Team Paper Mart initiated a detailed feature to get insights into why there has been a sharp increase in the prices of all types of paper and the challenges the Indian paper industry is grappling with, by interacting with a number of players in the industry.

As we are in the middle of the second wave of the COVID-19 pandemic outbreak, we can see the severity of the second wave and its impact on the healthcare infrastructure which is under significant stress. As per a report by S&P Global, in addition to the substantial loss of lives and significant humanitarian concerns, the outbreak poses downside risks to GDP and heightens the possibility of business disruptions.

The lockdown imposed due to the pandemic has affected almost every industry in the world economy including the pulp and paper industry. This has brought significant supply chain disruptions causing shortages and challenges in a number of areas in the industry.

The imposition of the lockdowns and the continuing constraints of the economy while the health crisis-aspect of the pandemic have meant a huge hit in a number of segments in the paper industry is not under control, for instance, the continued closure of educational institutions has dealt a massive hit to the writing & printing segment of the overall Indian paper industry.

In fact, the prices of all types of paper are surging and this upward price-hike trend can be attributed to a number of factors including the increase in basic price of the raw materials for the paper industry. Consequently, the price of the finished paper has witnessed a significant surge in the recent times.

Raw Material Price-Increase

At present, the Indian paper industry has been struggling with the shortage in the supply of one of the major raw materials for the paper mills in the country, i.e., the waste paper from the US and Europe. Further, as a major setback and dampener for the printing and packaging industry is the continually rising prices of kraft paper, which in turn is due to the rising prices of waste paper.

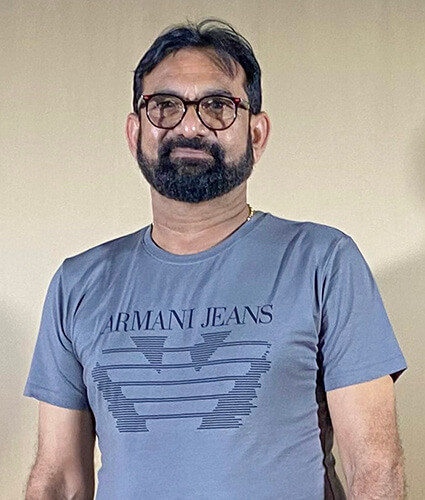

In the words of Mr. Sanjay Singh, Group Head – Paper and Packaging, ITC Limited, “in effect, the packaging board prices will continue to remain high in the next two quarters of FY 2020-21… This is also the need of the hour for the industry to cut costs which do not add value to our customers. While it is certainly true that these are testing times for the whole industry, there are a number of opportunities as well which we can explore.”

Shortage of Shipping Containers: A New Catch-22 Situation

The global shortage of shipping containers, primarily caused by the Covid-19 pandemic, has also resulted to a drastic inflation in shipping and container prices and has increased delay times for a number of industries. This has impacted the price of sea freight which has increased to almost threefold.

Explaining the impact of the container-shortage scenario, Mr. R N Agarwal, Chairman and Managing Director, N R Agarwal Industries Limited, asserts that, “the issue of price rise has been aggravated with the non-availability of shipping containers which has largely hindered the imports of Kraft paper and other kinds of packaging paper by China.”

To sum up, while the second wave of the pandemic is a grave concern at this time, the paper industry is trying to remain optimistic and is looking towards the government to put in place the building blocks needed to push the growth of the Indian paper industry.

While it is certainly true that these are testing times for the whole industry, there are a number of opportunities as well which we can explore.

The prices of paper and board have just about reached Pre-COVID level or slightly better. The main reason for the price-increase can be attributed to a number of factors including the increase in pulp prices, and a sharp rise in container transport charges. In effect, the packaging board prices will continue to remain high in the next two quarters of FY 2020-21 due to the high pulp prices and high waste paper prices as the collection of waste paper is relatively lower than before.

Also, the demand for paper could be further affected if schools/colleges and other educational institutions don’t reopen. This also brings us to the set of circumstances such that it becomes imperative for us to find new applications of paper. For instance, at high-class restaurants, all cutlery and plates are packed and stored in paper to maintain hygiene. The substitution of plastics for packaging with paper is a huge responsibility and presents a lot of opportunities for the paper industry.

In essence, we need to innovate and find innovative solutions. Although it is going to be challenging at first, there will be a plethora of opportunities in the area. This is also the need of the hour for the industry to cut costs which do not add value to our customer. While it is certainly true that these are testing times for the whole industry, there are a number of opportunities as well which we can explore.

The price increase in some of the grades of waste paper has even reached to be more than 100% over the Pre-COVID price range. Further, the issue of price rise has been aggravated with the non-availability of shipping containers which has largely hindered the imports…

It is true that the prices of all kinds of waste paper are soaring and this price-hike can be attributed to the effect of the price of sea freight rising to threefold in addition to the increase in basic price of the raw materials for the paper industry. As a consequence, there has been a substantial increase in the price of the finished paper.

Overall, the price of duplex packaging boards has remained quite steady over the past five years till 2020 (in Pre-COVID times). Also, the minor shifts in price have been majorly driven by some of the globally applicable factors such as – the significant variations in the overall demand and supply of waste paper and export. As a matter of fact, the price of waste paper significantly impacts the overall cost of the finished paper because it constitutes more then 50-60% of the total cost.

