Acquisition of overseas plantations, setting a pulp mill outside, continued experiments in agro-social-farm forestry, and even selling imported coated paper under its brand, among other things, are on the itinerary of JK’s journey ahead, feels Mr. V. Kumaraswamy.

Hinting towards a xeroxed news article with a curious smile, he says, “It’s seldom that Mr. Swaminathan Aiyer takes on individual companies in his columns; he has done so this time and done so nicely in illustrating how JK has been instrumental in engineering a social and economic revolution in Dedipada Taluka of Gujarat through social farm forestry accruing in a huge income for 2,500 households there.” There is sense of relief in his voice saying this. He has been an enthusiastic votary of ‘training the idle hands’ so that they contribute to the national kitty of goods and services apart from generating the income for self.

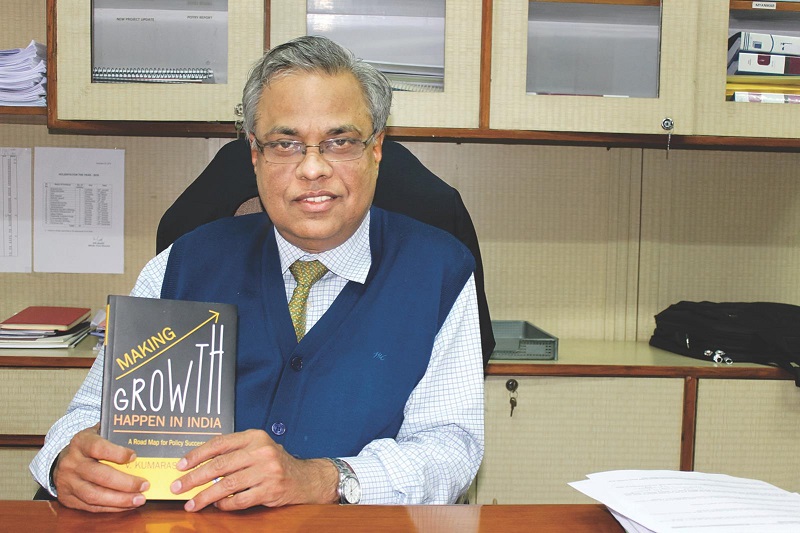

Paper Mart recently had a long conversation, which turned out to be even longer review of the Indian paper industry, with Mr. V. Kumaraswamy, CFO & Head-Strategy, JK Paper Ltd. An IIM-Ahemdabad alumnus, he is statistically assured, keenly engrossed in the surrounding business and economic environment. His latest authored book ‘Making Growth Happen in India’ is ‘refreshing non-economist’s perspective’ and his travelogue is dotted with rich, vivid, and vibrant memoirs he obtains during many expeditions and business related reconnaissance in far foreign soils. The interaction, which started on a simple note, turned out to be a kind of tinder box of issues and subjects normally left out in interviews otherwise.

Starting with how he proposes to circumvent the raw material challenge, he touched upon many issues such as relative stability of paper industry in contrast with other sectors such as FMCG or pharma (discouraging equity investors who are predisposed to like volatile sectors); the small size of the paper industry, not viable for bigger international players; and ingenious ways to improve social farm forestry and community development. He talked at length at how a mammoth chunk of forest land is lying unused which otherwise could be used to revolutionize the lives of many besides solving the raw material crunch irrevocably. “I think the industry has to shed some of its closed-mindedness when it comes to commercial aspects of doing business,” he states matter-of-factly on industry’s insular attitude towards adopting best international business and technological practices.

His business acumen and economic astuteness is borne by when he says, “Every 2 acre of land can take care of one family at lower level.” And, he sounds accurately well-calculated and ardently community oriented stating “If only you allocate 2 million hectares, it can support primary employment of 2 million people. It can be good income generator and can deliver growth where it matters – to poor people, to tribal people and to the people residing in rural hinterland.”

In the process of writing this interview, every effort has been made not to leave any matters, and inquiries about other stuff discussed. Here is almost a verbatim transcription:

Paper Mart: At JK Paper, as CFO or otherwise, you seem to have a wide-ranging responsibility portfolio in finance, accounting, IT initiatives, overseas and domestic M&A, JVs, etc. Please inform us about something significant which you are doing now and which we are not aware of.

V. Kumaraswamy: I would like to talk about my other role which is looking for and securing some credible raw material source or fiber supplies in long term. We are examining primarily Vietnam and Myanmar. Other locations such as South Africa, Mozambique, and Swaziland have also been explored for locating some viable raw material source. Besides, we earlier had also examined certain possibilities in Gabon and Sierra Leone. All these efforts are still on and a continuous process. These fact finding missions also have us realize that why only buy the sources of logs and chips, why not convert it in pulp and transmit it to India.

