the door for a sea of opportunities for newer innovations in the packaging industry.

As per a report presented by Retailers Association of India (RAI) and Boston Consulting Group (BCG) titled ‘Retail 4.0: Winning the 20s’, the Indian retail market is likely to hit USD 1.1-1.3 trillion mark from USD 0.7 trillion in 2019 – a 9-11% CAGR growth – driven by multiple structural, socio-demographic and economic drivers fueling consumption. The ongoing and projected growth of Indian retail sector further portends well for the packaging sector with more growth of the retail-ready packaging.

The big shift: India as a top consideration

China has been regarded as “the world’s factory” and being the global manufacturing hub, the country was one of the world’s largest packaging markets too, with fast-growing rates in segments such as paper packaging, flexible packaging, and rigid plastics packaging.

Although, in the pre-COVID times, the country was the leader in the sector it was the largest consumer, manufacturer and exporter of packaged materials and goods. However, the pandemic-led lockdown and the prevailing anti-China sentiments have led to countries and companies to look for alternatives, in order to eliminate their supply chain disruptions, which further directs to the projection that India’s growing packaging industry may benefit in the near future.

Packaging for building brand identity

With rising trade, the phrase “let the buyer beware” became popular since inferior and impure quality products were disguised and sold to uninformed customers by counterfeits. Consequently, the manufacturers turned to use packaging in innovative ways to establish their brand identity.

In what ways does packaging affect our perceptions and the shopping choices we make? Package colors, materials, and other design elements are very deliberate and shape our outlook for a product. Much like advertising, packaging appeals to our emotions and directs our attention to specific product features.

A study conducted by the Paper and Packaging Board and IPSOS shows that 7 in 10 (72%) of consumers agree that packaging design can influence their purchasing decisions. In the same study, it is stated that 71% of consumers said they were more likely to buy brands that package their products in paper or cardboard, than in other materials.

Shift in demand during pandemic

Amid the pandemic, the demand for packaging for groceries, healthcare products and e-commerce transportation has increased exponentially; but, at the same time, the demand for industrial, luxury and sections of B2B-transport packaging has declined.

It is noteworthy that the demand for all types of healthcare packaging and related substrates, including flexible blister foils, pumps, closures and rigid plastics, has soared. That is, the pharmaceutical packaging has become an important component of drug delivery in India. Similarly, the demand has also spiraled for packaging used in dietary supplements such as vitamins and essential supplies needed by consumers in a pandemic situation.

Outlook of the corrugating and packaging companies

The future trends and key demand drivers of the paper-based packaging sector are contingent on consistent evolution and efforts in R&D by the packaging and paper making companies which further raises a new set of indispensable parameters to accelerate value creation. With respect to the trend observed in the paper-based packaging segment, the light weighing packaging is slated to grow in the coming times, and for that, the mills need to produce low GSM and high SCT fluting paper. Another key concern associated with the quality of the paper is the issue of ‘bad odour’ and about improving the surface of the paper to enhance the overall printability of the paper.

In addition, it seems that a close collaboration between the corrugators and the paper mills will help in reaching a better understanding of the requirements of each other. Besides, one more matter of concern for the corrugating companies is around the erratic change or increase in the prices of the paper and they contend that the paper mills should hold the price for each quarter.

It is quite evident that if the quality of the paper is not satisfactory, the converting and corrugation production lines won’t be able to run efficiently. Also, the advantages offered by using modern technology – such as speed, quality control features, automatic delivery features cannot be realized if the machines have to run at slow speed or have to be halted.

Paper mills gearing up for the surging demand

Paper and paperboard have witnessed somewhat of an upsurge and they stand to gain further growth momentum in the coming times as it is the only renewable packaging material and moreover, it has an established collection and recycling system.

The present pace of technological development and revolution is projecting profound changes and in response, the paper mills are working to find innovative ways to not only reduce costs, but to increase productivity and develop new value-added products, particularly in specialty products and packaging papers. Growth opportunities are being created as eco-conscious consumers are demanding sustainable alternatives to plastics. The papermaking companies should adopt the cutting-edge technology to leverage the packaging design capabilities and to find new end uses for paper-based packaging materials. Also, there is a great scope in increasing the share of usage of paper as secondary packaging.

Overall, it may be said that the paper mills are investing and would be required to invest more in the capacity building and technological upgradation of the facilities to address the various challenges being faced by the corrugators and packaging companies.

Keeping in view the dynamism and promising growth potential of the paper-based packaging segment, Paper Mart has initiated a feature report on the packaging sector by interacting with the key paper mills, the corrugators, and the brand owners/buyers of packaging in India, on – the key emerging trends in the paper-packaging market, the challenges with regard to quality of paper, and the ambitions and strategies with regard to incorporating more sustainable packaging solutions.