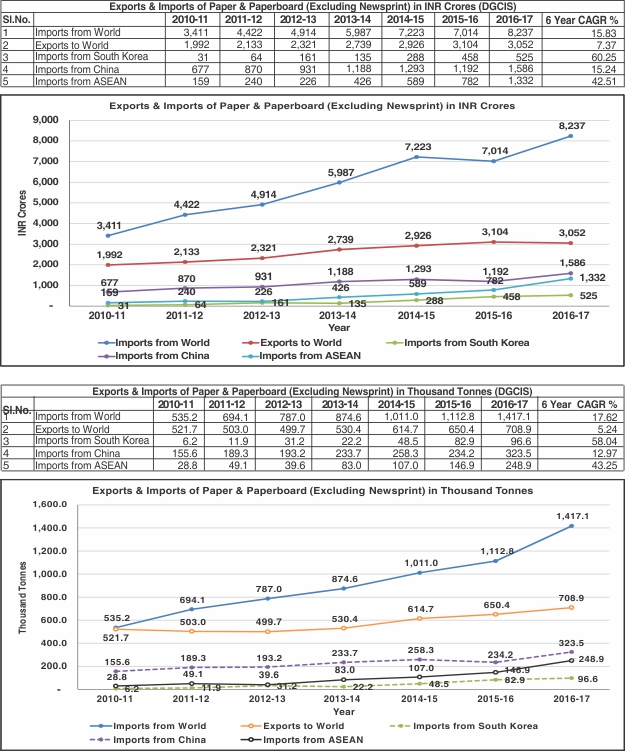

In the last six years, imports have risen at a CAGR of 15.8 percent in value terms and 17.6 percent in volume terms, which is a serious concern for paper makers.

Imports of paper and paperboard, excluding newsprint, into India have been steadily increasing. In the last six years, imports have risen at a CAGR of 15.8 percent in value terms (from INR 3,411 crores in 2010-11 to INR 8,237 crores in 2016-17), and 17.6 percent in volume terms (from 0.54 million tonnes in 2010-11 to 1.42 million tonnes in 2016-17). Imports are growing at a very high rate as compared to the increase in domestic production rate.

Imports of paper and paperboard, excluding newsprint, into India have been steadily increasing. In the last six years, imports have risen at a CAGR of 15.8 percent in value terms (from INR 3,411 crores in 2010-11 to INR 8,237 crores in 2016-17), and 17.6 percent in volume terms (from 0.54 million tonnes in 2010-11 to 1.42 million tonnes in 2016-17). Imports are growing at a very high rate as compared to the increase in domestic production rate.

India is a wood fibre deficient country. Inadequate raw material availability domestically is a major constraint for the Paper Industry. Mill delivered cost of domestic wood in India is higher by almost USD 30-40 per tonne as compared to other Asian countries. Due to this single factor, cost of paper production in India is higher by USD 100 per MT.

Even as the industry is grappling with the issue of producing paper and paperboard at competitive costs, the problem has been exacerbated by the Government’s policy of extending preferential tariff treatment to import of paper and paperboard under the different free trade agreements (FTAs) and other bilateral and multilateral trade agreements and pacts.

Thus, while domestic industry is operating under extremely challenging conditions, substantial quantities of paper and paperboard is imported in to the country at significantly lower costs under the aegis of the FTAs.

Under the India-ASEAN FTA, import duties on almost all tariff lines under paper and paperboard have been progressively reduced, and from a base MFN rate of 10 percent, the basic customs duty came down to 0% with effect from 01.01.2014. Under the India-Korea CEPA, the basic customs duty has been progressively reduced and will be 0 percent with effect from 01.01.2018.

Imports of paper and paperboard, excluding newsprint, into India from ASEAN in the last six years have grown at a CAGR of 42.5 percent in value terms and 43.3 percent in volume terms. Imports from South Korea have grown at a CAGR of 60.3 percent in value terms and 58.0 percent in volume terms.

The conventional markets for China and Indonesia have been the USA and EU. In both these markets, anti-dumping / anti-subsidy tariffs have been imposed on import of paper / paperboard to protect their domestic industries. Further, the economic slowdown in developed economies and export dependent economies like ASEAN countries has led to significant excess capacity of paper and paperboard in these countries. Taking advantage of the low import duty rates in India, these countries find India as an attractive outlet for diverting their excess inventory. Increased import of paper and paperboard is severely impacting the economic viability of many paper mills in India apart from revenue loss to the Government.

(Source: IPMA).