We realized that Indian market is the fastest growing in terms of consumption; and if we go by the words of international consultants, India will stay way ahead of China, way ahead of the global growth rate till 2025. So, as a marketer, this is the best place to be in. Though, as of now, the size of the market is very small, it’s growing. And, we would be like to be there because of our well-entrenched market position, fairly good distribution network, and brand presence. So the idea is to work backward where we have to manufacture the paper; and also work towards how to source the ready paper from overseas market. Hence, manufacturing pulp outside and transporting it to India happens to be the cheapest source of fiber supply – we will take that route.

Moreover, we are also now trying to expand the presence through outsourced paper from outside, from China, Indonesia, Korea, etc. Why not get some paper if FTA does offer some opportunities for sourcing cheap paper from outside! We are examining that aspect.

PM: Ensuring sustainable raw material supply has consistently been burning issue for the industry. As you have said that you are kind of undergoing a continuous reconnaissance of foreign soils to ascertain unbroken fiber supplies from outside, may be producing the pulp there also. What else are you doing in this direction?

VK: See, we have two existing plants and we have to make sure that these are viable and sustainable with unhindered supply of fiber. We are working in various directions for continuous and assured fiber supply, one being the successive reduction of maturation period of trees in years to come. If maturation time, instead of 5 years, is made to come down to 3 years, the farmers would get the same return and our chance of matching comparable yields from other crops like rice, wheat, sugarcane, etc. would become much easier. So long as we offer farmers a price on per acre per annum basis, which is better than other crops, they will probably stay with the yield. And, hopefully, we would get better supply at better prices.

Moreover, the distance of procurement will also crash – what was 400-500 km radius can become to 300 km. This would bring down the freight cost as well. And, if everything is in vicinity, we can offer farmers better quality clones and seedlings with regular visual inspection of plantations giving better yields. Our distance, of late, has crashed drastically in the last two years. Earlier the average distance in Orissa used to be 600-700 km which has come down to 380 km. We used to have woods for Surat (Songadh) plant from as far as Andhra and Karnataka; now we don’t go beyond 150 km to procure all the wood.

PM: Would you explain how all this happened, I mean this crashing down of procurement distance and better acquisition of fiber resources?

VK: Extension activities, which we may not have focused that much previously. Now, we have specific teams which are periodically going and meeting farmers, convincing them on the economics and dynamics of such plantations. They are entrusted with giving continuous inputs to farmers about what to do and what not, fertilizing time, and how to take care of plantations.

Also, the economics of demonstration has persuaded farmers to see the long term advantages and take up cultivation of trees. For instance, after such demonstration, farmers now understand that subabul is one variety which grows faster to give the yield in about 3 years.

That’s domestic. But overseas, we are trying to negotiate with various governments with plans for the development of plantations in coordination with local parties. We are testing various models of development, testing out many species that can grow there, et al.

PM: Tell us more about your international explorations…

VK: We have identified some plantations development opportunities in Myanmar. Vietnam, as you know, is the largest exporter of wood chips anyway and we have entered into an advanced level of negotiations for setting up a pulp mill here. Because, in Vietnam, setting up a plantation would not be necessary as the country is already exporting highest volume of chips, even higher than Australia. Efforts here are in a little more secondary stage. Moreover, we keep getting offers from African countries.

PM: When probing such overseas options such as plantation development or setting up a pulp plant, cost must be a major consideration. Do you think these options will give you noticeable advantages in terms of cost, or would you be just happy to receive unhindered fiber supply without major cost difference?

VK: See, there is a significant difference between the wood cost in these countries and India because of operational inefficiencies. First of all, farm forestry done by a corporate in contiguous land, say 10,000-15,000 acres, has its own advantages; mechanized farms have its own advantages. Whereas farming in 1.5-2 acres has its pitfalls – difficulties in aggregating yields; safety, security and tending of tress not being in our hands, et al. All this does affect the cost.

Just to give a number, in Brazil if it costs USD 70-80, it would cost about USD 130-140 here in India for the same kind of wood. In Brazil, a million tonne pulp mill can be sustained by forests which are just in the vicinity of 70 km radius – you see only trees without habitation in between. Whereas in India, even for 1-2 lakh tonne machine we may have to go to as far as 200-300 km to fetch the wood. That has its own implications on cost.