The average price trends of the duplex board of different qualities/grades during the years – 2019, 2020 and 2021 can be summed up as:

In 2019: INR 34000/T to Rs.35000/T

In 2020: INR 34000/T to Rs.36000/T

In 2021: Rs.39000/T to Rs.43000/T

All things considered, it can be said that after April, 2021, the prices of the duplex board range are projected to go up further depending upon the input costs.

At present, the Indian paper industry has been facing a problem of the shortage in the supply of waste paper from the US and Europe due to the ongoing COVID-19 pandemic. In effect, we were compelled to buy waste paper at unreasonable price points because of the availability-related issues. The price increase in some of the grades of waste paper has even reached to be more than 100% over the Pre-COVID price range. Further, the issue of price rise has been aggravated with the non-availability of shipping containers which has largely hindered the imports of Kraft paper and other kinds of packaging paper by China.

With respect to the duplex boards in the packaging segment, it seems that in the next two quarters, this segment is projected to have significant and increased opportunities owing to an increased demand in sectors like – the Pharma, FMCG and other related industries.

However, the second wave of the COVID-19 has started to heavily impact India, particularly from the first week of April onwards; and its side effects will be very difficult to predict. Now, considering the scenario, it seems better to wait, watch and act accordingly after assessing the situation and being diligent.

The future of the writing & printing paper in the short to medium-run is quite encouraging as the Government of India has already announced the implementation of the New Education Policy (NEP)… This would require an escalation in the printing and publishing of textbooks with the newly-implemented syllabus and other related activities.”

We are a writing & printing paper manufacturing company and we produce paper out of agricultural residues. The nature of the Writing & Printing segment is quite cyclical, and also, also during any year, the prices might vary from month to month owing to the seasonal nature of the demand which is majorly linked to the education sector. In fact, the education sector remains the biggest driver for the demand-and-supply situation of the segment.

A lot has been said regarding the recent and sudden increase in the prices of the Writing & Printing paper products, however, a rational analysis would clearly show that this price-increase was not exceptional nor was unjustified. If we look into the prices of the Writing & Printing paper during the last couple of years, this will seem to be amply borne out of a number of market-related factors.

In 2019, the prices of paper varied between INR 51,000 to INR 58,000/MT (base grammage of 56 GSM). This range was, as mentioned above, has been due to the seasonal nature of demand. In 2020, the pre-lockdown prices were about INR 54,000MT, which started coming down from the month of May 2020 after the mills restarted post-lockdown in March-April, 2020. There was a continuous slide in the prices of paper products and these prices even touched a low of INR 37,000/MT during November-December, 2020.

The year 2021 had started on a low note, but within the first week of January, due to the general control on the new pandemic infections, the announcements regarding the approval of vaccines and the general expectations regarding the reopening of educational institutions had uplifted the spirits of the country. Further, the prices of paper products started going up and the price-rise was quite sharp and rapid. Thus, within a period of around one month, the prices went up from a low range of INR 37,000/MT to quite high range of INR 63,000 to INR 65,000/MT, which resulted in a sharp outcry from the user-end. However, if we look at this issue rationally, the price range reached in the current year was only 7-8% higher than the corresponding price range of 2019. Further, the increase in prices was quite expected keeping in view the recent inflation in the system.

However, this price momentum has been dampened sharply by the recent spurt in the infection rate all over the country and also, on account of the uncertainty on the reopening of schools and colleges. At present, the prices have somewhat mellowed down. Going forward, much will depend on the trajectory of the spread of COVID-19 and I am hopeful that the current second wave would ebb down very shortly, thus kindling the hopes of a normal academic session starting by the third quarter of 2021.

In my viewpoint, the future of the writing & printing paper in the short to medium-run is quite encouraging as the Government of India has already announced the implementation of the New Education Policy (NEP) which is slated to be implemented by the 2022-23 academic session. This would require an escalation in the printing and publishing of textbooks with the newly-implemented syllabus and other related activities.

Overall, the Indian paper industry is looking forward to a much better performance in the current year as compared to the last year, but at the same time, we are keeping our fingers crossed as the COVID- situation still remains quite fluid and at peak.

While talking about the price of the finished paper, it must be kept in mind that the prices of various inputs have risen sharply, as the entire commodity market is on fire. The lower availability of the recycled fiber coupled with a three-fold jump in the sea freight has resulted in the sharp increase in the prices of recovered fiber which is a major input for many paper mills. Additionally, any other inputs have also shown sharp increases, therefore, a part of the increase in prices is due to the cost-push.

All in all, we hope that the situation will settle down to be in its equilibrium once normalcy returns on the health-front.

The Indian paper industry has a promising opportunity to become a global supplier of segments such as Kraft paper, and by upgrading technologically, we can seamlessly be on the path to be the leader globally.

The price of paper has been showing an upward trend these days and chiefly speaking, the less availability of the containers has substantially impacted the prices, and in effect, the collections in western countries has been majorly affected since the emergence of the pandemic.

As the availability of containers are getting eased day by day, I can see a slight downtrend taking place in the raw material prices; however, at this point, we have to observe the collections and output from the western countries since this factor is going to play a key role in the domestic market-conditions.

At present, India is going through the second wave of the COVID-19 and it is a completely different scenario than the first phase of the lockdown in which people had actually spent some money. However, in the current scheme of things, the people are cutting their expenses on a day-to-day basis and the new consumer behaviour has been affecting the local paper waste generation.

In my understanding, the Indian paper industry has a promising opportunity to become a global supplier of segments such as Kraft paper, and by upgrading technologically, we can seamlessly be on the path to be the leader globally.