Exact cost advantage in importing chips or ready pulp would differ from location to location, yet, just to give you a bump-up figure, it would be in the range of 10-15 percent. If you are doing it at USD 500 in India, it could be done at USD 425-450. We know that, in India, raw material prices may be aggressive because of various constraints, but the countries we are talking about are mature markets for wood – the prices therefore may not fluctuate much. We are also aware that the level of stability in their price structure is much better than that in our cost structure.

So, we keep working out these numbers time to time and we do see some significant differentials even after accounting for the freight cost – both in Myanmar and Vietnam. Obviously, Indonesia talks of different scale which we can’t afford as of now, but it’s still possible. And, it may be possible in Africa.

PM: You were saying something about importing paper…

VK: Since 2014, FTAs have liberalized the imports from ASEAN countries and we are also entering into newer bilateral trade agreements with Korea, Japan, and even China – the regional cooperation agreements. These people have good advantage in terms of size, especially Indonesia and China. Size has its own economies of scale; and other locations have some economies of chemicals and pulp. If they are already importing to India, let’s say coated paper where 50 percent of all volumes are imported, why not source the paper from them and sell using our fairly comprehensive network and brand image?

PM: You are talking of taking advantage FTAs where you will find most of your peers disagree as they see FTAs as threat rather than something to take advantage of…

VK: It is a threat in the sense that their infrastructure is way ahead of ours and that has to be granted. Their policy response to issues is very-very fast. Our response, even before you begin sensitizing people in the driver’s seat, is painfully slow. There is no inherent appreciation that businesses need some kind of eco-system to survive and be competitive. In that sense, of course, it’s a threat; and with these people we have to compete in the domestic market. The only thing which we have is the ocean freight cost, which they have to pay extra, and which is not a very big component and is down presently because the trade is down.

Notwithstanding that, we also have one or two advantages. First, the credit practices the overseas players adopt are somewhat different – they want a cash-and-carry kind of a basis and don’t want to incur any credit risk in a third country; they want the money up-front. Whereas the Indian system is slightly different – 30 days credit, 60 days credit, et al. Secondly, if they have to move from port cities to much interior of the country, they are subject to same kind of rickety infrastructure. Here we have an edge; the more interior they have to move, more competitive we become to them. That being said, we also enjoy some kind of premium because of our brand, which overseas players may take a long time to develop.

Moreover, the Indian market even today is nowhere in size which they are looking for. Their scale is such that our demand can be produced by their single large machine in a month’s time. So you can imagine the level of interest.

PM: Coming to the project at Jaykaypur, Odisha, has the project fully stabilized? Have you achieved any major cost efficiencies by now?

VK: The machine, after first teething troubles, is stabilized now – both the pulp mill and paper mill – as these are built on latest technologies. The pulp mill has delivered excellent cost efficiencies. Just to give you an example, we used to consume 240,000-250,000 tonnes of coal. This remaining the same, we are manufacturing 2.5 times 290,000 tonnes of paper – the coal consumption per tonne of paper is sort of halved. Because the paper mill with its recovery boiler system is throwing out surplus energy for use by the paper section. The energy consumption per unit of paper has also noticeably come down as well due to higher rotational speed. Together these have delivered a 7-9 percent of additional margin.

There has also been some savings on manpower and chemicals. We have done a couple of things such as substituting the furnace oil with pet coke (probably we are first or second company in India to do so); this has given us some significant benefits. So, the lime cost previously with coal based carbon monoxide used to be about Rs. 5000-6000 which has come down by 30-40 percent now.

The machine is operating at 95+ percent of capacity, but we do run it upwards of 100 percent capacity utilization on some days. We have been able to squeeze 100+ percent of capacity utilization for pulp, and far more than that for paper. So, now we are finding the balancing act required with small increment here and there so that this can become the norm.

In the copier paper market, we had a market share of 18-19 percent by the time project started in August/September 2013. The machine started showing up good volume only by mid 2014. Between that time (mid 2014) to September 2015, in the period of 15-16 months, our market share went up to 27 percent, a clear increase of 49-50 percent. So during the said period whatever growth had happened in the market place was largely because of us. Just to give you some numbers, our volume went up by nearly 30 percent vis-à-vis 6 percent market growth per annum in that period.

PM: Do you think the cost-efficiency of 7-9 percent is justified for such huge capital investments as in Jaykaypur?

VK: This is a capital investment industry. In first 2-3 years, you have to bear fairly heavy dosage of interest on the capital. But, it pays off. It’s not like a road project that takes 30-40 years to pay off. Though it may take a little longer than the FMCGs, consumer products, or white good, but we must realize that our advertizing cost, etc. are also very less. We don’t require that kind of brand building – so one aspect is compensated by another. We get our pay back in 7-9 years, but that’s all right. Our industry is also not prone to wild changes in customer preferences as may be the case for other industries like textile, FMCG, et al.

PM: Paper being one of the capital intensive industries does not seem to perform well on the financial considerations. What would you say to that? Would you like to tell us some positive side of the paper industry keeping both its financial performance and overall contribution of the industry?

VK: First of all, let me admit that I have experience of working in industries like chemicals, pharmaceuticals, and others. On account of my assorted exposure to various industries, I would say the quality of manpower in this industry, especially on the technical side, is one of the best – all these guys are virtually committed to this industry. Since they are related to paper technology, they kind of stick around – they don’t move from one industry to another as may be the case in other sectors. This definitely is a positive.

I also think that Indian companies are operating on very high efficiency standards, even compared to the global best class companies. Customer orientation is also very high – most of the companies, at least top 10-12, respond quickly to customers’ needs and problems.

Then, EBITDA margins are fairly stable, if you ignore some episodic reductions, as in 2009-11 which all was engineered by the steep increases in minimum support prices (MSP) given to the agricultural crops. So, the paper industry is fairly steady kind of an industry with regards to EBITDA – if you have, let’s say, an EBITDA margin of 20 percent, it may go up or down by 3-5 percent; there won’t be huge upheavals normally. Though in coated paper, we may not be as sure because it’s highly benchmarked to overseas parities where currency might move your prices including the volatility of international prices.

Going further on the positivity path, I would say, by nature, the industry has to go to the farmers and start developing the neighborhood in the process. So, CSR, taking care of the local community and their welfare are in-built in the business model of the paper industry. By nature, we also have to go to the tribal areas, rural areas and that’s where the most of development has to take place; and that’s where we are because of business regions.

PM: But, there may be some handicaps associated with this steady nature of the industry…

VK: Yes, especially when trying to convince the equity lenders. These equity lenders see the fluctuations as main source of making money – you have to have fluctuations for having day traders or long term investors. So, in that sense, it’s not a very volatile or sexy industry. The paper industry is stable and equity investors are much loathe to moving here.

Having said that one must appreciate that, in the Western Europe and Northern Europe, 20 percent of people are employed by the paper and allied industries like plywood, plantations, forestry, paper machinery manufacturing, etc. Obviously, a lot of their pension funds are invested in the pulp and paper related industry. For them, India can be an alternative destination. But right now, the volumes in the market here are relatively small by their standards. They talk of typically a holding of EUR 50-100 million worth of equities in one company and here they have to buy the whole industry for such kind of market capitalization. So they are staying away for a while. However, their market is matured and they are forced to look elsewhere. Probably, they will come to India too in course of time.

PM: We have seen international players like IP, MWV, an others coming to India, but they have somehow failed to create significant values for themselves and the market. Do you know why?

VK: There are two or three issues here worth noticing. One is difficulties in doing business here – not very enchanting business environment. So, India has to offer much better on the ease of doing business, which is hardly the case. We, the Indian companies, have developed the patience because of having been brought up here and know all the possibilities and limitations. So, that has to be corrected.

Secondly, the size has been an issue. Their unit of thought is half a million tonne to one million tonne. Even if they want to shut those machines down there and shift those to here, which still would not qualify for this. The best you can have 1 – 1.5 lakh tonnes of W&P paper at one location which is economical from the view-point of production and cost. However, even their old machines, established 30 years back, are 2-3 lakh tonnes.

Once they do these economics, it does not work out. That’s why they are faltering actually. Their practices, technology, and outlook are tuned to those kinds of levels. There is mismatch between their capabilities and ground realities of market – it’s like a high-end surgeon is tasked to act as general physician, unable to create value.

PM: When would they feel that the Indian market has become operationally viable for them?

VK: The total industry size is about 14 million tonnes today. It has to go to at least 30 million tonnes and the segments within like uncoated paper, which is right now 0.6-0.7 million tonnes, should be about 2 million tonnes at least. Moreover, there should be good concentration within areas like Mumbai-Ahmedabad belt – if it becomes a million tonne consumer population, then they can come and estabilish a 3-4 lakh tonne machine and hope to sell the product there. But, I think we are still a distance away from that.

PM: Your take on low per capita paper consumption in India…

VK: I don’t give much credence to this per capita consumption being low or high because 70 percent of people here don’t account for any market. Literacy level is very low; they are in rural areas having very low mobility across society and income i.e. they are not graduating from being low income to middle income in 5-10 years. So, I don’t give any weightage to that aspect in short term – we have to bear with the prevailing consumption rate and think of ways to improve it in long term.

Regarding various segments, uncoated segment is growing at 5-6 percent because the service sector growth has been good of late and India is slowly emerging as a force to reckon with in the service industry. Apart from this programs like Sarv Siksha Abhiyan and emphasis on literacy are opening up the consumption of paper in areas hitherto untapped.

In coated paper, there is some amount of shift and the segment is growing at 8 percent. Packaging board is growing at 12-15 percent and will continue to do so because packaging practices, which have been primitive till recent, are improving very fast in terms of quality and presentation. Mall culture has fast caught up and super markets are mushrooming in cities. We expect the packaging segment should continue growing like this for next 10-15 years at least.

We are there in all three and for Corrugated Cartons we have a joint venture directly with Oji and Marubeni.

PM: Any plan for expansion in JV with Oji and Marubeni…

VK: May be. At an appropriate time and stage we have to increase it. Because of the bulky nature of corrugated paper/carton, it becomes uncompetitive beyond 150-200 km. Hence, you have to have a plant every 200-300 km – that’s the way it will be.

Having said that the corrugated cartons manufactured by us are way over in terms of quality at par with international standards. It has its own advantages in terms of reusability – the number of times it can be reused and the number of stacks one can put above another. Of course, in a place where Maruti 800 is selling, marketing Volkswagen would take a bit of time. But, we are confident that quality graduation will take place once the economics is demonstrated.

PM: Apart from recommending buying plantations and invest in setting up pulp mill near the source of wood overseas to solve the raw material challenge, where else would you recommend investment?

VK: Right now, our position is very strong in W&P (copier paper) with share of 27-28 percent where market is growing at 5-6 percent. So, once the current capacity is absorbed, or we are near total capacity utilization for the industry as a whole, that would be the time people should be coming up with new capacities. But, it has to be based on sustainable raw material supply base. In coated, as I mentioned, we are trying to get outsourced paper and grow there.

Moreover, our next level of investment focus technically should be targeting packaging board because the produce out of our 90,000 tonnes plant has been absorbed very well and also because packaging is the fastest growing market yielding very good returns.

However, I would circumscribe the aforesaid by one thing – today given the capacity utilization rates and the capacities that have come up like TNPL and Emami, industry may not require additional capacities to come up for at least 5-6 years to disturb the market. Still, individual players should have their own growth strategies to grow despite these constraints. For us at JK, there may not be any Greenfield Project for next 2-3 years.

PM: Your advice to the industry, especially financial heads of the paper industry…

VK: I will talk about the industry first and then will come to finance. The industry is fantastic within the limits of factories – there can be no questions about that. However, I think the industry has to shed some of its closed-mindedness when it comes to commercial aspects of doing business. The world has made many strides and we need to catch up with advances in science, business doing methodology, e-Commerce, implementing systems like ERPs in far better ways, analytics, etc.

We need to do a lot on marketing side also. If you look at the price band of various products between the highest selling product and the lowest selling, there is hardly a difference of 10 percent or so, which only means that everything is a commodity. I don’t think there is anything like that. Even cement bricks are a branded resource. Look at Havell’s switches, or Dominos’s pizza – they have recreated the way of selling by adding some values in the minds of consumer. So, creating significant value is something that is going to give your product certain edge in the market in long term view.

See, one of the biggest things we need is employment – employment for uneducated, untrained, and unskilled. This industry has tremendous potential for offering such employment to innumerable people. Every 2 acre of land can take care of one family at lower level. You don’t require him to go through 11 years of education to get there – though that may be the best thing to happen. He is doing some kind of farming anyway, you just have to train him a little more (3-4 months). Once this is done, the cost of trees will come down appreciably.

JK is consciously crafting strategies to harness human and natural resources at this level and has been engaged in various activities which have borne extremely good results, which was also highlighted by a leading columnist in an engrossing article in the Times of India recently.

There is so much of waste land and fallow land available; and the so called forest land where not even a grass grows exists in plenty – almost 68 million hectares, out of which is 30 million is cultivable. If only you allocate 2 million hectares, it can support primary employment of 2 million families. It can be good income generator and can deliver growth where it matters – to poor people, to tribal people and to the people residing in rural hinterland.

Moreover, if the wood is delivered at the same prices as in Indonesia or Brazil, I am 100 percent certain that the industry with its technical skill is good enough to deliver value at the same cost as our international counterparts, not a penny more.

Of course, most of my thoughts I wish to share with financial people come from above two-three assumptions. So, we should expand our horizons, do better in terms of using latest technology, operations, and become commercially fit.